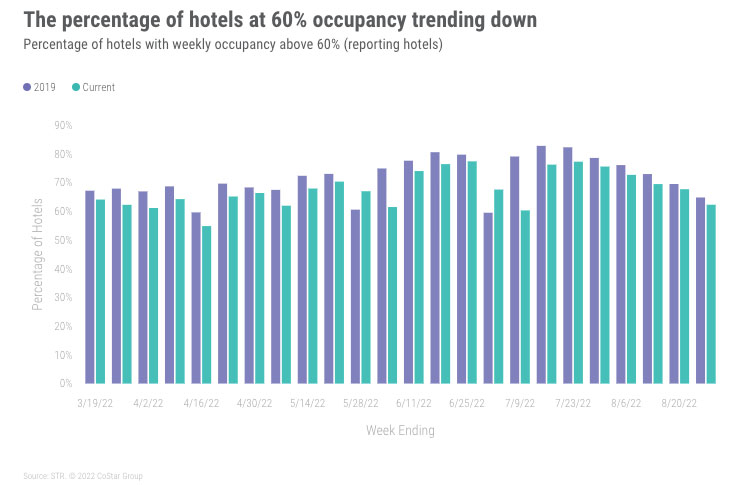

As anticipated for the reason that finish of July, demand is trending down, however the week-on-week (WoW) lower for 21-27 August 2022 continued to be lower than what was noticed in earlier years. Extra importantly, this was the best demand ever recorded for this particular week relationship again to 2000. Weekly demand was equal to 2019, however that stage was simpler to satisfy as a result of that was the week forward of the Labor Day vacation that 12 months. The other of that vacation calendar shift can be true within the information that STR processes subsequent week. Weekly occupancy was 65%, which was 1.7 share factors decrease than within the comparable week of 2019, however do not forget that provide is up 2.6% since over that point. Nominal common each day fee (ADR) decreased 2.6% WoW to US$147 however was 15% increased than 2019 and 11% increased than a 12 months in the past. Nominal income per out there room (RevPAR) fell 5.9% WoW to US$96, which was 12% better than in 2019 and 18% increased than a 12 months in the past. Actual (inflation-adjusted) ADR was one p.c decrease than in 2019 whereas actual RevPAR was three p.c decrease than in 2019 and unchanged from per week in the past.

Weekly demand fell 3.4% as in comparison with -6.8% in 2011, a 12 months with the identical calendar composition as 2022. Excluding 2020, the common weekly demand lower for this particular week over the previous 21 years has averaged -6.1% or roughly -1.4 million rooms. At -898,000 rooms, the decline was the bottom for this specific week going all the way in which again to 2000 (excluding 2020).

So, what modified? Prime 25 Market and Group weekday (Monday – Wednesday) demand elevated. The latter could also be early affirmation of what shoppers have been telling us a few robust Fall convention season. Weekday Group demand amongst Luxurious and Higher Upscale motels was up 10% WoW and reached the third highest total quantity since 2000, behind 2016 and 2019. Within the Prime 25 Markets, Group demand noticed the same rating and elevated 14% WoW. Seventeen of the Prime 25 Markets noticed weekday Group demand improve WoW, together with Atlanta, Dallas, Orlando, New York, San Diego, and San Francisco.

