Bordeaux is again within the information with the 2022 classic mentioned to be the most effective this century. However is it actually that good? And, above all, do you have to purchase these wines and at what worth? Let’s discover out1.

Prepare for Bordeaux’s primeur season in Spring 2023

As with yearly, the wines from the newest harvest had been first introduced to critics, retailers and all the opposite gamers within the wine market, who had been in a position to kind their very own opinion on the standard of the 2022 classic and share it with their neighborhood. Now we’ve entered the thick of the “en primeur marketing campaign”, and the wines are steadily being launched by the varied châteaux. As is usually the case, probably the most sought-after crus will most likely be among the many final to be launched, i.e. in direction of the top of June.

The en primeur machine is well-oiled and every part is continuing as typical, with a couple of nuances. Firstly, the tastings happened slightly later than final yr, which barely delayed the discharge of the tasting notes and scores. However, above all, the classic seems to be completely magnificent. Local weather is a recurring supply of uncertainty, however within the case of 2022, it appears to have contributed to the manufacturing of completely lovely wines.

Traditionally, nice vintages are synonymous with robust demand and due to this fact excessive costs. Within the present century, this has been the case for the 2000, 2005, 2009, 2010, 2016, 2018 and 2020 vintages. The magnificent 2019 classic is an exception. It was supplied at reasonably low costs because of the pandemic and subsequent recession. The 2022 comes at a really totally different time: the well being disaster has waned, however the struggle in Ukraine and inflation have stoked geopolitical and financial uncertainty.

The target of this text is to find out the costs at which Bordeaux 2022 ought to be launched, given the circumstances at the moment prevailing on the nice wine market.

Truthful Pricing for Bordeaux Wines

To find out the “honest” worth for every wine, we use a mannequin primarily based on a easy precept: the value of the newest classic have to be in step with the vintages already in the marketplace and nonetheless accessible on the market2.

In concrete phrases, for the value of a 2022 cru to be thought of honest, it should replicate the present fame of the château producing it, and have in mind the standard of the wine in that specific classic and its age (which, in contrast to wines already in the marketplace, is near zero). In different phrases, for a worth to be thought of honest, a possible purchaser could be simply as possible to purchase a 2022 cru versus a comparable wine from an earlier classic. The time period “comparable” is used intentionally: the thought is to not discover wines which can be completely an identical – that’s not attainable. Reasonably, the thought is to determine, on the idea of their attributes, wines whose relative weaknesses as in comparison with different wines are offset by qualities of equal significance. For instance, a château may justify promoting its 2022 on the similar worth as its 2010, if the 2022 is clearly higher than the 2010 – which might compensate for the age distinction in favor of the 2010 bottle. Equally, given the distinctive high quality of the 2022 classic, some châteaux will be capable to promote their wines at a worth equal to and even increased than 2021s from producers with a stronger fame and that are due to this fact often dearer.

We utilized our method to 73 châteaux for which we had entry to all the required info and variables. This pattern is consultant, because it incorporates the vast majority of the “most prestigious châteaux” from Bordeaux. Just a few Pomerol wines are lacking, for which it’s harder to acquire dependable information.

To be able to set up the honest worth for every wine of the 2022 classic, we proceed in two steps. We first analyze the costs of older vintages that already commerce on the wine market and estimate the worth hooked up to every château (fame impact) in addition to the consequences of age and high quality scores on costs. We then use these estimates and the scores of the 2022 crus to find out their honest launch costs.

At this level, it ought to be famous that “honest worth” will not be synonymous with “whole lot”. It’s merely a good worth primarily based on the data and variables accessible to us on the time of writing.

