Funding Developments

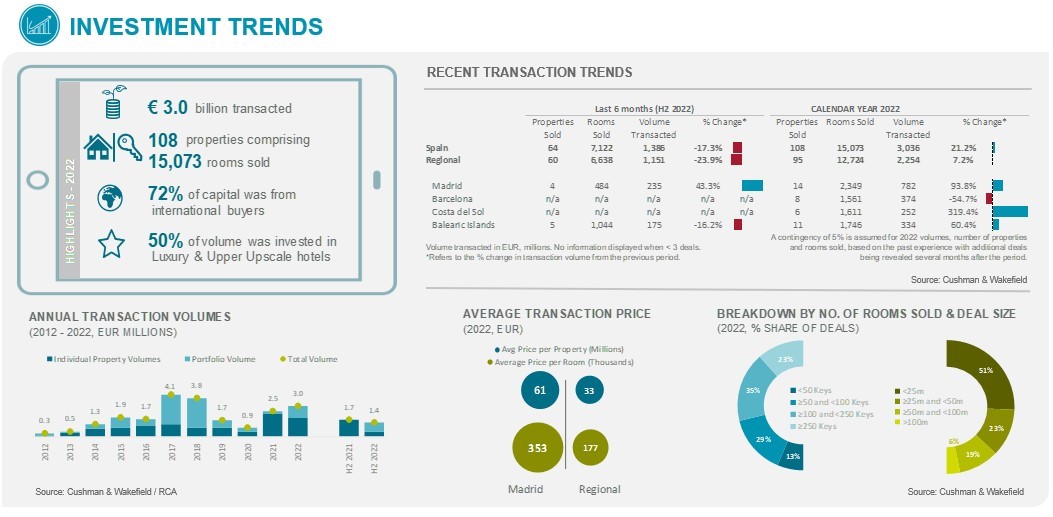

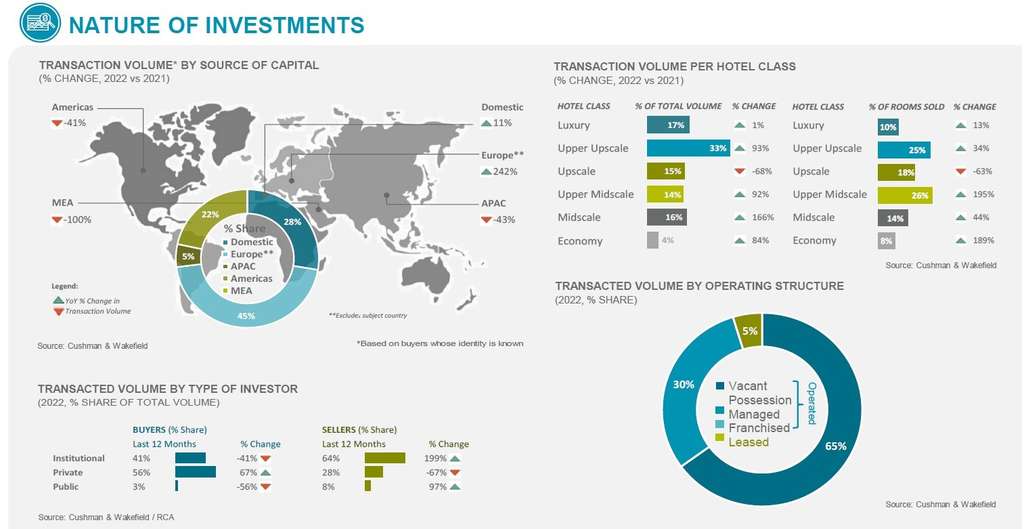

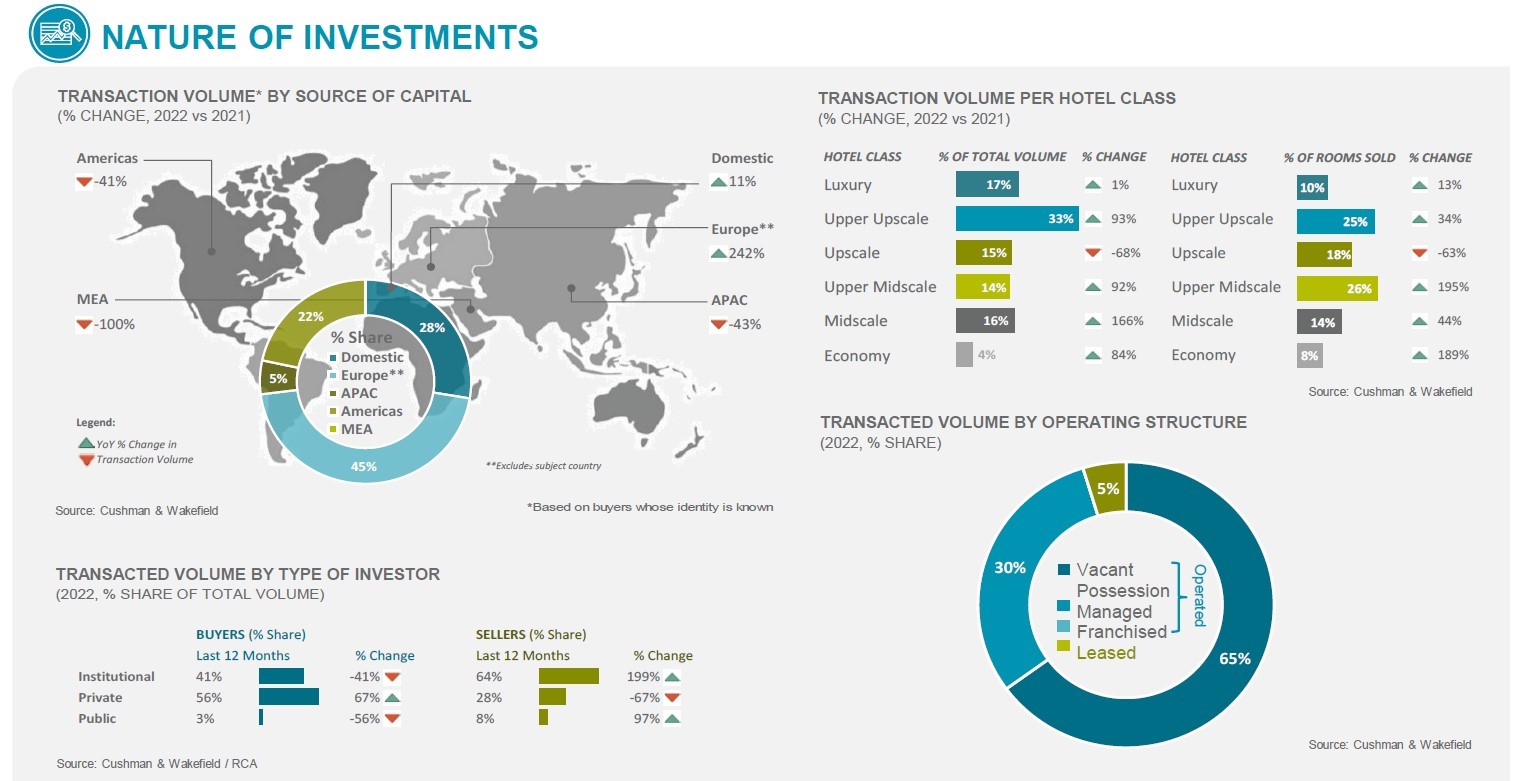

In 2022, the resort transaction exercise in Spain reached €3Bn; a degree solely exceeded in 2017 and 2018 (file years). The entire quantity was 21% above 2021, regardless of the financial and political considerations. The rising recognition of resorts inside resort investments, in addition to the continued attractiveness of main gateway cities with a robust leisure attraction, contributed to this vital progress.

Prime Yields

Yields remained flat in 2022, given the restoration of tourism demand, robust investor urge for food, excessive liquidity available in the market, and commercialization of prime property, contributing to the relaunch of funding exercise in Spain. Nonetheless, the tempo could decelerate in 2023 as record-breaking resort performances in Q2 and Q3 led to excessive promoting costs, which, including to growing financing prices, provides strain on yields and expands pricing expectations between consumers and sellers.

Market Efficiency

General, the Spanish market has skilled an accelerated restoration throughout 2022, with a RevPAR 5% above 2019 ranges (+€1.5). This was primarily pushed by the rising ADR (+16% vs 2019), whereas the occupancy continues its path to restoration (10% under 2019).

Provide

