One of many issues that we, Filipinos, have to maintain earlier than any worldwide journey is the journey tax. However do you know that not all vacationers must pay this? Sure sorts of vacationers are eligible for exemption or diminished price. On this article, we’ll sort out all these, so learn on!

WHAT’S COVERED IN THIS GUIDE?

What’s journey tax?

The Philippine journey tax (or just “journey tax”) is a levy collected from vacationers leaving the Philippines. Generally, it’s already included in your flight reserving. More often than not, it is advisable settle this by yourself on the airport.

However this quantity doesn’t go to the airline. It goes to the Philippine authorities:

- 50% of the proceeds to the Tourism Infrastructure and Enterprise Zone Authority (TIEZA)

- 40% to the Fee on Increased Training (CHED)

- 10% to the Nationwide Fee for Tradition and the Arts (NCCA)

How a lot is the journey tax?

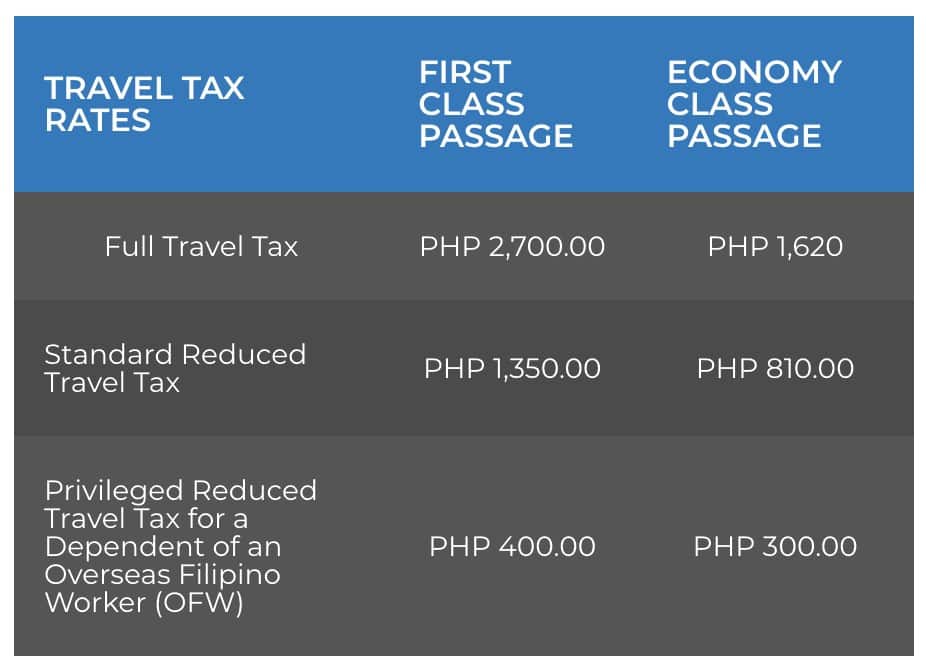

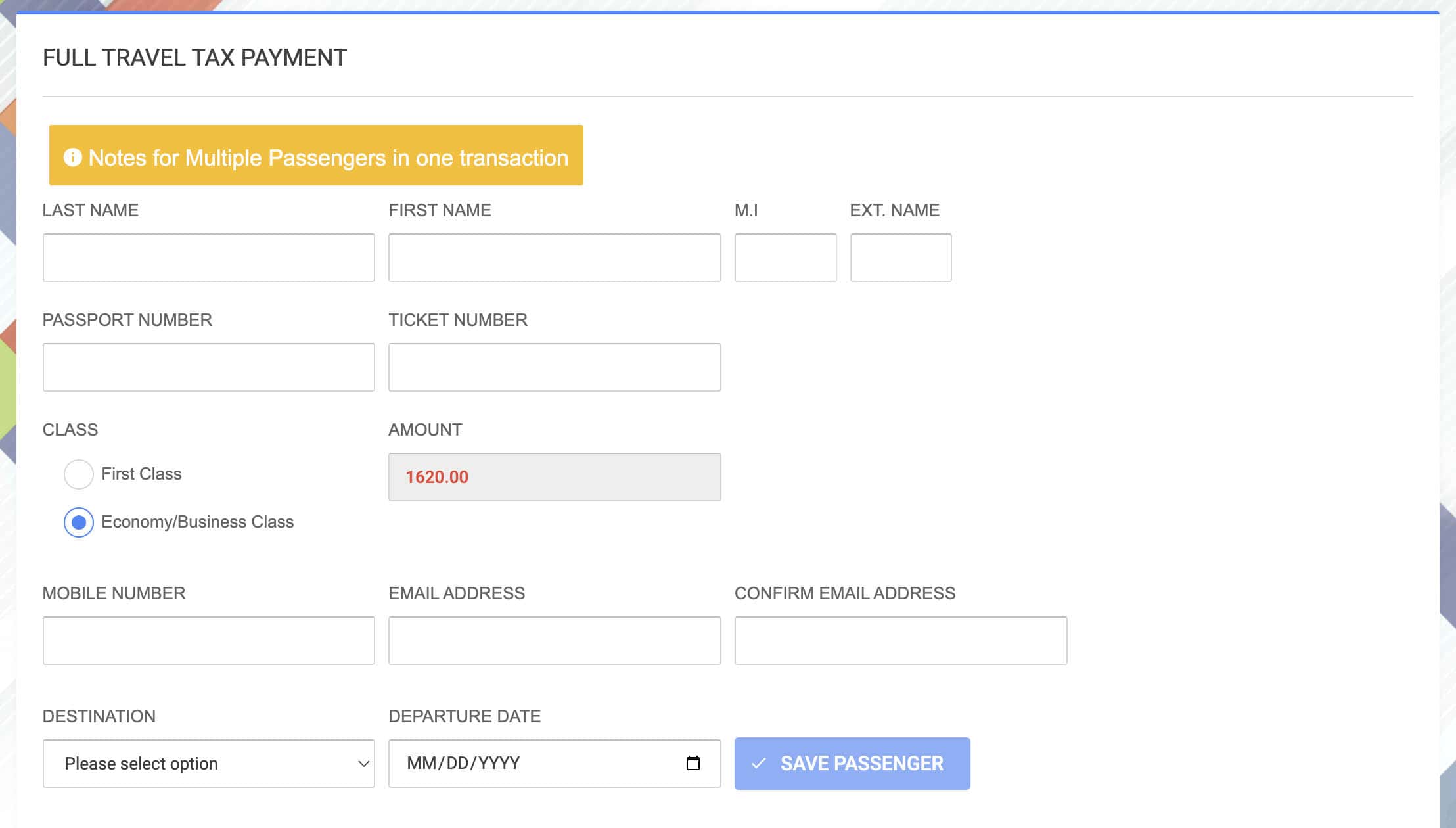

Generally, the journey tax prices PHP 1,620 for economic system class passengers or PHP 2700 for first-class passengers.

I say “most circumstances” as a result of some sorts of vacationers are eligible for decrease or diminished charges.

Right here’s the worth matrix:

So who can avail of the diminished journey tax?

REDUCED Journey Tax Eligibility & Necessities

Vacationers falling underneath eligible courses pays diminished or discounted journey tax as an alternative of the total quantity. There are two primary classes: STANDARD diminished journey tax and PRIVILEGED diminished journey tax.

To avail of the diminished charges, you could apply on-line or on website:

- In the event you don’t have a flight ticket but, accomplish this TIEZA kind on-line.

- In the event you’ve already booked your flight, you could file at any TIEZA journey tax workplace together with the journey tax counter on the counter.

Listed below are the eligible sorts of passengers and the corresponding paperwork it is advisable current to avail of the diminished charges.

STANDARD Lowered Journey Tax

CHILDREN: 2 years and 1 day to 12 years outdated

- Authentic Passport

- Flight reserving affirmation, if issued

- If the unique passport can’t be offered, submit authentic delivery certificates and photocopy of identification web page of passport

Accredited Filipino journalists on project

- Authentic Passport

- Flight reserving affirmation, if issued

- Certification from the Workplace of the Press Secretary

- Certification from the station supervisor or editor

People with authorization from the President

- Authentic Passport

- Flight reserving affirmation, if issued

- Written authorization from the Workplace of the President

PRIVILEGED Lowered Journey Tax

Some relations of Abroad Filipino Employees (OFWs) could avail of the diminished charges in the event that they’re touring to the nation the place the OFW is predicated and capable of present the next paperwork:

OFW’s Official Partner

- Authentic Passport

- Flight reserving affirmation, if issued

- OEC – Abroad Employment Certificates (authentic copy) or Balik-Manggagawa Kind (licensed true copy)

- Marriage contract, authentic or authenticated

- Certification that the seaman’s dependent is becoming a member of the vessel, issued by the manning company

OFW’s youngsters who’re single and under 21 years outdated (authentic or illegitimate)