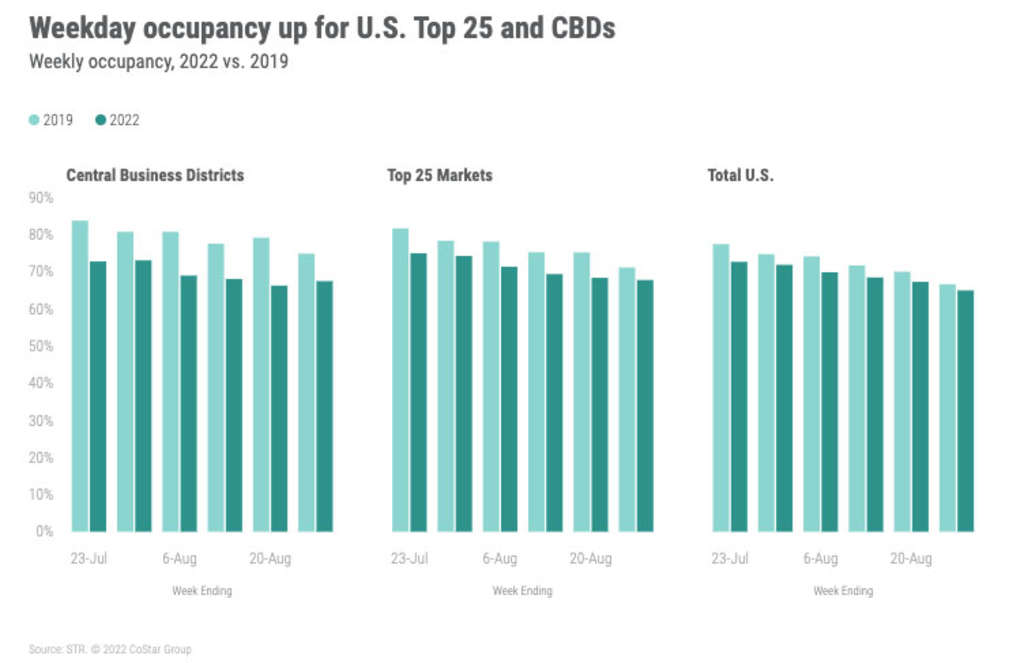

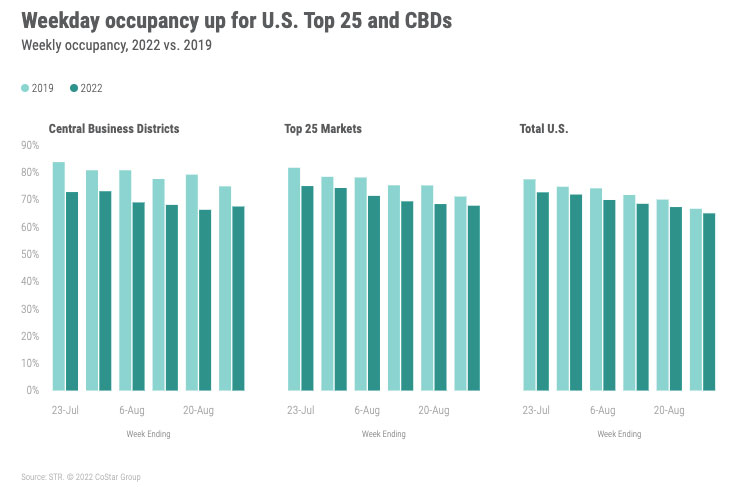

Weekday occupancy for the Prime 25 Markets elevated, for the primary time in six weeks, by 0.8 share factors to 67.9%. Eleven of the Prime 25 Markets, together with Atlanta, Boston, Chicago, Houston, and Philadelphia noticed weekday occupancy good points. At 81%, Boston had the best weekday occupancy among the many Prime 25. Weekday occupancy for conference and convention motels within the Prime 25 elevated 5.4% WoW.

Among the many scales inside the Prime 25 Markets, Luxurious (+3%), Higher Upscale (+5%), and Upscale (2%) motels all noticed WoW good points with the rest persevering with to see declines. Weekday demand in giant (300+ rooms), city, Higher Upscale motels elevated 9% WoW.

For the whole week, Prime 25 Market occupancy fell 0.6 share factors resulting from 1.9% WoW lower on shoulder days (Sunday & Thursday) in addition to a 2.7% decline on the weekend (Friday & Saturday). This 12 months’s Prime 25 weekend occupancy continued to be increased than on the similar time final 12 months however was simply 94% of 2019’s quantity. The most important WoW lower in demand was additionally on the weekend for non-Prime 25 Markets, falling 5.1%. The week-on-week decreases stay in keeping with earlier years given the beginning of Okay-12 faculties. Based on STR’s 2022-23 Faculty Break Report, 73% of faculties had resumed courses.

In contrast to the Prime 25, central enterprise districts (CBD) noticed occupancy good points, up 1.2 share factors to 67.5%. Weekday occupancy was up 3.5 share factors WoW whereas weekend occupancy dropped 1.7 share factors. Shoulder days had been up barely. Ten of the 20 CBD markets reported weekday occupancy above 70%, with Atlanta (86.1%) main the way in which. Austin, Boston, and Denver CBDs additionally noticed weekday occupancy high 80%. The bottom weekday occupancy was seen in New Orleans (33%), which was the market’s lowest stage since early within the 12 months. In reality, the whole New Orleans market had the bottom occupancy of any STR-defined U.S. market (45%). Even at its low stage, weekly occupancy for the market has been barely higher than a 12 months in the past however properly under 2019.

