- €4.1 billion transacted over 154 properties, comprising 16,817 rooms

- Continuedstrong urge for food for resort inns, accounting for 22% of transactions

- Strong efficiency restoration and constrained provide development driving the constructive investor sentiment

- Vendor and purchaser expectations set to converge within the coming months, elevating the prospect of an lively H2 2023

London, June 16, 2023 – Europe skilled wholesome lodge funding exercise with €4.1 billion transacted in Q1 2023, in line with international actual property providers agency Cushman & Wakefield. This represents an 18% improve on Q1 2022 regardless of excessive financing prices and financial and geopolitical issues.

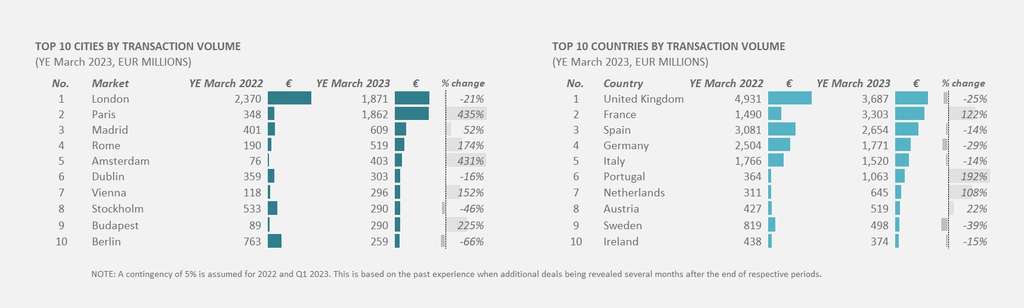

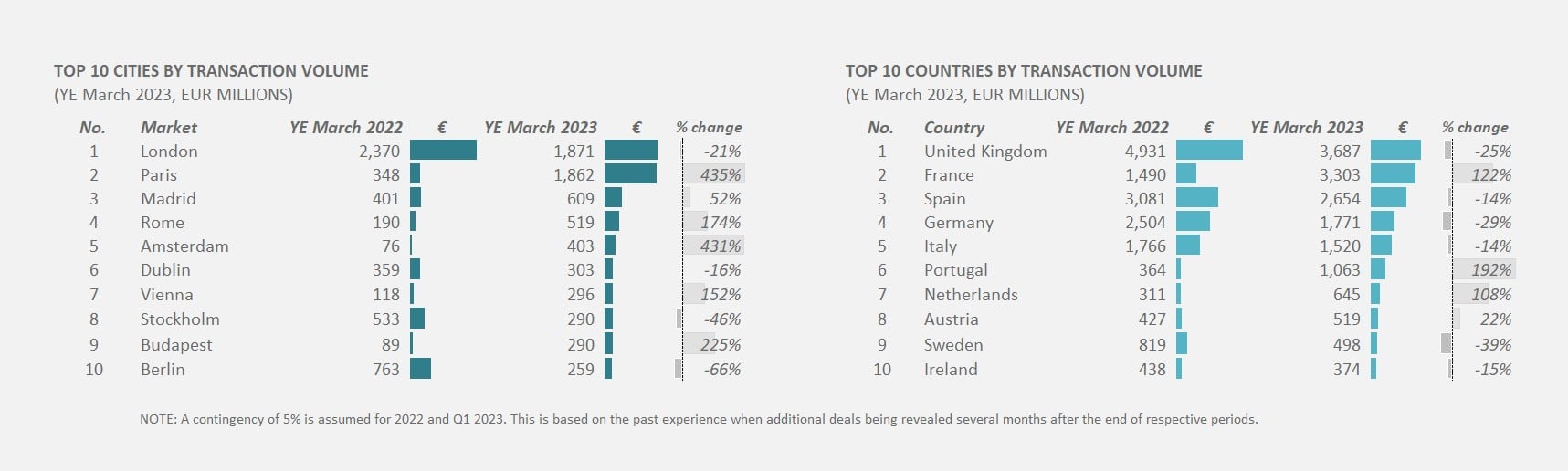

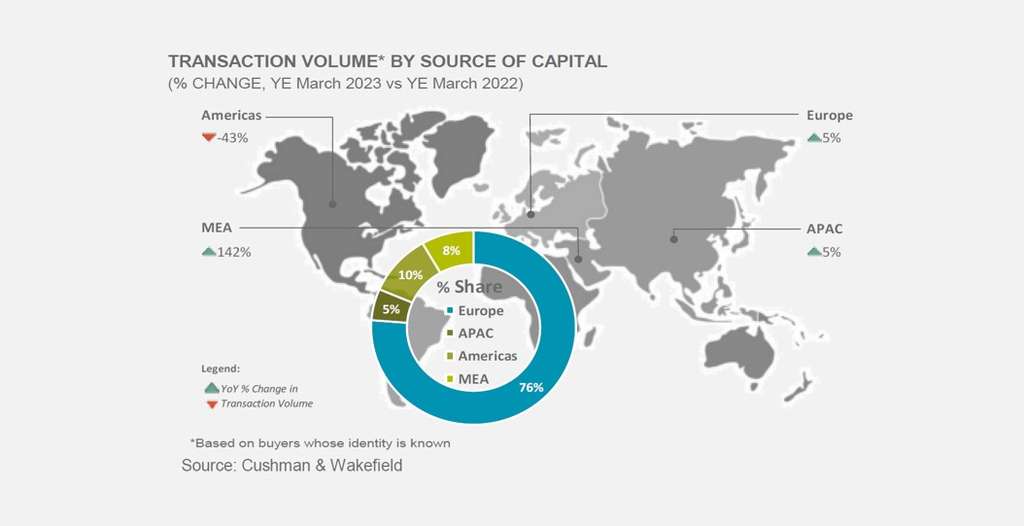