- Authentic Passport

- Flight reserving affirmation, if issued

- OEC – Abroad Employment Certificates (authentic copy) or Balik-Manggagawa Kind (licensed true copy)

- Start certificates, authentic or authenticated

- Certification that the seaman’s dependent is becoming a member of the vessel, issued by the manning company

OFW’s youngsters with disabilities (no matter age)

- Authentic Passport

- Flight reserving affirmation, if issued

- OEC – Abroad Employment Certificates (authentic copy) or Balik-Manggagawa Kind (licensed true copy)

- Start certificates, authentic or authenticated

- Certification that the seaman’s dependent is becoming a member of the vessel, issued by the manning company

- PWD ID card, authentic copy issued by a Nationwide Council of Incapacity Affairs (NCDA) workplace

EXEMPTION Eligibility & Necessities

Some vacationers are additionally exempted from paying the journey tax altogether. TIEZA has recognized 19 sorts of passengers who’re eligible for exemption together with worldwide flight crew members, diplomats, and Philippine officers on official enterprise.

However let’s spotlight these 4 (4) classes as these are probably the most inclusive:

Abroad Filipino Employees (OFWs)

- Authentic passport

- Copy of passport bio web page

- 2×2 ID photograph, taken inside the previous six months (JPG solely)

- Airline ticket or flight reserving

- If employed by means of POEA, Abroad Employment Certificates (OEC)

- If instantly employed overseas, Employment Contract authenticated by the Philippine Embassy or Consulate OR Certificates of Employment issued by the Philippine Embassy or Consulate

Balikbayans whose keep within the Philippines is shorter than one 12 months

- Authentic passport

- Copy of passport bio web page

- 2×2 ID photograph, taken inside the previous six months (JPG solely)

- Copy of stamp of final departure from the Philippines and stamp of arrival within the Philippines, which ought to present period of at the very least one (1) 12 months

- Flight ticket/reserving used to journey to the Philippines

Filipino everlasting residents overseas whose keep within the Philippines is shorter than

one 12 months

- Authentic passport

- Copy of passport bio web page

- 2×2 ID photograph, taken inside the previous six months (JPG solely)

- Airline ticket or flight reserving

- Copies of the stamp of final arrival within the Philippines

- Proof of everlasting residence overseas (US Inexperienced card, Canadian Kind 1000, or related)

- Certification of Residence, issued by the Philippine Embassy or Consulate (if the nation of residence doesn’t grant everlasting resident standing or applicable entries within the passport)

Infants (2 years outdated and under)

- Authentic passport

- Copy of passport bio web page

- 2×2 ID photograph, taken inside the previous six months (JPG solely)

- Airline ticket or flight reserving

- If the unique passport can’t be offered, delivery certificates (authentic copy)

There are 15 extra eligible varieties. To see the total listing of eligible passengers and corresponding necessities, go to this web page.

Tips on how to Pay Journey Tax

There are a number of methods to settle the journey tax.

Choice A: Upon reserving your flight

Some legacy airways mechanically embrace the Philippine journey tax in every reserving. Most low-cost carriers don’t, however offer you an possibility to take action.

