International locations included: United States, Canada, China, El Salvador, France, Germany, Indonesia, Italy, Japan, Mexico, Seychelles, Singapore, Spain, and United Kingdom

U.S. Efficiency

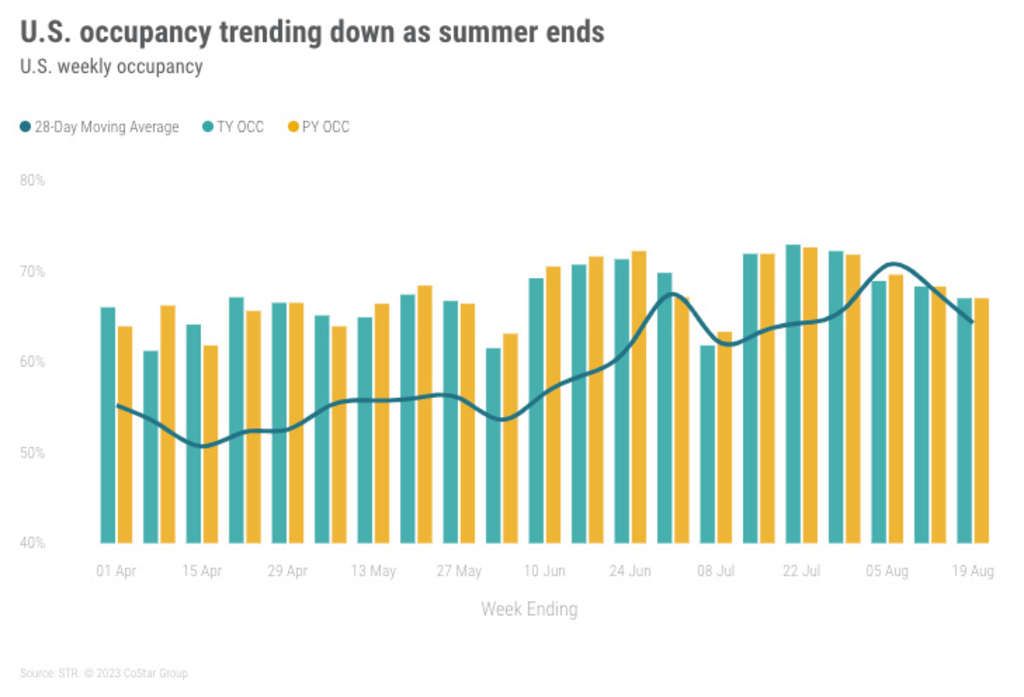

With nearly two-thirds of U.S. Ok-12 college students again in class, lodge occupancy adopted regular seasonal patterns and trended down for a fourth consecutive week. The business misplaced 1.3 share factors (ppts) from the prior week, and at 67.0%, was unchanged from a 12 months in the past however down 2.9 ppts from the identical week in 2019. Occupancy is predicted to pattern down week on week by Labor Day after which develop as group/convention journey climbs to its annual peak. Weekly income per out there room (RevPAR) elevated 1.8% 12 months over 12 months (YoY) to US$103, pushed by a 1.8% enhance in common every day charge (ADR) to US$154. ADR features took a step again following three weeks above 2%. Actual (inflation-adjusted) ADR remained slightly below the 2019 degree.

Weekday (Monday – Wednesday) occupancy elevated 0.4ppts YoY whereas shoulder (Sunday and Thursday) and weekend (Friday and Saturday) durations declined 0.5ppts and 0.3ppts, respectively. Weekday occupancy has elevated in 25 of the previous 33 weeks this 12 months as in comparison with 12 and 16, respectively, for weekends and shoulder days.