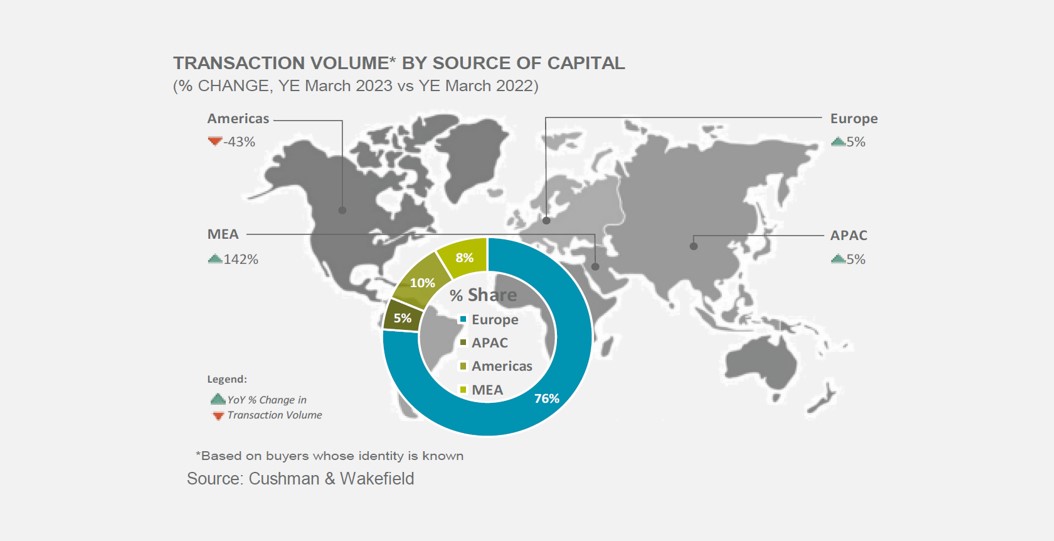

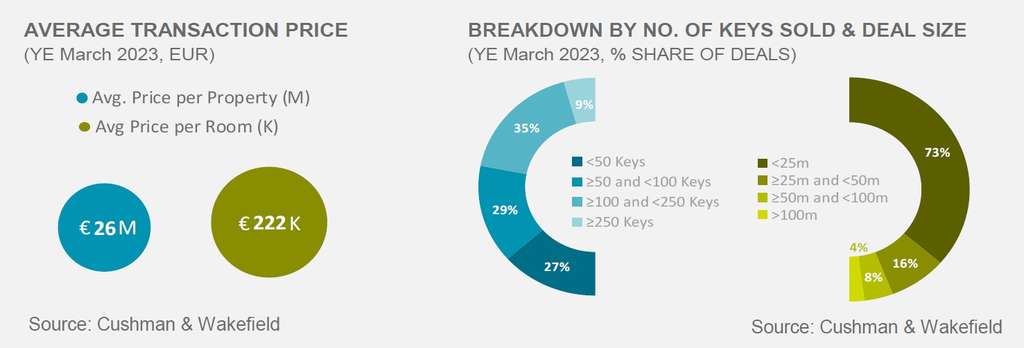

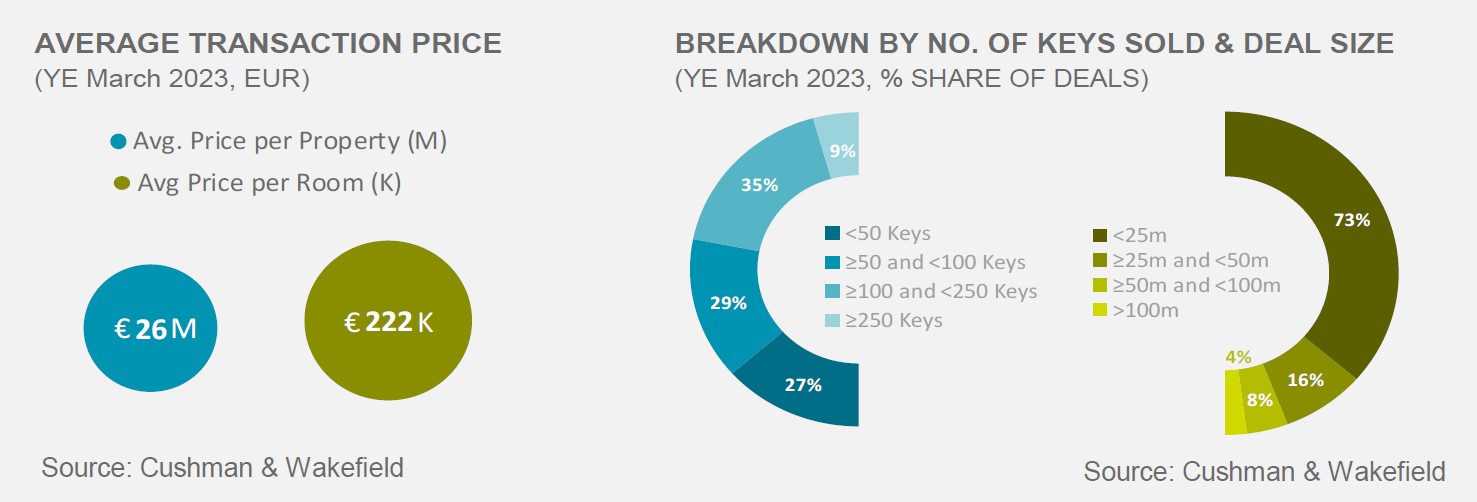

A number of main offers drove this sturdy development, together with the sale of Westin in Paris, Mandarin Oriental in Bodrum and Le Richemond in Geneva. However, funding exercise on a 12-months foundation – which smooths the affect of unusually giant offers – reveals lodge transaction volumes in Europe grew by about 3% for the operating 12 months ending Q1 2023, in contrast with the operating 12 months ending Q1 2022. The UK, France and Spain have been essentially the most engaging markets, accounting for 52% of transactions. When it comes to the important thing city markets, London continues to be on the highest of the record for buyers adopted by Paris and Madrid. Most funds got here from European consumers (76%) whereas the Center East was the quickest rising supply of capital (up by 142%). Upscale and Higher Upscale inns accounted for half of Q1 2023 transaction volumes, with resorts persevering with to be in excessive demand from buyers.

Borivoj Vokrinek, Strategic Advisory & Head of Hospitality Analysis EMEA at Cushman & Wakefield, stated: “Resorts continued reputation amongst buyers is underpinned by the sturdy restoration of leisure demand, long-term development potential and constrained provide development. Total, resorts accounted for 22% of complete transaction volumes in Q1 2023, and 28% when taking a look at information on 12-months operating to March 2023. That is notably greater than earlier than Covid-19, when this sort of lodge accounted just for about 13% of complete lodge transaction volumes in 2019.”

