Foreword

Prior to now 12 months, Israel’s resort sector has continued to exhibit its resilience and its means to face up to the impression of COVID-19, just like the way in which it has bounced again from so many earlier adversities. The home tourism market has been a saviour – reaching development in extra of 2019’s ranges by the tip of 2022 – and there are actually indicators that worldwide visitation is recovering strongly, and we’re assured that, barring any unexpected challenges, this might have recovered to 2019 ranges by the tip of 2023.

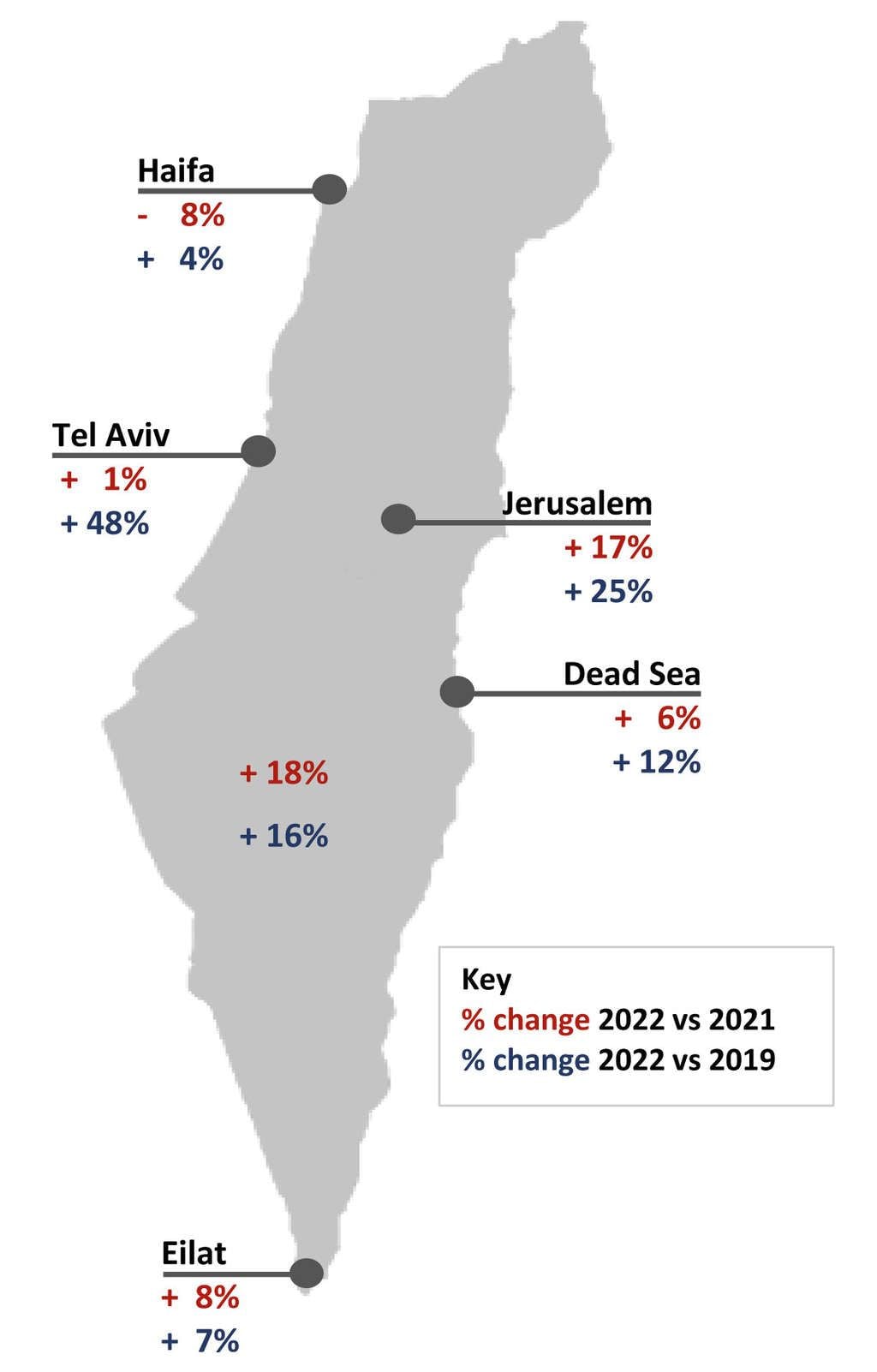

Israelis have an unquenchable thirst for journey, and the alternatives created by the signing of the Abraham Accords, almost three years in the past as I write this (June 2023), have resulted in big numbers exploring the charms of the United Arab Emirates specifically, with the opposite primary signatory international locations – Bahrain and Morocco – welcoming extra Israelis.

