Background

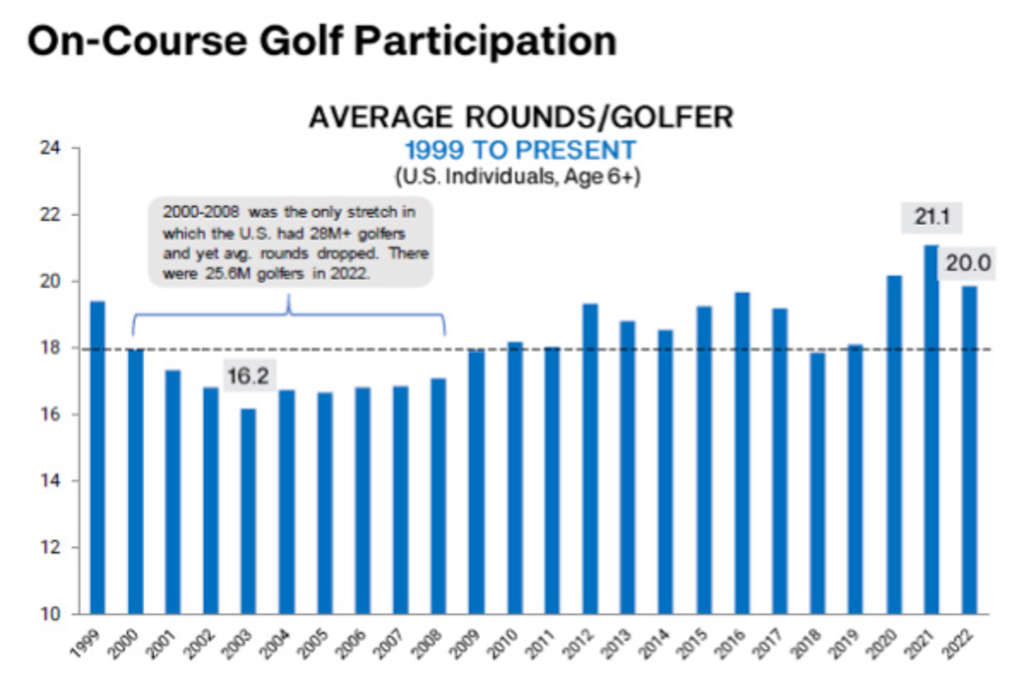

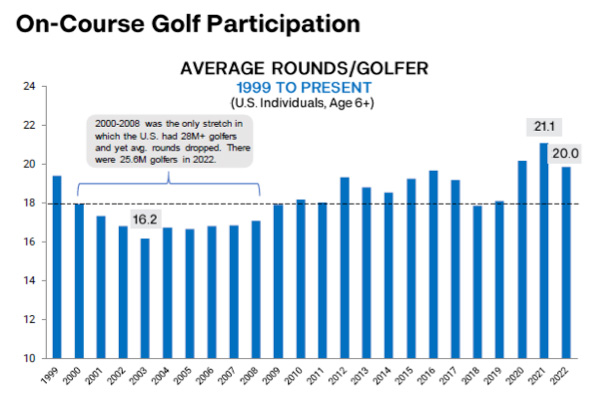

For sure, leisure sports activities picked up in recognition in the course of the COVID-19 pandemic- particularly golf. In response to the Nationwide Golf Basis, 67% of golfers credited their elevated play within the late summer season of 2020 to having“fewer other ways to spend leisure time”. Not solely did present golfers improve their time on the course, however the Nationwide Golf Basis additionally reviews 25.6 million golfers on the course in 2022, a 1.3 million improve from 2019. Furthermore, the Nationwide Golf Basis reviews a mean of 21.1 rounds of golf performed per golfer in 2021. That is the best common variety of rounds per participant in a single yr seen since 1999.

