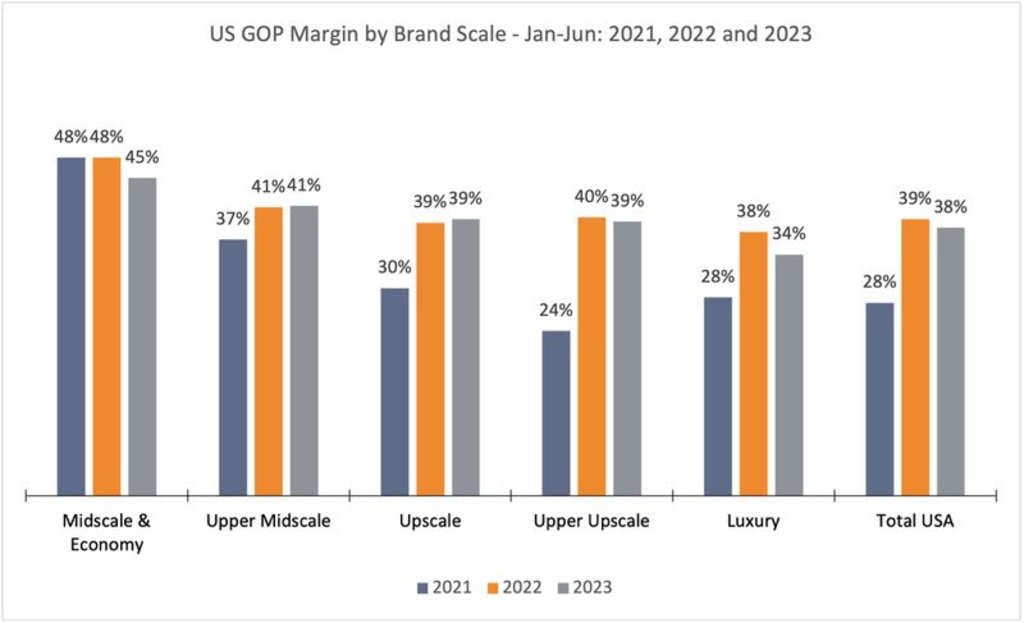

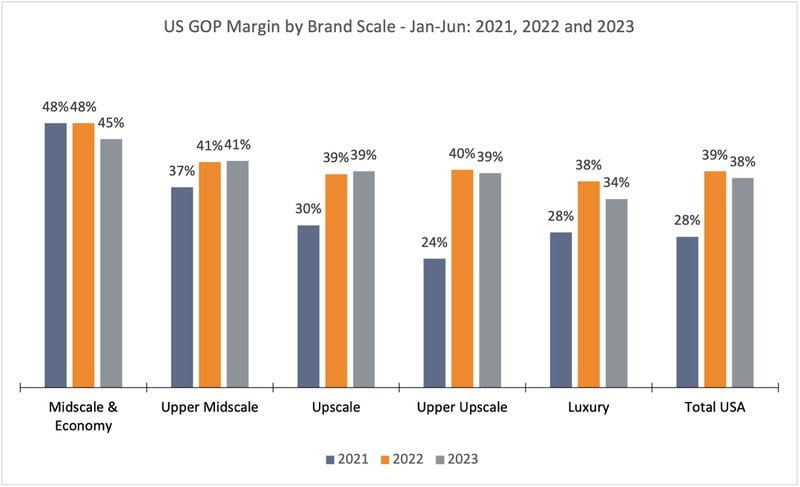

Resorts in the US noticed normal strain on revenue margins within the first half of 2023, with Gross Working Revenue (GOP) margin falling by 1 share level in comparison with the identical interval in 2022. A more in-depth take a look at brand-scale efficiency reveals that the extremes have been significantly affected: each the posh and midscale and financial system segments exhibited the best year-on-year margin declines, as proven in Determine 1.