Throughout 2022, HVS shaped an alliance with the Abraham Accords Peace Institute (AAPI), a non-partisan, non-profit US organisation devoted to supporting the implementation and growth of the historic Abraham Accords peace agreements, to advise on methods through which tourism between the international locations might be expanded, thereby enabling development in every nation’s GDP.

We printed our first report – Leveraging the Abraham Accords to Stimulate Tourism Progress – earlier this 12 months. The target of this report was to determine these alternatives, by the expansion of tourism, that may deepen the relationships and cultural understanding between the folks of the international locations that are signatories of the Accords and construct tourism’s contribution to the GDP of every nation. As soon as profitable, it will strengthen the worth of the Accords amongst the prevailing international locations and exhibit concrete advantages to different international locations which might be contemplating changing into a part of this historic alternative.

The report included an in depth evaluation of tourism alternatives for every of the Abraham Accords (AA) international locations together with a few of their key neighbours. Amongst our many suggestions for Israel, we inspired the creation of a particular division within the Ministry of Tourism liable for utilizing the AA as a catalyst to (1) develop tourism to Israel from the member nations and (2) create and promote regional initiatives to develop tourism from all of the member nations. Moreover, Israel ought to develop a sturdy advertising and marketing plan for every member nation, allocate VIP accreditation to bona fide travellers from AA nations to make sure a clean and protected journey expertise, and set up an eVisa facility for nations that supply such choices to Israeli travellers.

Such is the significance of the visa scenario that we now have simply printed a follow-up paper with AAPI – Simpler Visas Result in Tourism Progress and Elevated GDP – which signifies that improved visa procedures would increase the motion of vacationers amongst AA member nations, leading to potential financial development and stronger people-to-people ties. The discount in limitations to elevated tourism is an integral part in enabling regional commerce and financial partnerships. Typically, international locations which have a extra traveller-friendly coverage concerning entry visas profit from expanded tourism development, which has a constructive impact on their GDP.

My colleagues and I hope that this annual overview of the Israel Lodge Market will help traders, builders, house owners and operators of accommodations in Israel – each throughout the nation and from overseas – to be a part of the chance to develop the nation’s resort sector and the ensuing enchancment in its GDP because the journey and tourism sector will increase its prominence throughout the Israeli financial system.

Nation Highlights

A Resilient Financial system

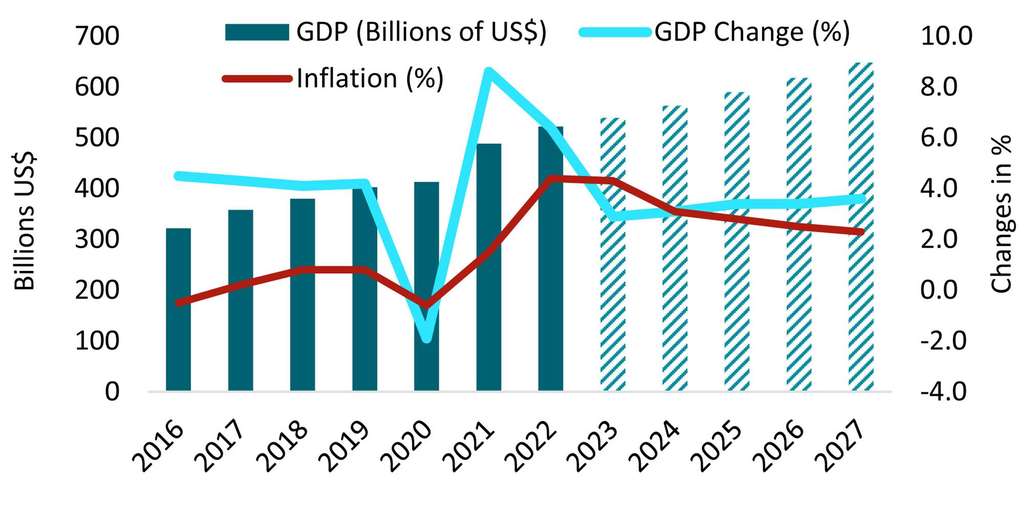

The Israeli financial system skilled a decade of flourishing development, positioning itself as one of many prime performers amongst OECD international locations with a powerful GDP compound annual development price (CAGR) of 6.0% between 2010 and 2019. Nonetheless, 2020 marked a major downturn for the financial system, with a contraction of 1.9% in GDP, the primary decline since 2002. Regardless of this setback, the Israeli financial system has exhibited a sturdy restoration following the COVID-19 pandemic, aided by a profitable vaccination marketing campaign. It has additionally demonstrated energy within the face of the repercussions of Russia’s warfare on Ukraine, pushed by its resilient financial sectors equivalent to high-technology, industrial manufacturing, vitality, monetary providers, tourism and agriculture.