Launch costs

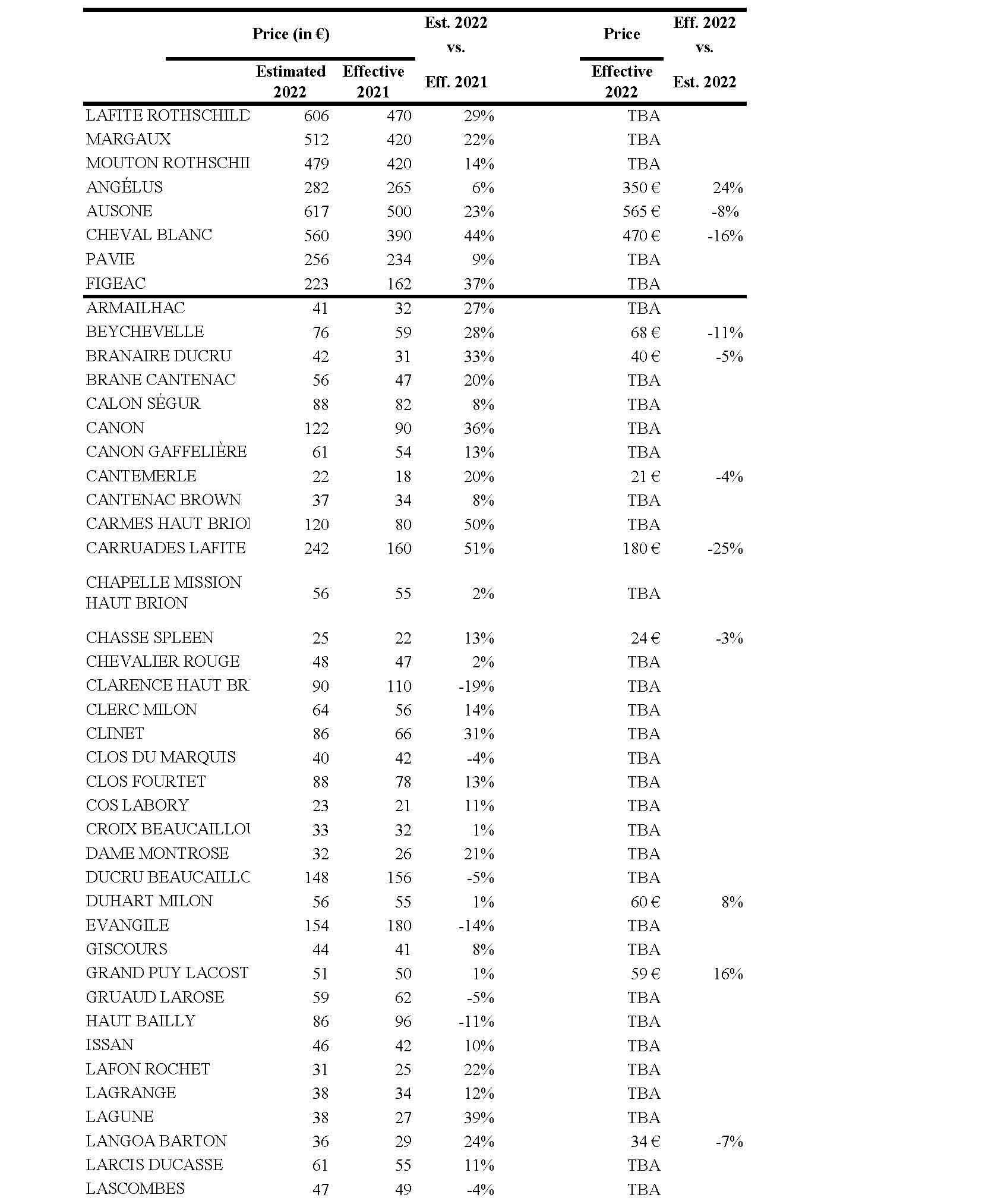

Desk 1 reviews the value at which wines from the 2022 classic are anticipated to achieve the market. The desk additionally compares these estimates with costs for a similar wines within the 2021 classic. For the overwhelming majority of wines, a worth improve may be justified on the idea of the mannequin. That is because of the high quality of the 2022 classic, which seems to be considerably higher than that of the 2021. On common, this improve ought to quantity to 13%.

We now have additionally included within the desk, the few wines which have already been launched. On the entire, these wines are supplied at costs near these estimated by the mannequin. We are able to due to this fact take into account them to be accurately valued. However there are additionally some notable exceptions.

Among the many wines which can be virtually completely in line (between -5% and +5%) with the mannequin are Branaire Ducru, Cantemerle, Chasse-Spleen, du Tertre, and Tour Carnet. There are additionally a couple of wines that seem ‘underpriced’ in comparison with our mannequin’s estimates: Langoa-Barton (-7%), Léoville-Barton (-7%), Ausone (-8%), and Beychevelle (-11%). Within the case of Beychevelle, it ought to be famous that the model’s worth has been on the rise on the secondary market since final yr, which largely explains this case. Had we used info from July 2022 (on the finish of the final primeur marketing campaign), the discharge worth would have been solely 3% decrease than that predicted by the mannequin.