— Supply: HotStats Restricted

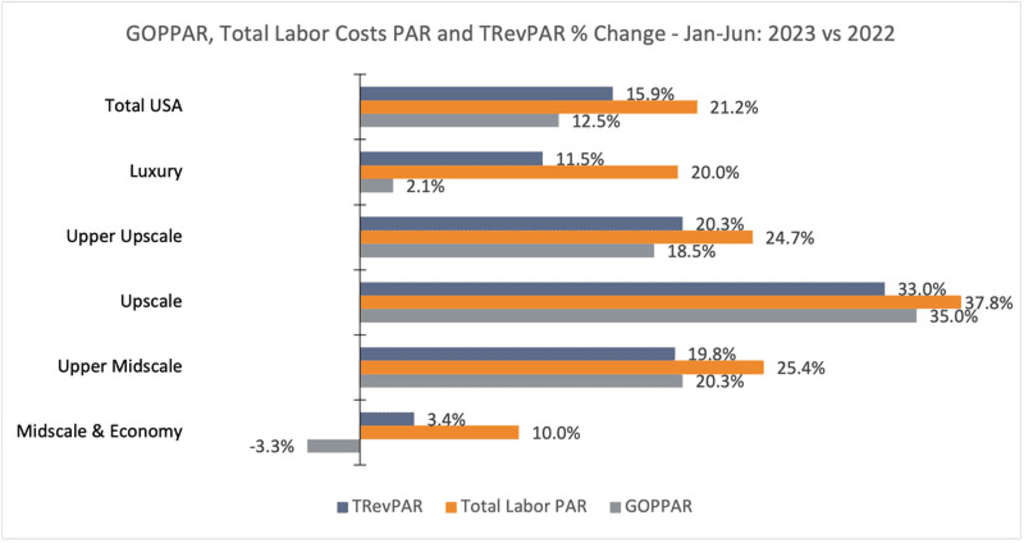

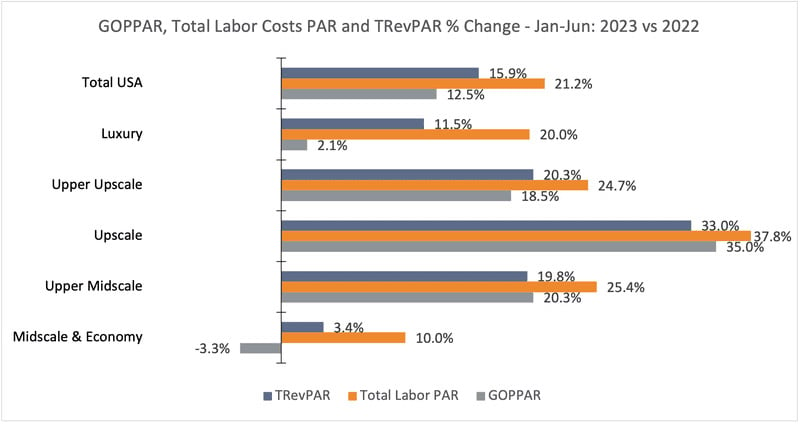

A significant component influencing this development is the rise in labor prices. At a time when many inns face continued labor shortages, the reliance in time beyond regulation and contract labor, in addition to the necessity to supply extra engaging wages and advantages to compete with different industries for expertise, has resulted in a major growth on this expense class. A lot so, that throughout asset lessons and within the whole United States, whole labor prices have outpaced whole income year-over-year will increase on a per obtainable room foundation.

— Supply: HotStats Restricted

The extremes of the model scale once more bore the brunt of this disparity: the posh section noticed labor prices per obtainable room outpace TRevPAR progress by 5.3 share factors, whereas midscale and financial system properties had a 6.6 percentage-point hole. This had important implications on the achieved GOP per obtainable room, with a 2.1% year-on-year uptick in luxurious and a 3.3% decline in midscale and financial system.