Though inflationary pressures have emerged, Israel has managed to keep up comparatively higher management than many European and world nations, primarily as a result of its self-sufficiency in pure fuel. Trying forward, Israel’s GDP development is anticipated to be reasonable within the short- to medium-term, however it’s anticipated to stay substantial and strong, as illustrated in Determine 1.

Undeniably, the journey and tourism sector performs a major position in contributing to Israel’s GDP. It serves as a significant financial pillar, producing income, creating jobs and attracting international trade. It contributed US$16 billion (3.0%) to GDP in 2022, in response to the WTTC, which stays 28% wanting the 2019 contribution to GDP of US$22 billion (5.6%) however reveals a major 66% enhance over the bottom contribution in 2020.

Two Years of the Abraham Accords

The historic signing of the Abraham Accords in August 2020 has offered an unparalleled alternative to reshape the Center East by fostering unity and shifting past longstanding conflicts. Initially established between Israel and the United Arab Emirates (UAE), the Accords have expanded to contain a number of different nations, together with Bahrain, Kosovo, Sudan and Morocco.

This growth has unlocked the potential for development by facilitating regional coordination in essential financial areas equivalent to commerce and tourism, thus aiding the restoration of the tourism sector, which has been impacted by the COVID-19 pandemic. The strategic focus and collaboration amongst these nations maintain immense potential for producing substantial financial good points and sociocultural advantages all through the area.

Vital progress has been made within the first two years because the Accords’ signing, significantly in deepening diplomatic relations between the collaborating governments. This progress is clear by the opening of embassies, the appointment of first-ever ambassadors and a few bilateral visits involving prime ministers and international ministers.