Whatever the present difficult geopolitical and macroeconomic setting, quite a few resorts are anticipated to open by 2023, following the optimistic pattern of 2022. Examples of main openings embrace the Barceló Costa Papagayo (720 keys), Gloria Palace Costa Teguise (350 keys) and Ikos Porto Petro (319 keys). The primary two are situated within the Canary Islands and the latter in Mallorca, reaffirming the funding concentrate on coastal resorts.

Demand

Spain skilled a robust restoration throughout 2022, primarily pushed by home demand, whereas worldwide travellers additionally began to choose up in April. Though evening stays remained decrease than in 2019, common spending per visitor improved, with an elevated demand for premium resort merchandise (+2.7% in a single day stays in 4- and 5-star resorts Jan-Nov 2022 vs 2019), reflecting lower cost sensitivity.

Sources: C&W, STR, Oxford Economics

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a number one world actual property providers agency that delivers distinctive worth for actual property occupiers and homeowners. Cushman & Wakefield is among the many largest actual property providers companies with roughly 50,000 staff in over 400 workplaces and roughly 60 international locations. In 2021, the agency had income of $9.4 billion throughout core providers of property, amenities and venture administration, leasing, capital markets, and valuation and different providers.

To study extra, go to www.cushmanwakefield.com or observe @CushWake on Twitter.