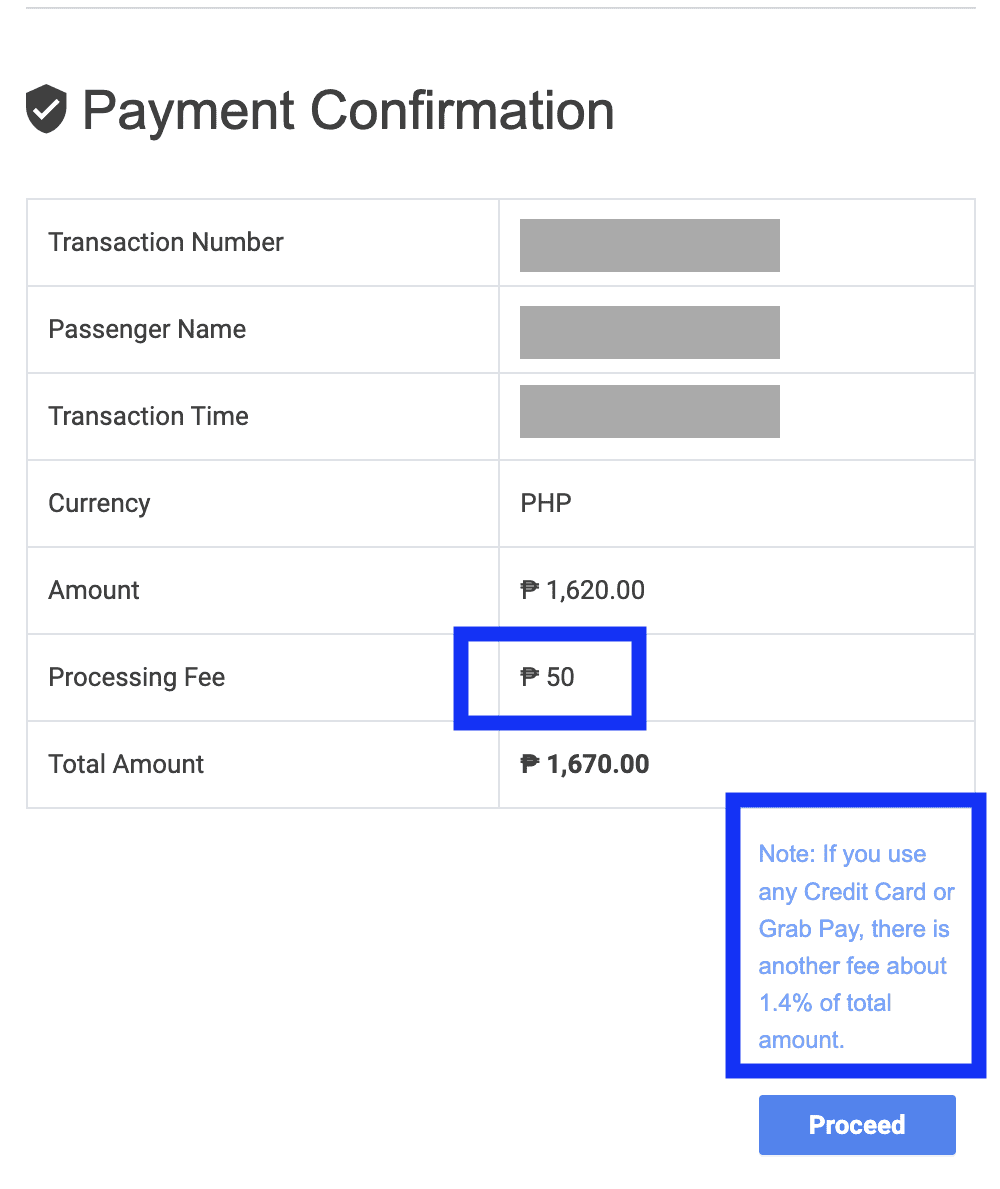

When reserving with Cebu Pacific and AirAsia, the system will ask you if you wish to embrace the journey tax in your cost. It comes with a PHP 50 processing payment.

Choice B: On the Airport Journey Tax Counter

That is the commonest and my most well-liked approach of paying.

TIEZA has journey tax counters in any respect terminals of all worldwide airports within the Philippines. At Manila’s Ninoy Aquino Worldwide Airport (NAIA) Terminal 3, you’ll discover a counter at each aisle. Simply method one and current the next:

- passport

- flight reserving affirmation

As soon as paid, you’ll be handed two copies of the official TIEZA receipt. You may hold the unique copy to your self, however the duplicate copy should be submitted to the check-in agent with the intention to obtain your boarding go.

In the event you’re undecided if it’s already included in your flight ticket, verify the cost breakdown in your reserving affirmation. It ought to present you the varied taxes and charges that you just paid for, however look particularly for PH TAX that prices P1620 (P2700 for first-class) or equal quantity in overseas forex.

In the event you discover it, no have to pay on the airport. In any other case, don’t pay simply but since you may be double charged. As a substitute, skip the journey tax counter and line as much as the check-in counter instantly. As you verify in, the agent will let you know whether or not or not the journey tax has been settled. If not, they are going to instruct you to pay first and return to them with the receipt earlier than they may offer you a boarding go.

Don’t fear, you gained’t must queue up once more. Simply stroll straight to the agent if you come again.