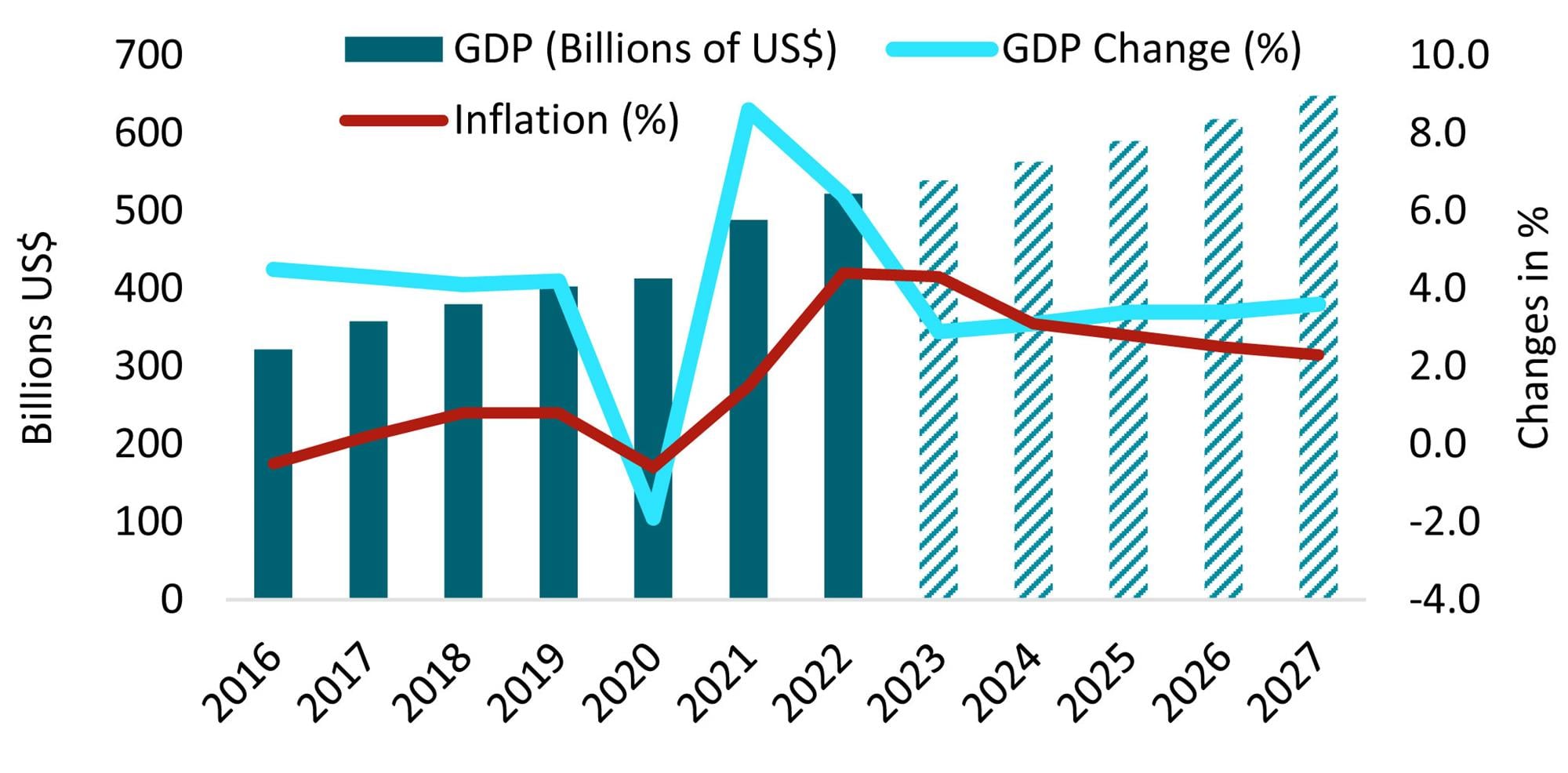

The Abraham Accords have contributed to Israel’s financial development by facilitating commerce among the many member nations. This potential is anticipated to increase additional as relations between these nations proceed to strengthen. The 2022 commerce numbers between Israel and the AA members are offered in Determine 2. A spotlight has now been positioned on increasing the people-to-people ties between AA member nations. The concerned international locations will work to extend tourism and cultural collaboration with Israel, notably by introducing new airline routes between capital cities.

Inbound Tourism on the Rise Once more

Between 2016 and 2019, previous to the pandemic, Israel’s tourism trade skilled exceptional development by way of vacationer arrivals, with a CAGR of 16.2%. This development was attributed to focused advertising and marketing efforts, visa regulation facilitation and a rise within the variety of air routes, due to the implementation of the Open Skies settlement.

Information for 2020 and 2021, alternatively, noticed consecutive declines in international vacationer visits to Israel. Because of the pandemic, Israel closed its borders to international guests and solely permitted entry to completely vaccinated vacationers in November 2021, a choice overturned 4 weeks later in response to the unfold of the Omicron variant. From March 2022 onwards, all vacationers, vaccinated or not, have been allowed entry by offering pre- and post-flight PCR exams, aimed toward supporting the struggling tourism trade. All pandemic-related entry restrictions have been then lifted later in October. As mentioned in our final Israel Lodge Market Overview, international locations and markets with a higher reliance on worldwide demand and air journey are more likely to expertise an extended tourism restoration curve.

Whereas home tourism dominated the share of room nights spent in Israel in 2022 (accounting for 69%), it’s anticipated that international travellers will quickly regain their 2019 share of round 47% and even surpass home traveller numbers. This projection takes under consideration Israel’s vital efforts in selling tourism, the present enhance in attractiveness of sure cities and areas, and the profitable growth of regional, cultural and spiritual tourism pushed by the Abraham Accords.

Home Tourism at an All-Time Excessive

The home tourism sector in Israel reached an all-time excessive in 2022 with near 16 million home travellers recorded, reflecting the altering journey panorama amidst the pandemic. With worldwide journey restrictions nonetheless in place early within the 12 months and several other geopolitical uncertainties, Israelis continued opting to discover their very own nation, resulting in a surge in home tourism, in any other case often called ‘staycations’.