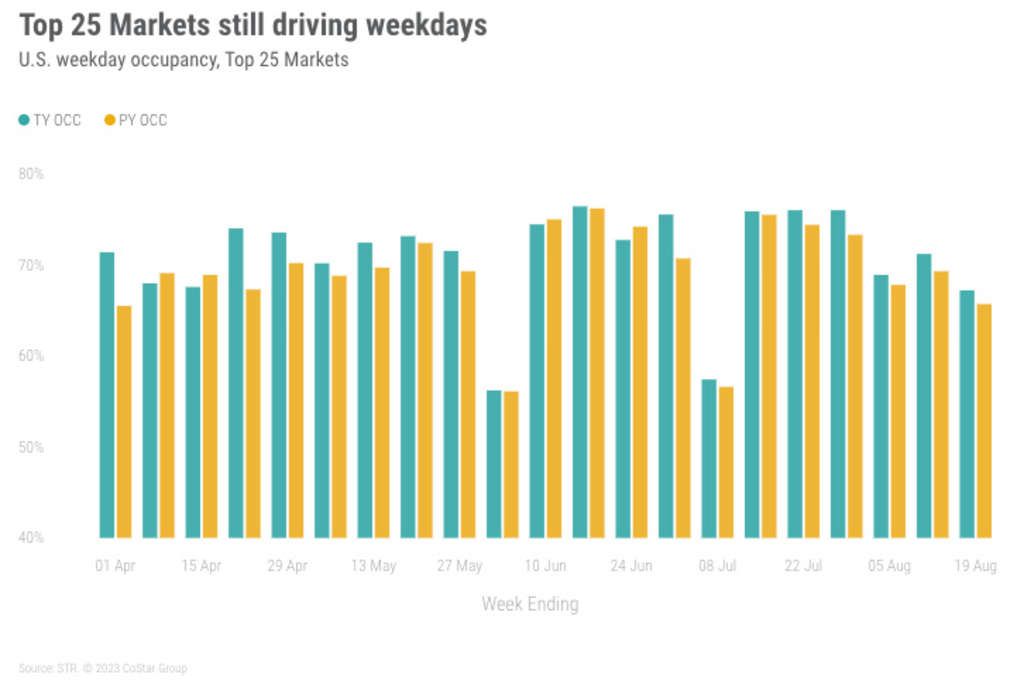

The Prime 25 Markets noticed stronger occupancy development in comparison with the remainder of the nation, rising 0.7ppts YoY to 68.6%. In all however two of the 33 weeks of 2023, the Prime 25 Markets have seen higher occupancy features than the remainder of the nation. Occupancy outdoors the Prime 25 got here in at 66.1%, down 0.5ppts YoY. RevPAR for the Prime 25 Markets elevated 3.2%, fueled by an ADR enhance of two.1%. Within the the rest of the nation, ADR grew 1.5%, leading to RevPAR enhance of 0.9%.

Prime 25 Market weekday occupancy confirmed one of the best year-on-year enhance (+1.5ppts), adopted by shoulder days (+0.5ppts). Weekends within the Prime 25 Markets decreased barely, -0.2 YoY. This sample continued with the healthiest ADR features for weekdays (+3% YoY) yielding a RevPAR achieve of 5.4% YoY. Shoulder days produced ADR development of two.2% leading to a 3% RevPAR achieve. The weekend confirmed a 1.0% ADR enhance and a 0.7% RevPAR enhance.

Exterior the Prime 25 Markets, occupancy was down throughout all day elements with weekdays reducing the least (-0.1ppts). Weekdays produced the best ADR enhance (+2.1%), leading to a RevPAR achieve of 1.9%. Weekend RevPAR elevated 0.8% whereas shoulder days had been down 0.8%.

The nation’s highest occupancy for the third consecutive week was in Alaska (89.5%) adopted by Oahu (88.4%) and Portland, ME (85.9%).

The devastating hearth on Maui, which brought about a 27.8% YoY lower in room demand, continued contributing to Oahu’s occupancy efficiency. Based mostly on CoStar hospitality analysis and particular person lodge reporting standing, 5 properties representing 1,904 rooms in Maui have sustained injury or had been destroyed. That whole represents roughly 2% of room provide within the Maui market.

New York Metropolis was the one different Prime 25 Market, apart from Oahu, recording occupancy above 80%. New York occupancy elevated 6.3ppts to 83.7%, ensuing within the highest RevPAR enhance (+19.7%) throughout all Prime 25 Markets, assisted by a wholesome 10.7% ADR enhance. Total, weekday occupancy elevated 1.5ppts throughout the Prime 25 Markets, however many noticed even greater development, together with Las Vegas (+2.5), Minneapolis (+2.2), Houston (+2.6), Detroit (+8.4), Nashville (+1.8), Atlanta (+3.8), and Houston (+2.6).

Throughout the chain scales, Higher Upscale (68.9% occupancy) skilled the biggest yearly occupancy (+2.5ppts) and RevPAR (+4.4%) features. Upscale reported the best occupancy (+1.0% to 73.3%) and a 3.7% RevPAR achieve. Luxurious occupancy superior 0.8ppts to 64.2%, however RevPAR decreased 2.8% due to a 4.0% ADR decline. Occupancy throughout the remaining chains scales fell from -0.2ppts in Higher Midscale to -0.7ppts in Midscale to -1.8ppts in Financial system. Higher Midscale elevated ADR 2.1%, leading to a 1.8% RevPAR enhance. ADR remained nearly flat for the opposite two chain scales, netting RevPAR adjustments of -1.1% for Midscale and -2.6% for Financial system.

Group demand amongst Luxurious and Higher Upscale resorts, which is usually sluggish throughout this time of 12 months, elevated 1.1% in comparison with the identical week final 12 months. Over the previous 4 weeks, group demand was up 1.8% in comparison with the identical 4 weeks final 12 months. The group phase is predicted to see week-over-week decreases however year-over-year features by the Labor Day vacation adopted by robust development up till the vacations.