The constructive funding sentiment in the direction of inns is supported by a robust restoration efficiency, with Income Per Out there Room (RevPAR) for the entire of Q1 2023 already overpassing 2019 ranges by almost 13%. This was pushed by a sturdy improve of lodge room costs throughout Europe, with Common Each day Charge (ADR) rising 19% above 2019 ranges.

The best RevPAR will increase have been recorded in Lithuania, Turkey, Eire, Croatia and France, with Paris, Belgrade, Istanbul and Vilnius being the important thing city markets in Europe experiencing the strongest RevPAR development in Q1 2023 relative to Q1 2019.

Frederic Le Fichoux, Head of Resort Transactions, Continental Europe at Cushman & Wakefield, stated: “The lodge sector stands out as the one property section experiencing development in transaction volumes in Europe. Whereas many different actual property sectors are going through structural challenges and softening occupational demand, inns proceed to outperform the expectation throughout most markets. Certainly, the sector’s speedy rebound after the pandemic and robust efficiency registered over the previous yr mixed with the sturdy long-term demand fundamentals underpinning the potential of wholesome investment-returns, is more and more attracting new buyers to the sector which can be reassessing their fund allocations and long-term funding methods. The ‘hotelisation’ of the general actual property trade helps these non-traditional lodge buyers to higher perceive lodge investments and future upsides generated by this asset class. This coupled with the return of conventional lodge buyers from Center East and Asia is rising prospects for elevated transaction exercise in coming months.”

Traders additionally respect the comparatively low provide development throughout the lodge sector, that was under 2% in 2022. Going ahead the event pipeline is anticipated to stay hampered by rising building prices and a excessive rate of interest inflicting delays and cancellations. Whereas extra openings are anticipated in 2023 (similar to The OWO, Raffles in London, Six Senses in Rome and One & Solely Aesthesis in Athens), the general lodge pipeline in Europe is comparatively reasonable, with sector development anticipated to stay under 2.5%.

Whereas single asset transactions have been the main target of buyers over the previous months, we see a resurgence of portfolio offers. A number of are already available on the market similar to Centre Parcs portfolio within the UK, Tryp portfolio in Spain, Landsec portfolio comprising 21 inns within the UK and most lately Travelodge chain with 595 inns throughout the UK, Eire, and Spain.

Trying forward, the restoration of transactional exercise is anticipated to be bolstered by the stabilization of inflation charges, providing a clearer outlook and the prospect of a moderation in rates of interest. Moreover, there may be mounting strain on some homeowners to promote on account of difficult refinancing phrases or excessive capital expenditures, with some funds additionally going through redemptions and needing to dispose property. On the customer facet, the important thing drivers are the enhancing efficiency, the burden of dry powder and decompressing yields (on common up by about 70bps in Q1 2023). These elements ought to contribute to a narrower bid-ask unfold and facilitate the profitable completion of transactions.

Jonathan Hubbard, Head of Hospitality EMEA at Cushman & Wakefield, stated: “While the headline figures point out a constructive lodge funding market, exercise is undoubtedly being held again throughout Europe by elevated debt prices and inflationary price pressures. This has resulted in a level of investor warning. Nonetheless, funding exercise is anticipated to realize momentum within the second half of the yr, supported by continued efficiency restoration compensating for decompressing yields, the necessity amongst many buyers to deploy capital and strain on some homeowners to deleverage or handle fund redemptions. Resorts stay an efficient hedge in opposition to inflation which, mixed with the return of worldwide capital and pricing consensus, ought to help exercise throughout the sector”

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a number one international actual property providers agency that delivers distinctive worth for actual property occupiers and homeowners. Cushman & Wakefield is among the many largest actual property providers corporations with roughly 52,000 workers in over 400 places of work and roughly 60 international locations. In 2022, the agency had income of $10.1 billion throughout core providers of property, amenities and mission administration, leasing, capital markets, and valuation and different providers. To be taught extra, go to www.cushmanwakefield.com or observe @CushWake on Twitter.