Duhart-Milon (+8%), Grand-Puy Lacoste (+16%) and, above all, Angélus (+24%) and Palmer (+37%) look like too costly. Within the case of Angélus and Palmer, this case appears to be the results of a positioning technique, mixed with low portions delivered to market.

There are additionally some “good offers”. These embrace Carruades de Lafite (-25%) and Cheval Blanc (-16%). Within the case of Cheval Blanc, that is solely defined by the truth that this wine stands out as the nice success of the classic among the many Premier Crus Classés and the like. In different phrases, if its scores had been nearer to 95 than 98 (as is the case), the discharge worth would now not be notably engaging, however good. The case of Carruades de Lafite ought to be analyzed at the side of the remainder of the Lafite-Rothschild household, and Duhart-Milon specifically. There’s a model portfolio logic that must be taken into consideration to know their respective costs. Thus, the fame ‘premium’ is priced into our estimates.

Premium vs. low cost pricing methods

Our mannequin reveals {that a} worth improve over the earlier classic is justified. For many crus, this premium ought to stay average, between 5% and 20%. Nonetheless, in view of their high quality and/or the energy of their model on the secondary market, some crus may afford a extra marked improve. Amongst these not but launched, Figeac, Canon, Carmes Haut-Brion, Clinet, La Lagune and Troplong Mondot may improve by greater than 30% with out turning into too costly, in keeping with the mannequin. Then again, quite a few crus, which have been persistently overpriced in latest vintages, ought to be cautious to not improve their costs – ideally they need to even lower them. These embrace Clarence Haut-Brion and Evangile.

Is Bordeaux 2022 well worth the funding?

As talked about above, our mannequin is designed to find out the honest worth primarily based on present circumstances on the secondary marketplace for Bordeaux wines. Nonetheless, it can’t have in mind sure complicated elements similar to the next.

Given the succession of nice vintages lately, and the truth that the wines produced from them stay broadly accessible in the marketplace, some may ponder whether the standard of the 2022s is sufficiently extraordinary for consumers to be content material to buy them on the honest worth, or whether or not a reduction could be wanted to encourage them to take action. During which case, the corresponding quantity must be subtracted from the estimated costs reported in Desk 1.

The earlier consideration is bolstered by inflation and, above all, rising rates of interest. We generally hear the argument that inflation justifies increased costs. However for nice wines, there is no such thing as a direct relationship between worth and inflation. Financial circumstances do play a job, however not a lot by way of inflation. Sustained financial progress and rising inventory markets usually translate into increased nice wine costs. At present, this isn’t the case. Rates of interest, alternatively, play an necessary function, as shopping for en primeur wines means tying up your cash for round two years. This have to be mirrored in a reduction. Our mannequin takes this into consideration through the age impact, however it might be argued that this impact (2% each year for first growths, and 4% for others) doesn’t but absolutely worth in present rate of interest circumstances.

Volumes launched in the marketplace usually are not taken into consideration within the mannequin, as they’re a intently guarded secret. Nonetheless, it’s common data that they’ve been falling for a number of years now. This has two results. Firstly, it supplies considerably synthetic assist for costs. Secondly, it signifies that a considerable amount of wines from the 2022 classic shall be put again on sale within the coming years. In sensible phrases, that is more likely to put downward strain on the long run costs of these wines. This strain might be bolstered by the truth that many retailers nonetheless have massive portions of wine from earlier vintages to backlog sooner or later sooner or later. It due to this fact appears clever to give attention to shopping for wines whose worth seems honest in keeping with our mannequin, and for which a really vital amount of manufacturing is being marketed now. For these wines, the deal ought to be good, particularly if the classic seems to be as outstanding as first tastings recommend.

References

1. EHL Hospitality Enterprise Faculty, HES-SO, College of Utilized Sciences and Arts Western Switzerland, Route de Cojonnex 18, 1000 Lausanne, Switzerland. Electronic mail: [email protected].

2. Readers concerned about a extra detailed view of the mannequin are invited to seek the advice of the next article: Masset, P., Weisskopf, J., & Cardebat, J. (2023). Environment friendly pricing of Bordeaux en primeur wines. Journal of Wine Economics, 1-27. doi:10.1017/jwe.2023.5.

EHL Hospitality Enterprise Faculty

Communications Division

+41 21 785 1354

EHL