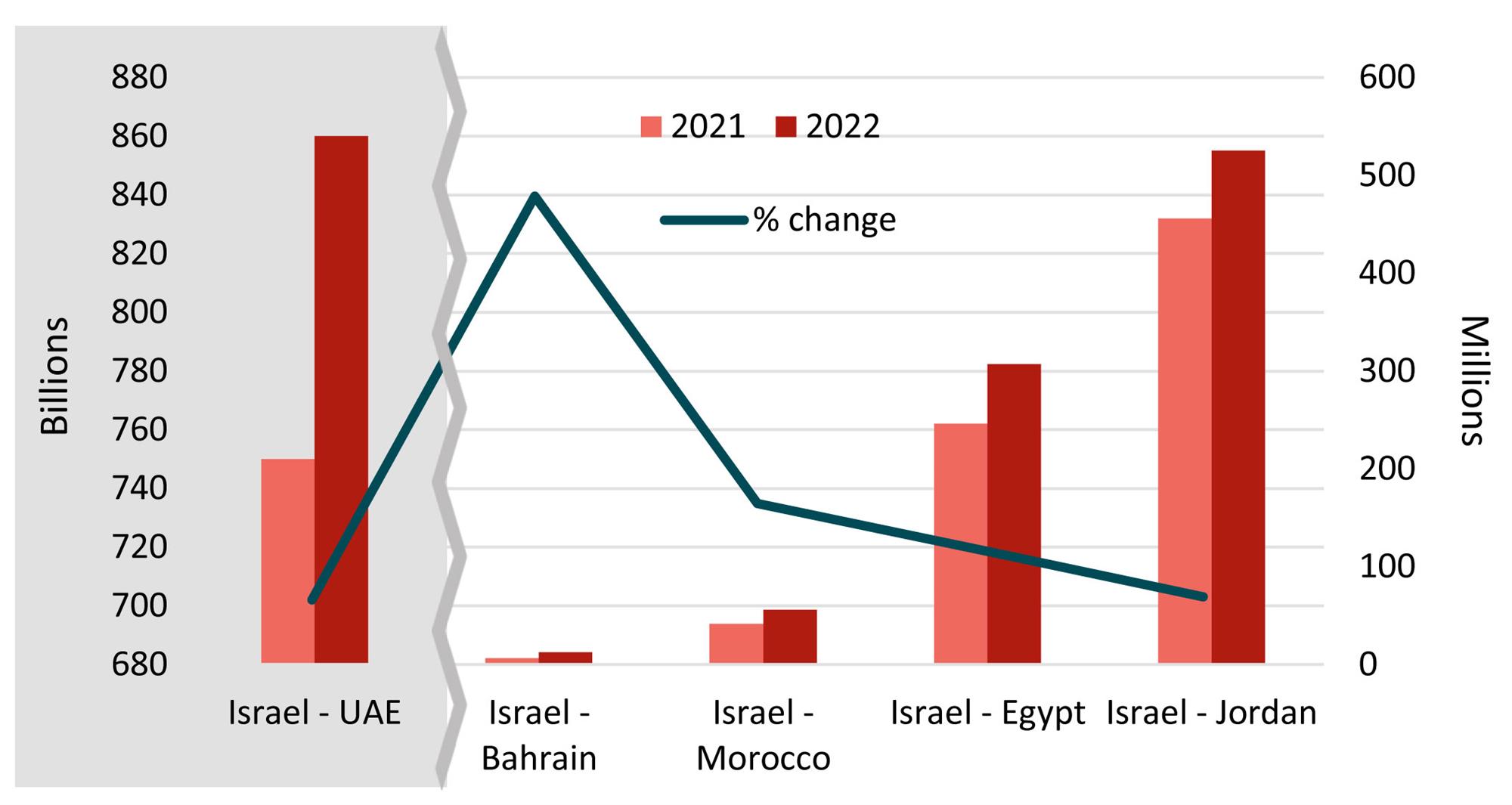

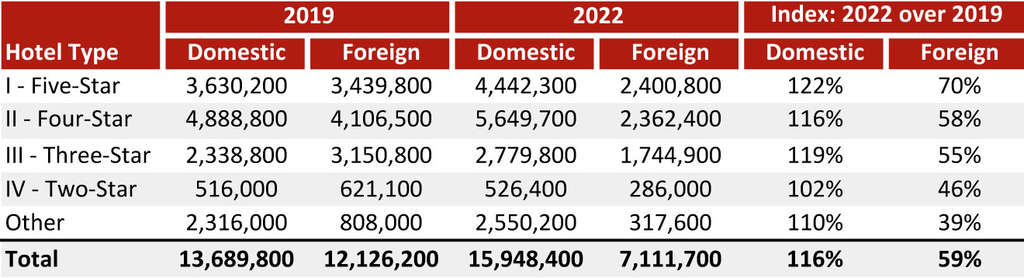

As proven in Determine 3, home bednights in 2022 have been equal to 116% of 2019 ranges and grew by 18% over 2021. As detailed later on this report, all locations in Israel benefitted from this development in 2022, some greater than others, serving to to drive resort occupancy ranges and common charges upwards in the course of the restoration.

Determine 4 offers an summary of the change in room nights arising from home friends in 2022 versus 2021 (in purple) and 2019 (in blue). The information present that every one main markets in Israel generated home demand figures over full-year 2019 outcomes.

Not solely does home tourism present a chance for Israelis to find and recognize their very own heritage and tradition, nevertheless it additionally contributes considerably to the native financial system, supporting companies and employment within the tourism sector. The rise in home tourism is testomony to the resilience and adaptableness of the trade, and it showcases the enduring enchantment of Israel as a fascinating vacation spot for each home and worldwide travellers.

Extra Accommodations Than Ever Earlier than

The variety of accommodations in Israel has witnessed regular development during the last a number of years, with a present provide of round 58,000 rooms (448 accommodations), of which 27% are Stage I (outlined as five-star by the Central Bureau of Statistics), 35% are Stage II (four-star), 28% are Stage III (three-star); the remaining 10% being cut up between two-star, serviced residences and hostels. It’s attention-grabbing to spotlight that 18 new accommodations have opened their doorways since early 2020, in the course of the COVID-19 pandemic, demonstrating the resilience and willpower of Israel’s tourism trade within the face of difficult circumstances. And these accommodations haven’t opened at a considerably completely different scale, as the common variety of rooms per resort has remained at 129 within the nation since 2019.