At $US$147, nominal ADR was under US$150 for the primary time in 12 weeks. The lower in nominal ADR got here primarily from non-Prime 25 Markets, the place the metric fell 3.7% WoW as Prime 25 Market was down by only one% WoW. Among the many non-Prime 25, the most important decline was seen over the weekend (-5% WoW).

Weekday nominal ADR among the many Prime 25 Markets was down 0.6%. By chain scale, the most important weekday drop was in Luxurious motels, the place nominal ADR fell 3.6% WoW. Higher Upscale, which benefited by the acquire in group journey, noticed nominal ADR lower 0.7% WoW. Group ADR amongst these motels was down barely extra at -1.2%.

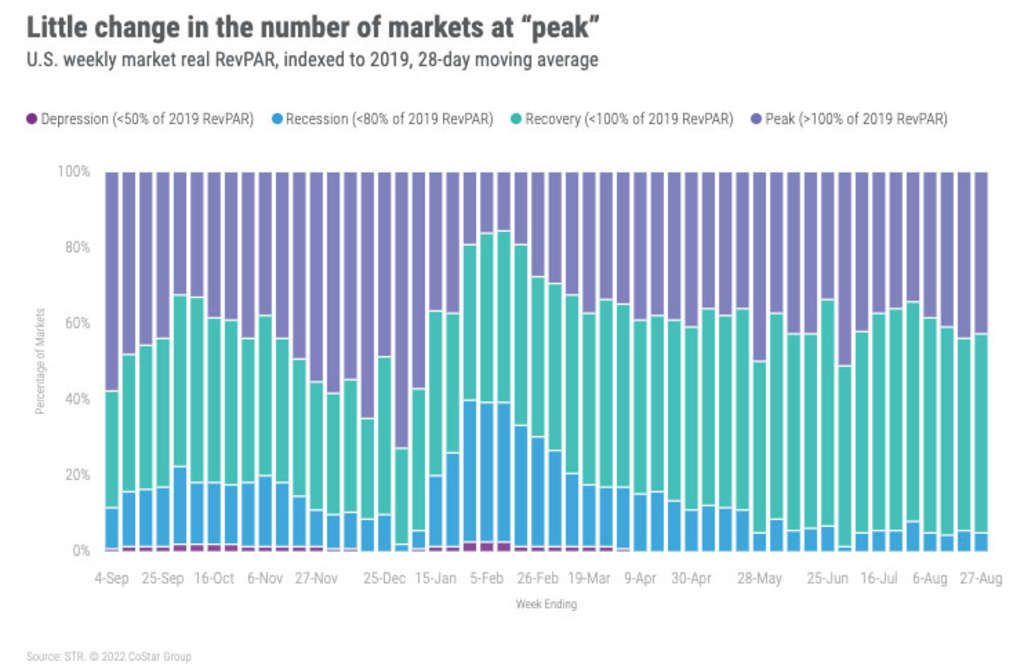

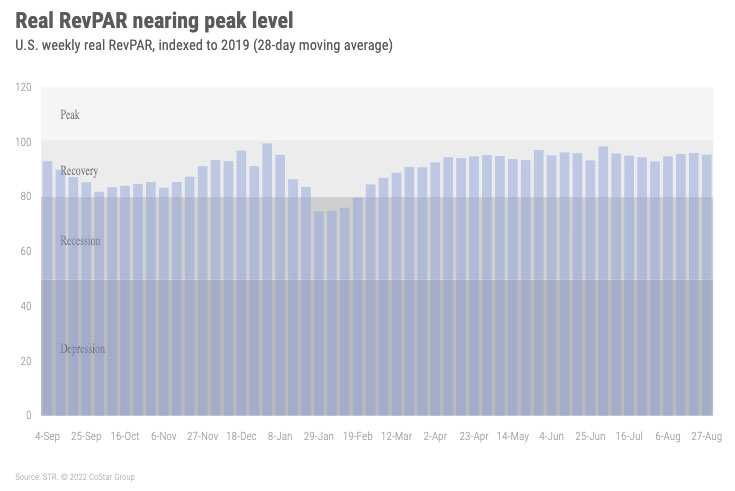

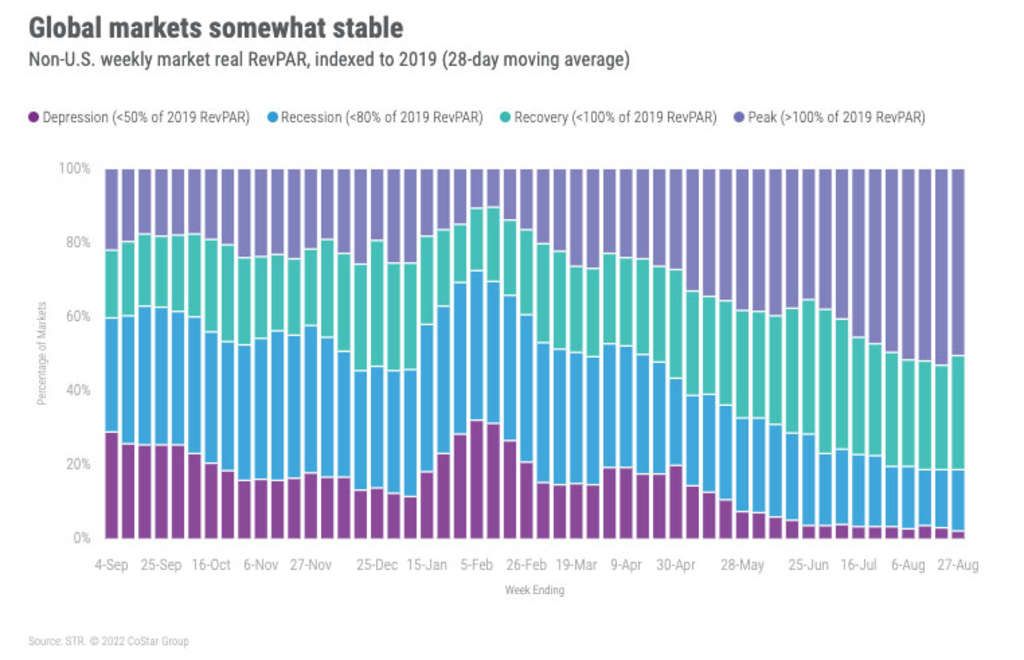

Nominal RevPAR remained properly forward of 2019 in practically all of the 166 STR-defined U.S. markets for the week and previously 28 days. Actual RevPAR, nonetheless, was forward of 2019 in simply 71 markets for the week and for the previous 28 days. One other 87 markets had been in “restoration” with actual RevPAR between 80% and 100% of 2019 ranges over the previous 28 days. Solely eight markets had been in “recession” with actual RevPAR between 50% and 80% of the 2019 stage. This was barely lower than per week prior.