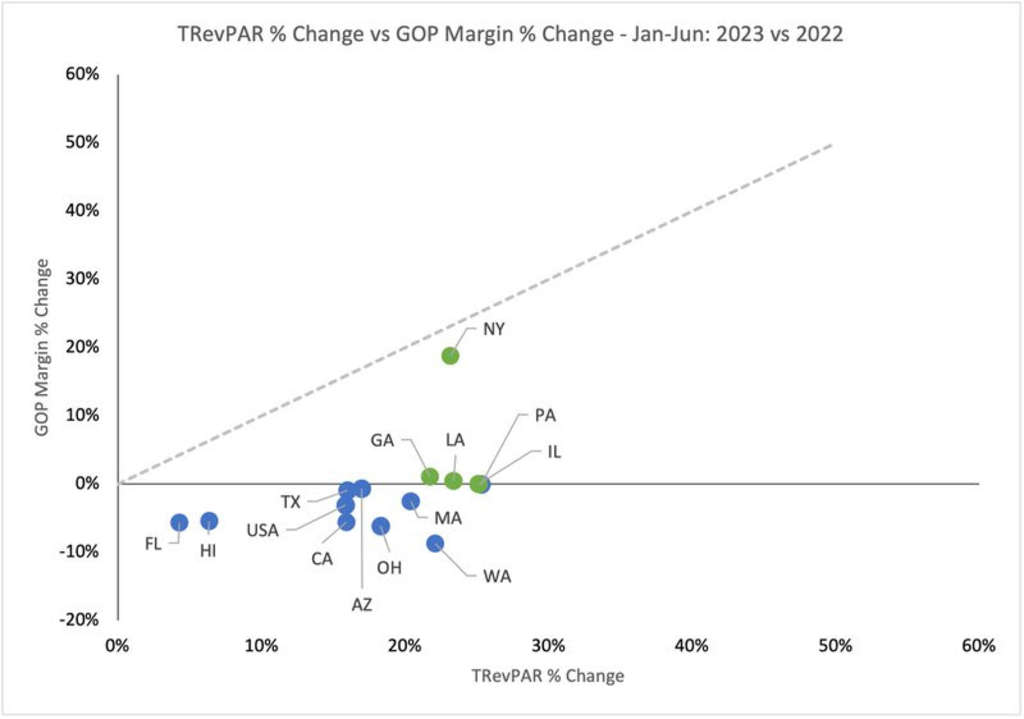

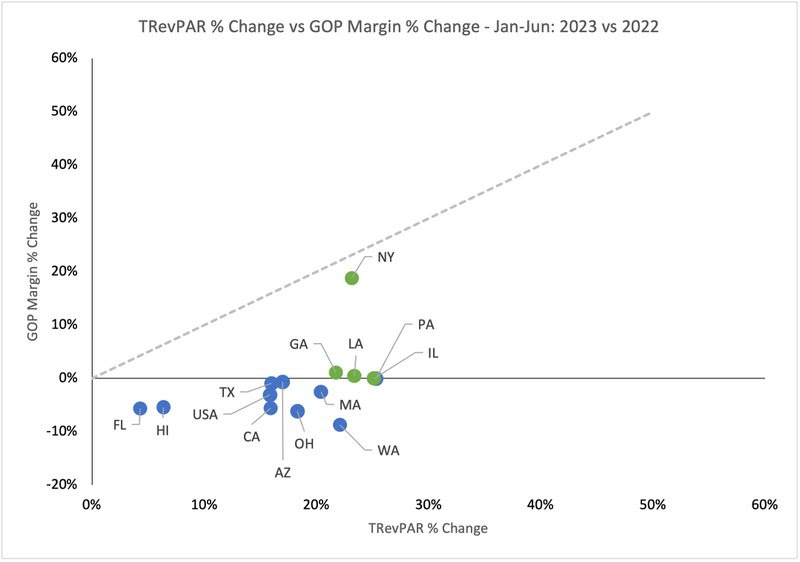

To additional perceive the evolution of margins in the US, we created a two-dimensional graph utilizing state-level information for New York (NY), Pennsylvania (PA), Massachusetts (MA), California (CA), Texas (TX), Illinois (IL), Florida (FL), Georgia (GA), Ohio (OH), Louisiana (LA), Arizona (AZ), Hawaii (HI) and Washington (WA). We additionally included the nation whole (USA) for context.