As offered in Determine 5, Israel has skilled a selected development in four- and five-star lodging, with CAGRs over the 2014-2022 interval of 5.3% and 5.0%, respectively. The rising demand for high-end experiences and the inflow of worldwide vacationers in search of extra luxurious facilities have pushed this development. The hospitality trade in Israel has recognised the significance of catering to upscale travellers, resulting in the event of extra luxurious accommodations throughout the nation.

The expansion within the variety of luxurious accommodations signifies the nation’s means to place itself as a premium tourism vacation spot. Israel’s dedication to offering luxurious lodging aligns with its efforts to reinforce its world picture and appeal to a wider vary of holiday makers, together with prosperous travellers and enterprise professionals. As offered in Determine 6, the 2022 bednights that recovered probably the most to 2019 ranges in Israel and per resort kind have been these spent in five-star accommodations, even with not totally recovered international bednights.

General, the rising variety of luxurious accommodations in Israel displays the nation’s dedication to assembly the evolving wants and preferences of vacationers whereas elevating its standing as a sought-after vacation spot for luxurious journey experiences.

Lodge Market Efficiency

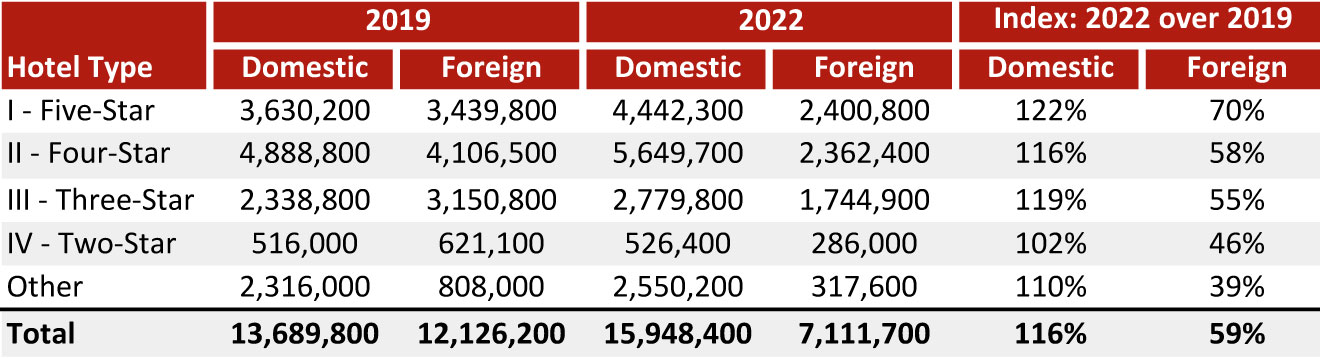

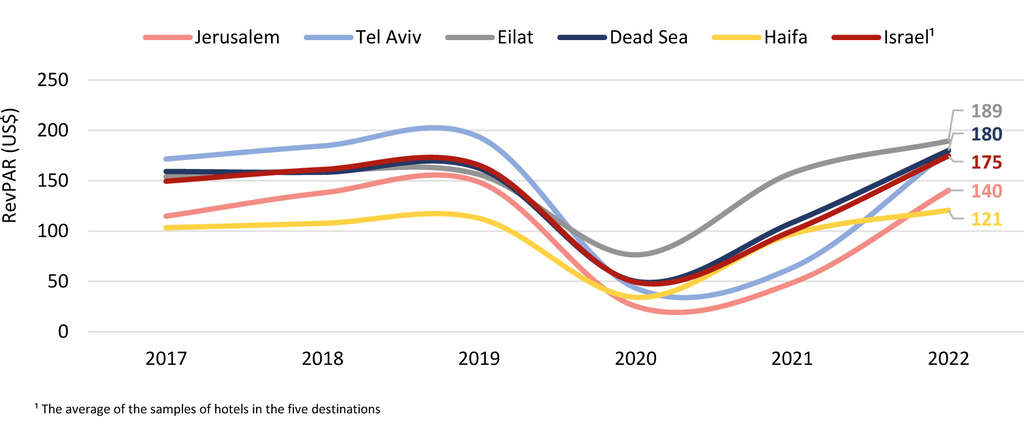

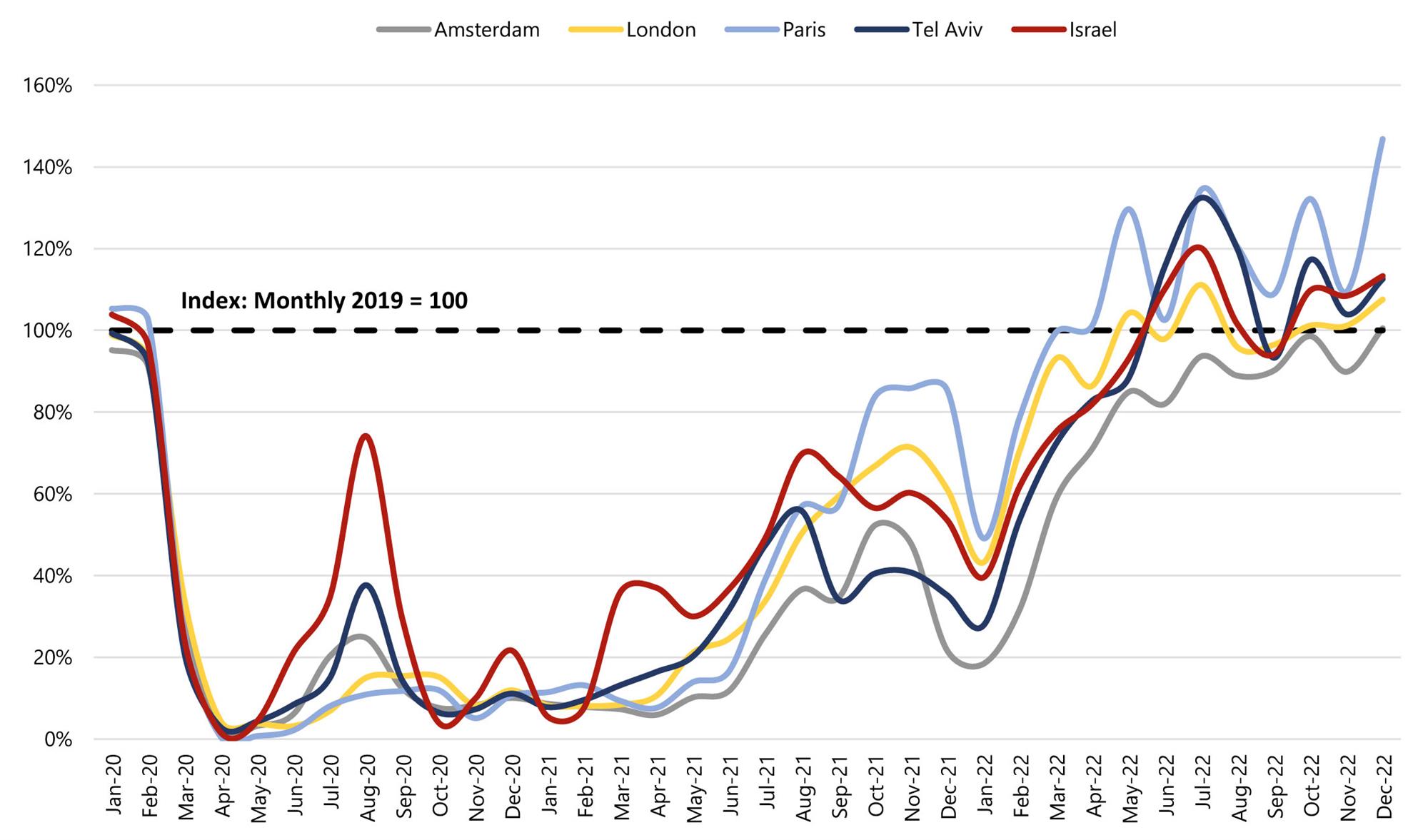