Across the Globe

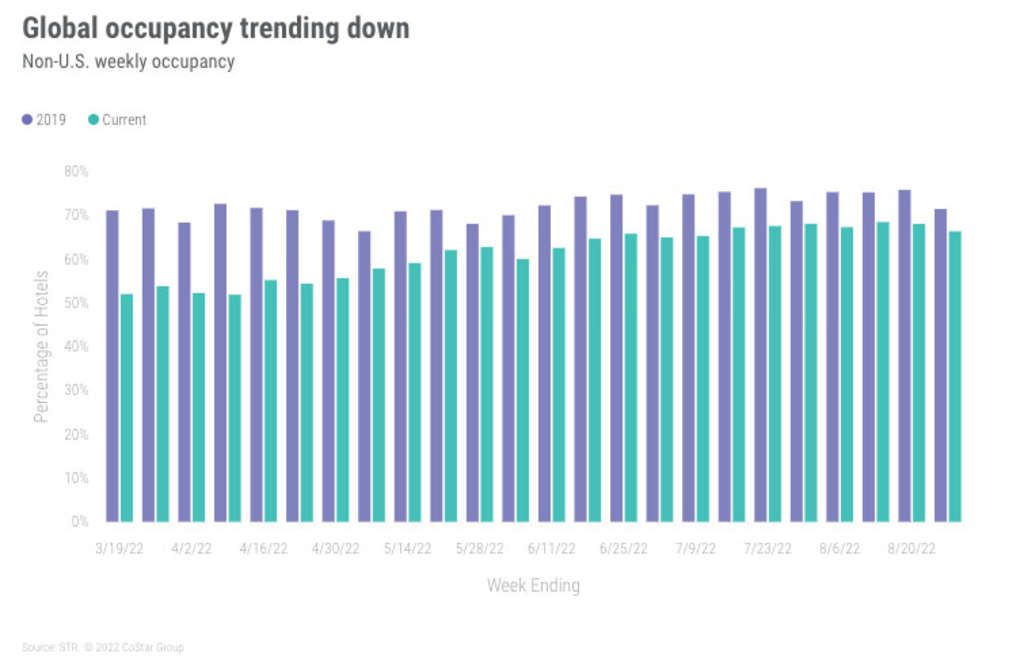

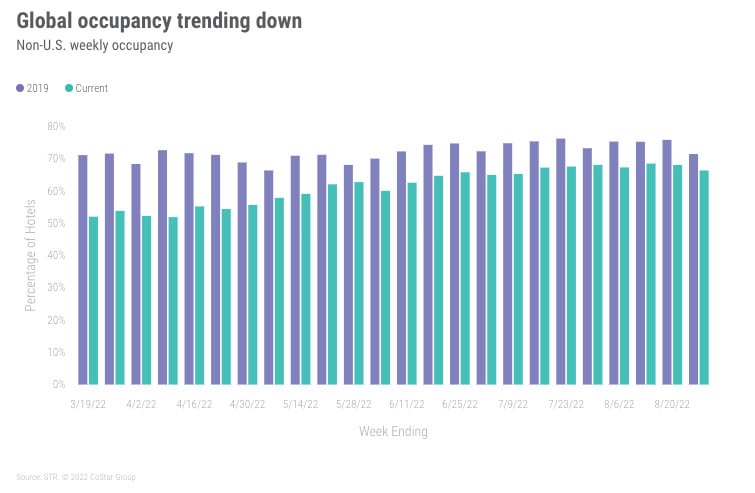

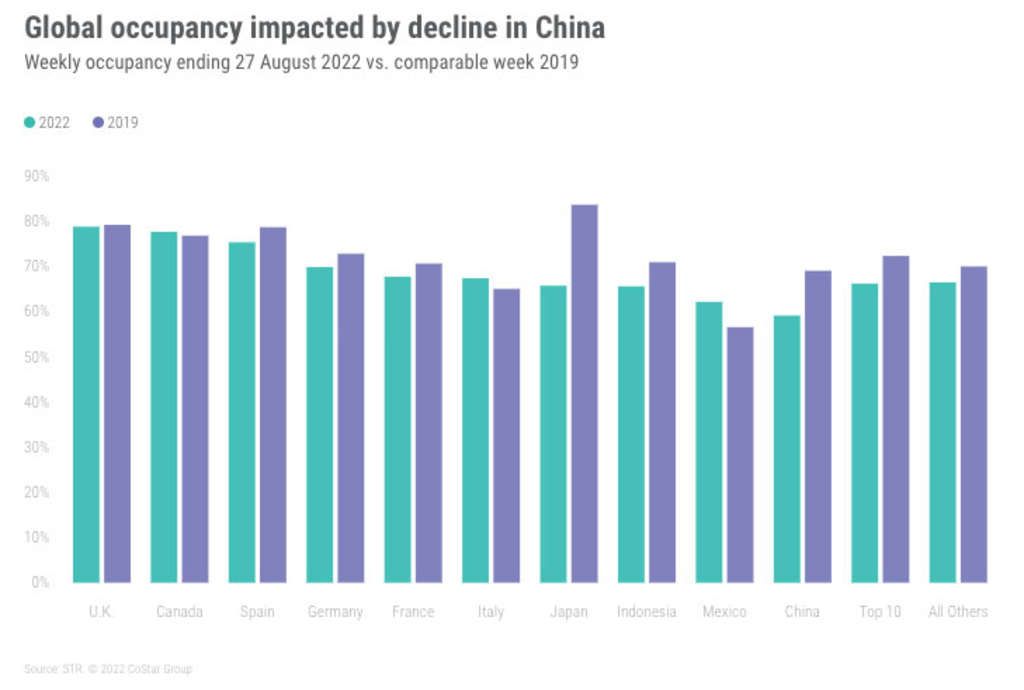

Excluding the U.S., international occupancy reached 66.3%, down 1.7 share factors from the week earlier than—second consecutive weekly lower. Nominal ADR and RevPAR additionally fell (-3.2% and -5.6%, respectively). Of the 103 nations tracked on a weekly foundation, 54 collectively misplaced 2.4 million room nights week on week with China accounting for 54% of the loss. Spain made up 11% of the loss adopted by Italy (5%). The remaining 49 nations noticed progress led by Indonesia (+210,000), however they collectively didn’t offset people who misplaced demand.

With China posting a big demand loss, the highest 10 nations by provide noticed occupancy retreat to 66.2% from 68.5% per week earlier. Solely three nations among the many high 10 noticed demand progress within the week (Germany, Mexico, and Indonesia). The U.Okay. continued to have the best occupancy of the highest 10 (79%) adopted by Canada (78%) and Spain (75%). China had the bottom occupancy at 59%, which was additionally the nation’s lowest stage of the previous eight weeks.

China’s demand decline was widespread as 34 of the 43 markets noticed demand retreat within the week led by Beijing, the place occupancy dropped 13 share factors WoW to 60%. Occupancy gainers had been led by Shanghai, the place the measure elevated 3.4 share factors to 61%. Macau additionally noticed progress (30 share factors) with occupancy rising to 49%, its highest stage since February.