— Supply: HotStats Restricted

The primary dimension within the graph is the year-over-year share change in TRevPAR, which we measure on the horizontal x-axis. On the vertical y-axis, we measure our second dimension, year-over-year share change in GOP margin. The concept is to grasp not solely how these two efficiency indicators modified as in comparison with the primary half of 2022, but in addition what’s the interplay between them.

The x-axis in Determine 3 reveals that each one the states within the pattern in addition to the USA positioned to the suitable of zero, which means that all of them achieved a larger TRevPAR in January by means of June of 2023 than they did in the identical interval of final yr. Nevertheless, the story is extra nuanced when wanting on the y-axis: solely 5 states within the pattern positioned at or above zero, which implies that the remaining 8 and the entire USA skilled a margin decline in 2023 in comparison with 2022 regardless of the top-line progress. That is proof of a flow-through deterioration in these markets, as they’re retaining smaller parts of the elevated income.

It’s evident that GOP margins can’t develop indefinitely, nevertheless it does increase issues over price creep when markets can’t maintain the GOP% they managed to realize in previous durations however income progress. Of explicit curiosity are the states of Washington, Ohio, California, Florida and Hawaii, as a result of they’ve the best margin decreases of the pattern, starting from 5 to 9 % under 2022 ranges. On the flip facet, the state of New York skilled the best margin enhance within the pattern, a 19-percent leap over 2022.

— Supply: HotStats Restricted

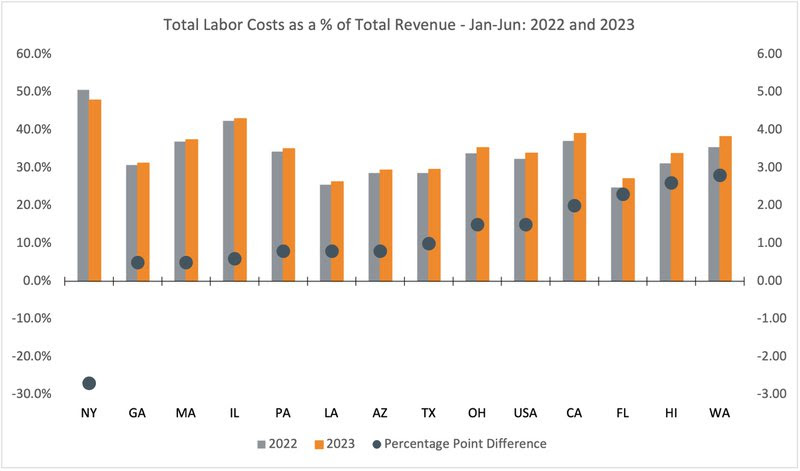

Determine 4 reveals whole labor prices as a share of whole income for the primary half of 2022 and 2023, in addition to the share level distinction between the 2 time durations. It’s no shock to seek out that the identical states with the deepest margin falls are those that skilled the best percentage-point labor price will increase, whereas the state of New York is the one one which recorded a percentage-point fall.

The truth that resort whole income continues to develop is constructive. Nevertheless, you will need to remember that income is just not a synonym for profitability. As quantity expands and the restoration of the totally different visitor segments progresses, price controls turn into ever extra necessary to guard flow-through and optimize revenue conversion.

About HotStats

HotStats supplies month-to-month P&L benchmarking and market perception for the worldwide resort business, accumulating month-to-month detailed monetary information from greater than 8,500 inns worldwide and over 100 totally different manufacturers and impartial inns. HotStats supplies greater than 550 totally different KPIs masking all working revenues, payroll, bills, price of gross sales and departmental and whole resort profitability.