A lot in step with the remainder of the world, Israel’s resort trade suffered severely in 2020 and 2021 with plummeting RevPAR ranges, as mirrored within the knowledge offered in Determine 7. The vast majority of accommodations throughout the nation remained closed for a big a part of 2020 and, for these remaining operational, occupancy ranges declined considerably. Common charges additionally suffered considerably, leading to an total RevPAR lower of 70% for the overall Israel market in 2020.

2021 knowledge mirror a number of the constructive upsides taken from the increase within the staycation development, as beforehand mentioned. Accommodations, particularly in resort locations such because the Lifeless Sea and Eilat, which in years unaffected by COVID already relied extra on home visitation, took benefit of the scenario and boosted each common charges and occupancy ranges, leading to spectacular RevPAR recoveries and managed to additional enhance in 2022 to succeed in record-high RevPAR ranges of US$180 and US$189, respectively. Jerusalem and Tel Aviv continued to wrestle in 2021 with very low occupancy charges, reflecting the cities’ heavy reliance on worldwide visitation. With the easing and later lifting of worldwide journey bans in 2022, each cities began a steep restoration and benefitted from the high-rate surroundings globally to yield higher outcomes. In 2022, Jerusalem and Tel Aviv remained the areas with RevPARs beneath their 2019 ranges (-6% and -7%, respectively) in nominal phrases, whereas all different markets achieved between 7% (Haifa) and 21% (Eilat) above their respective 2019 ranges.

RevPAR Recovered to 2019 Ranges

Throughout Europe, most main cities adopted related developments, as offered in Determine 8, which reveals the RevPAR development from the start of 2020 to the tip of 2022, in US$ listed to 2019, as per knowledge from STR.