Thesis

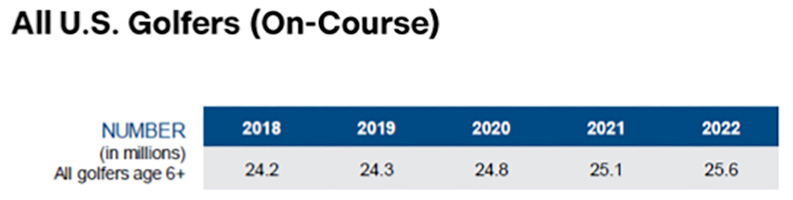

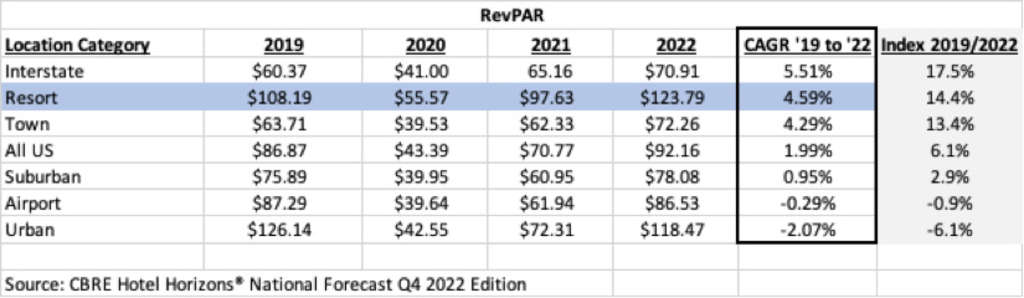

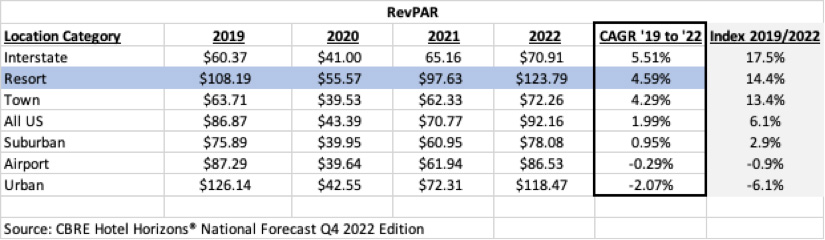

In response to the CBRE Resort Horizons® Nationwide Forecast This autumn 2022, inns in resort places achieved the second highest RevPAR CAGR (4.59%) from 2019 to 2022, behind solely inns in interstate places. Apparently, the RevPAR for inns in resort places was 14.4% higher in 2022 than pre-pandemic ranges in 2019. Based mostly on location sort, we assumed inns in resort locations benefited from“revenge journey” or pent-up leisure demand given the underlying development in efficiency. Being that this pent-up demand in leisure contains a rise in golf play, we explored the next impression to the resort trade by analyzing the efficiency of inns in resort places with golf facilities.

Resorts With Golf Programs vs. Resorts with No Golf Amenity

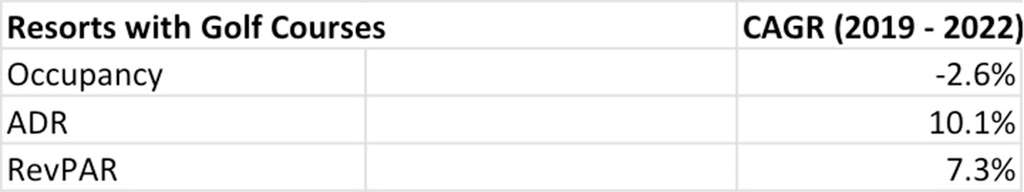

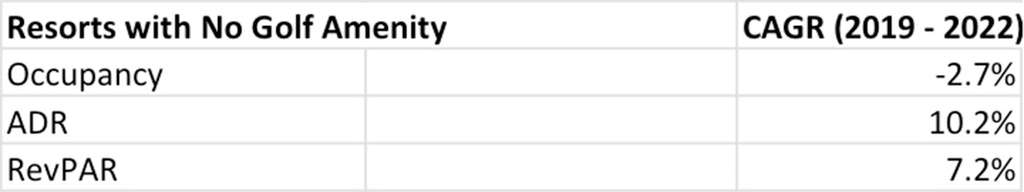

We studied the efficiency of 55 resorts with a mean over 500 rooms that supplied an annual working assertion to CBRE from 2018 to 2022. Our analysis focuses on the interval from 2019 to 2022 to focus on the impression of the pandemic. The composition of the info set contains two property teams: 22 resorts with golf facilities and 23 resorts with no golf amenity. Based mostly on our evaluation, we have been stunned to see a minimal distinction in CAGR for occupancy, ADR and RevPAR between the 2 property teams. Albeit unknown variables corresponding to disruption in property operations from renovations, modifications in provide, group reserving patterns or different elements, we have been additional inspired to research golf departmental revenues given the dearth of disparity.