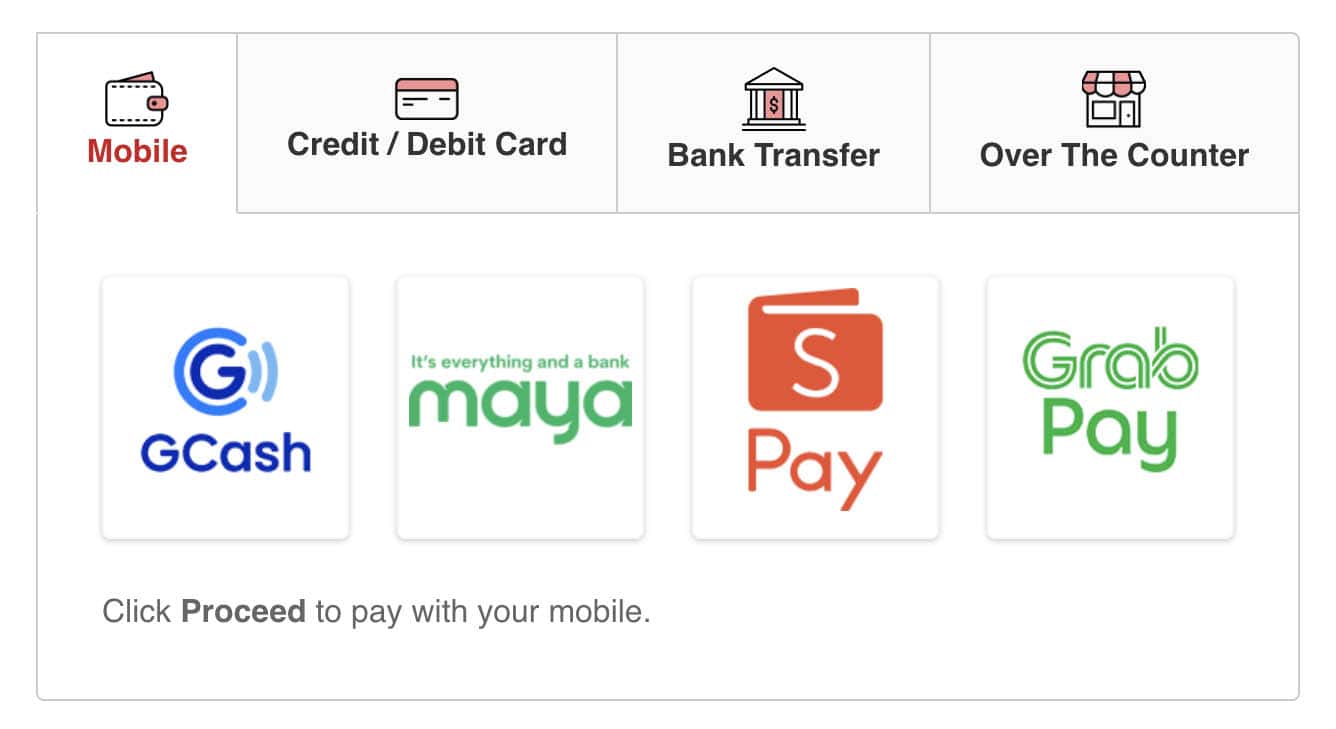

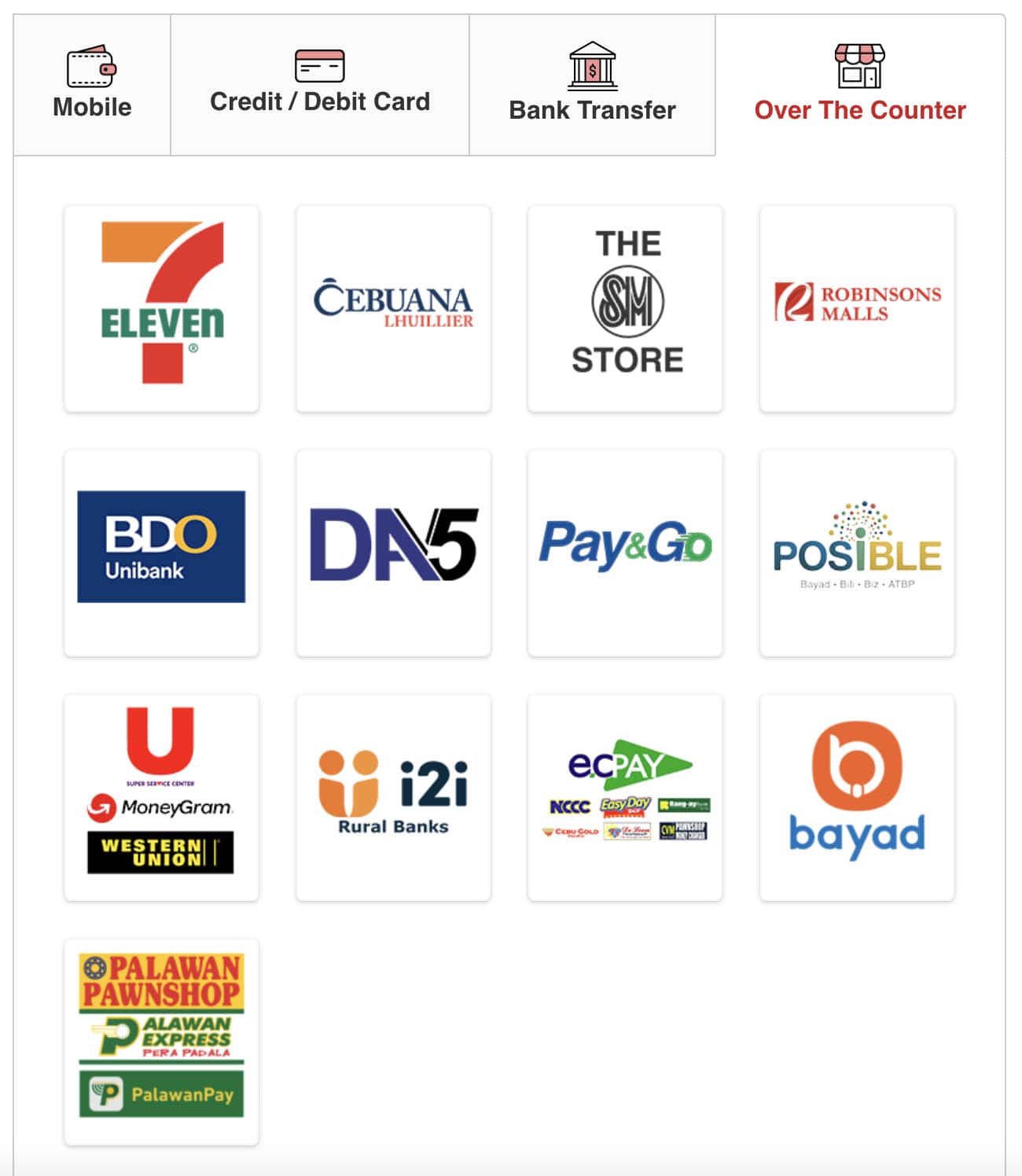

Choice C: By way of the TIEZA Web site

You too can pay on-line upfront. Simply go to the TIEZA Cost Web page, fill out the shape, and choose probably the most handy cost technique for you.

You may pay by means of any of the next:

- E-wallet: GCash, GrabPay, Maya, ShopeePay

- Bank card: Visa, MasterCard

- Financial institution Switch: BDO, BPI, UnionBank, Metrobank, RCBC, Maybank, Instapay

- Over the Counter: 7-Eleven, Cebuana Lhuiller, Western Union, Bayad Middle, EC Pay, The SM Retailer, Robinsons Malls, and so forth.

⚠️ Notice: The TIEZA web site fees a processing payment of PHP 50. As well as, paying by way of GrabPay and bank card entails extra cost of 1.4% of whole quantity.

Journey Tax Refund

You may file for a refund for those who paid if you’re not imagined to otherwise you paid greater than what you’re imagined to.

Listed below are the appropriate causes or circumstances for a refund:

- You didn’t get to journey as a result of the flight was cancelled, you have been offloaded, otherwise you simply selected to not for no matter purpose.

- You’re a non-immigrant foreigner who should not topic to the Philippine journey tax.

- You’re eligible for journey tax exemption.

- You’re eligible for diminished journey tax however you paid the total quantity. On this case, you may get a partial refund.

- You paid for first-class passage however you have been downgraded to economic system class. Partial refund applies.

- You paid the journey tax TWICE for a similar ticket.

In the event you paid the journey tax on the airport counter, you may get the refund on the identical day or on the newest, inside the subsequent 24 hours. In the event you paid it by way of different channels, it’d take longer to course of, relying in your chosen cost technique.

Typically, listed below are the necessities it is advisable current to say a refund:

- authentic passport

- TIEZA refund kind no. 353

- TIEZA journey tax receipt

- airline ticket exhibiting you paid the journey tax (if included within the flight cost)

However relying in your purpose, there could also be extra paperwork it is advisable current to help your case. You’ll find the full listing of necessities right here.

You may file for a refund declare inside 2 YEARS from the date of cost. When you have unflown tickets from final 12 months or so, you may nonetheless get a refund for that now.

Updates Log

2024 • 5 • 9: Authentic publication