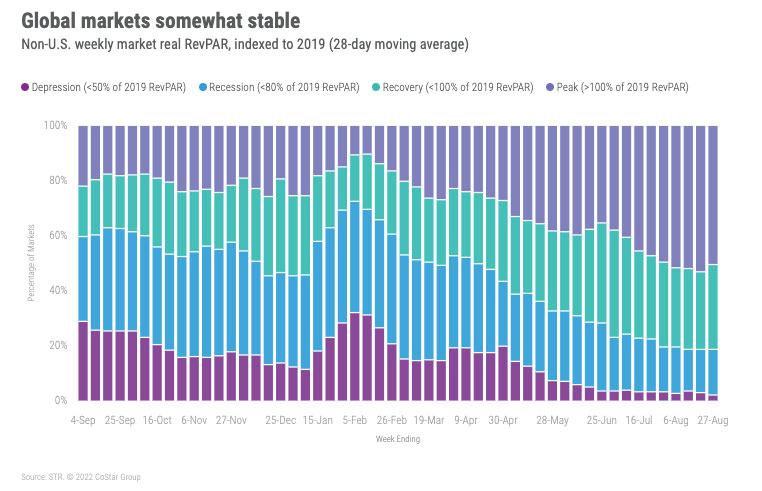

With the dip in efficiency, the share of markets with “peak” 28-day actual RevPAR (RevPAR above 2019) fell with 174 of the 344 non-U.S. markets at that stage. Per week earlier, 183 markets had been at peak. The following largest variety of markets (106) had been in “restoration.” Solely seven markets had been in “despair” (actual RevPAR under 50% of 2019).

Massive Image

Whereas per week doesn’t make a pattern, we had been happy to see the week-on-week acquire within the U.S. Prime 25 Markets and in Group demand in the course of the weekdays. We anticipated a pointy lower throughout all markets and day varieties. Over the subsequent two weeks, comparisons with 2019 will probably be askew because the Labor Day vacation was per week earlier in 2019. Moreover, 2019 comparisons in a number of markets can be affected from the landfall of Hurricane Dorian in that 12 months. The ultimate batch of faculties are additionally anticipated to start after the Labor Day vacation, additional impacting leisure journey within the close to time period.

About STR

STR supplies premium information benchmarking, analytics and market insights for the worldwide hospitality business. Based in 1985, STR maintains a presence in 15 nations with a company North American headquarters in Hendersonville, Tennessee, a global headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the main supplier of business actual property info, analytics and on-line marketplaces. For extra info, please go to str.com and costargroup.com.