Golf Division Evaluation

On the resorts that provided golf as an amenity, we noticed a rise of 65.5% in golf income from 2019 to 2022 regardless of a drop in occupancy of seven.5% from 66.8% in 2019 to 61.8% in 2022. Golf income per accessible room elevated by 66.3% from $7,730 in 2019 to $12,854 in 2022. With golf income rising quicker than whole income, golf income elevated as a p.c of whole income from 2019 to 2022. With potential validation to our thesis, golf income per occupied room elevated by 79.6% from $31.71 in 2019 to $56.95 in 2022—suggesting golfers composed of a bigger p.c of visitors in 2022 in comparison with 2019.

Lack of Disparity in Income: Golf vs Non-Golf

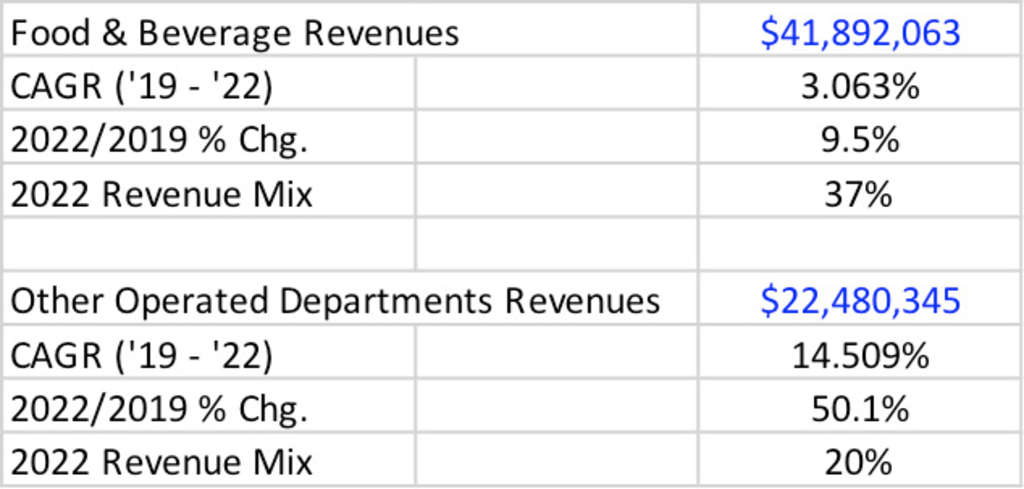

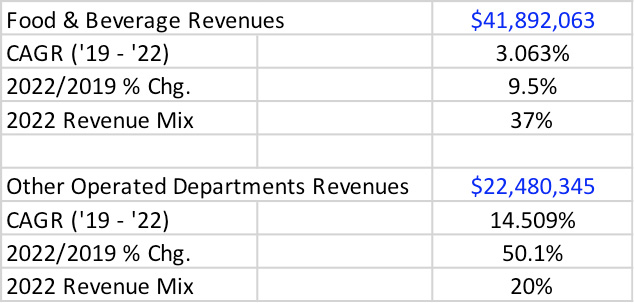

Though golf income contribution elevated and the p.c of golfers as resort visitors possible elevated, inns with golf facilities definitely didn’t outperform resorts with out golf. We regarded on the Meals & Beverage Revenues to look at if resorts with out golf programs have been compensating for his or her earnings on this division. Nevertheless, Meals and Beverage Revenues for each property units achieved a CAGR round 3% from 2019 via 2022 and had solely a $1,211,415 distinction in revenues. We analyzed the opposite operated departments, which golf departmental revenues are recorded in, for each property varieties to realize a greater understanding for the dearth of discrepancy. The CAGR for Different Operated Division Income from ’19-’22 was roughly 14.5% for each varieties of resorts. The substitutional facilities accessible at resorts with no golf programs clearly closed the hole in income between resorts with golf programs. Such facilities at resorts with no golf amenity embody tennis, pool/water parks, spa, seaside golf equipment and reward outlets.

Golf Resorts

Non-Golf Resorts

Conclusion

Hoteliers could also be aware of enhanced income era from their golf departments as illustrated on this research. Golf income at resorts elevated regardless of a decline in occupancy from 2019 to 2022. This development might be attributed to a higher mixture of golfers as whole visitors post-COVID, a rise in inexperienced charges with higher golf demand, larger pro-shop spending with elevated play, and probably elevated play from native residents. Golf resort restoration would most probably have been worse had it not been for elevated golf play. The elevated play didn’t create premium occupancy and ADR efficiency over non-golf resorts; nevertheless, golf play was a major contributor to the success of golf resorts submit pandemic. With out such an examination, hoteliers could not have realized the potential leisure sports activities, particularly golf, can embark on the hospitality trade.