International Efficiency

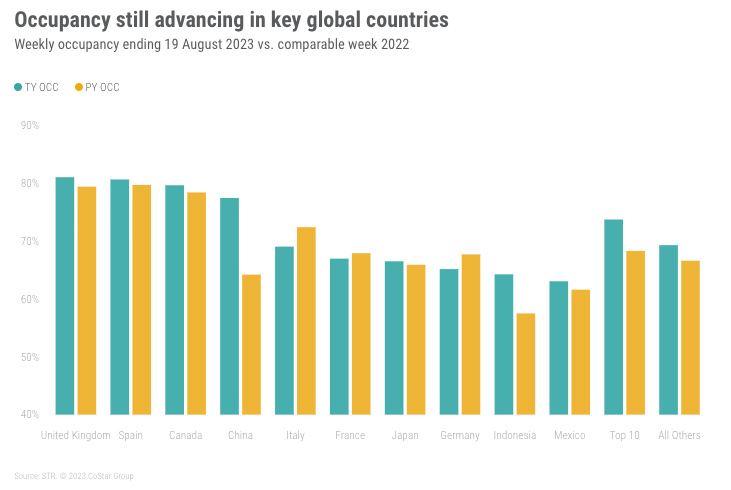

International efficiency (excluding the U.S) confirmed a marginal week-over-week lower in occupancy, down 1.2ppts to 72.1%, which is according to historic patterns and anticipated given the business’s seasonality. Whereas occupancy was down from the prior week, it was up 4.4ppts YoY. ADR was up 12.8% YoY to US$154 and has been above US$150 for the previous 11 weeks. RevPAR got here in at US$111, up 20.2% YoY.

The Prime 10 international locations, by provide, posted occupancy of 73.7%, up 5.4ppts YoY however down 2.4ppts from per week in the past. ADR grew 9.5% YoY to US$143. RevPAR was the eighth highest results of the 12 months at US$105 with development of 18.2% YoY.

Inside within the Prime 10, France, Italy and Germany reported slight year-over-year declines. The U.Ok had each the best occupancy (81%) of the highest 10 and the biggest year-over-year achieve (+1.6ppts) amongst these in Europe. Total, the biggest occupancy gainers are these in Asia with occupancy in China up 13.2ppts YoY to 77.4%, its second highest occupancy since March 2020, and Indonesia, up 6.8ppts to 64.3%. Canada noticed its highest occupancy (79.6%) since March 2020 on the peak week of the summer season journey season. Moreover, a number of markets noticed greater occupancy from evacuees fleeing the fires in northern Canada. In Spain, occupancy grew to 80.6% with ADR rising 3.3%. Charges in Spain have been at their highest ranges over the previous three weeks. This most up-to-date week’s ADR was 22% greater than the comparable week of 2019.

Exterior of the highest 10, Seychelles had the best occupancy within the Center East/Africa area at 77.9%, up 0.5ppts YoY. Eire topped the record for Europe at 90.8%, up 2ppts. Singapore as soon as once more posted the best occupancy in Asia Pacific (86.7%, up 15.1ppts), and El Salvador skilled the best YoY occupancy achieve within the Americas at 82.4% (+22.2ppts).

Closing ideas

U.S. demand has flattened general in comparison with a 12 months in the past, however journey stays robust on condition that air journey, primarily based on weekly TSA screenings, has been above 2019 ranges in 23 of the previous 24 weeks. Individuals, touring internationally at a lot greater ranges than their international counterparts, are serving to to carry efficiency in different international locations whereas softening efficiency domestically. The business is in a interval of normalization because it readjusts to seasonal patterns. Changes by way of stronger demand within the Prime 25 Markets whereas the remainder of the nation slows in addition to power throughout all markets on weekdays replicate this return to regular. Shifting into the autumn season, the business is relying on enterprise/group journey to advance, additional propelling the business’s return to regular.

Wanting forward

U.S. occupancy will see regular demand and occupancy declines heading towards a summer season seasonal low within the week containing Labor Day. Thereafter, we anticipate each measures to rise, however the magnitude of that development relies on the power of group/convention journey and the continuing restoration in enterprise transient demand. International occupancy will even pattern down because the leisure season involves an finish within the western hemisphere

*Evaluation by Isaac Collazo, Chris Klauda and William Anns.

About STR

STR supplies premium information benchmarking, analytics and market insights for the worldwide hospitality business. Based in 1985, STR maintains a presence in 15 international locations with a North American headquarters in Hendersonville, Tennessee, a global headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), a number one supplier of on-line actual property marketplaces, info and analytics within the business and residential property markets. For extra info, please go to str.com and costargroup.com.