The Israel resort market stood at 6.0% above its 2019 RevPAR ranges in 2022, in nominal phrases, at US$175. In actual phrases (by taking out the IMF inflation for Israel), which means the nation’s RevPAR has recovered to its 2019 stage of US$165. Just a few months after worldwide journey resumed, this can be a vital achievement and a constructive indication of the general well being of the tourism trade in Israel. It signifies a powerful restoration in demand for lodging, elevated traveller confidence, profitable advertising and marketing efforts, elevated occupancy charges, improved pricing methods and accommodations’ means to adapt to altering market situations, all of which contribute to larger income technology for accommodations.

International Circumstances

The worldwide hospitality trade has been considerably impacted by varied exterior components, together with the COVID-19 pandemic, the Russian invasion of Ukraine, inflationary developments and labour shortages. The pandemic brought about a extreme decline in journey and enterprise exercise, whereas the battle in Ukraine created financial and political uncertainty. Rising vitality costs and disrupted provide chains have contributed to inflation, and labour shortages have affected resort operations. Though restoration and mitigation efforts are underway, there stays a stage of uncertainty influencing the market and the financial system.

Lodge Growth

Regardless of having been considerably challenged in the previous couple of years, Israel’s resort trade has displayed exceptional energy, with continued strong entrepreneurial exercise and elevated ranges of resort funding. Previous to the COVID-19 pandemic, Israel’s resort pipeline was at report ranges and, regardless of the latest difficulties, the vast majority of deliberate initiatives have persevered and are shifting ahead, albeit with some inevitable delays. With assist from authorities grants, the variety of accommodations at present within the planning phases or beneath development totals a number of thousand new rooms.

The pipeline is led by a number of acquainted and worldwide operators/manufacturers with a big share of developments as a result of enter the Tel Aviv market, supporting hoteliers’ perception that tourism will proceed to develop there within the years to come back.

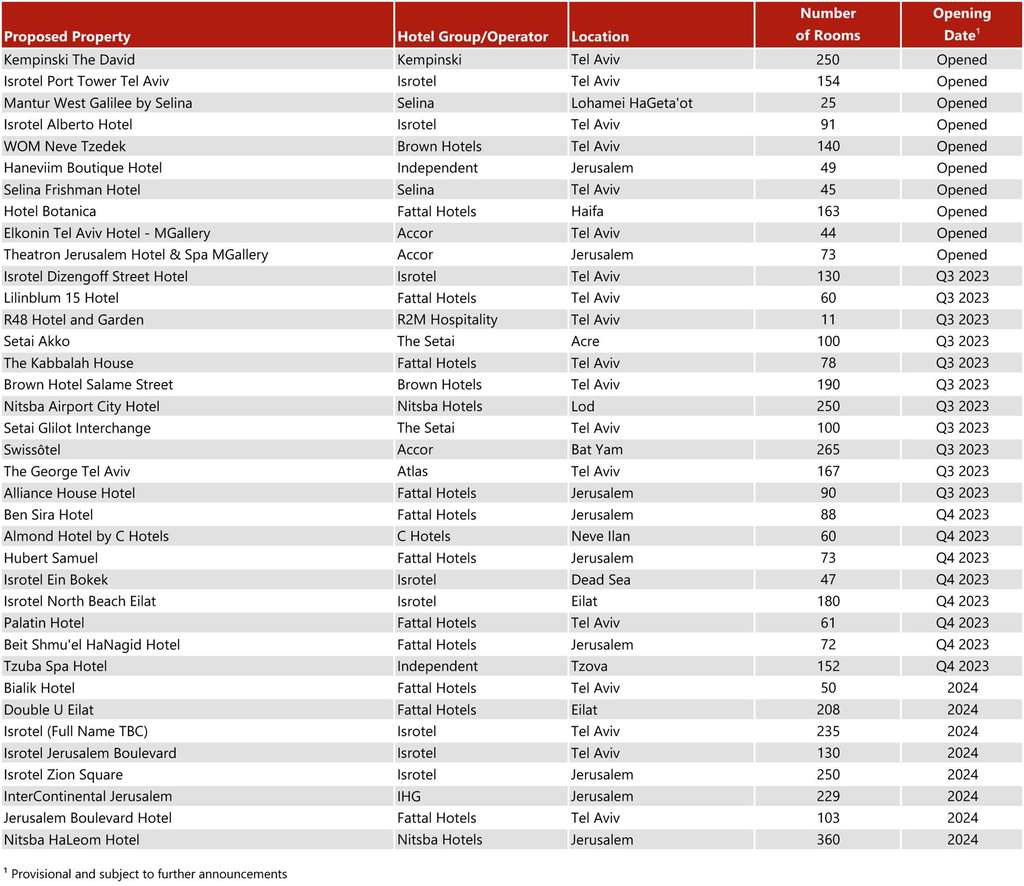

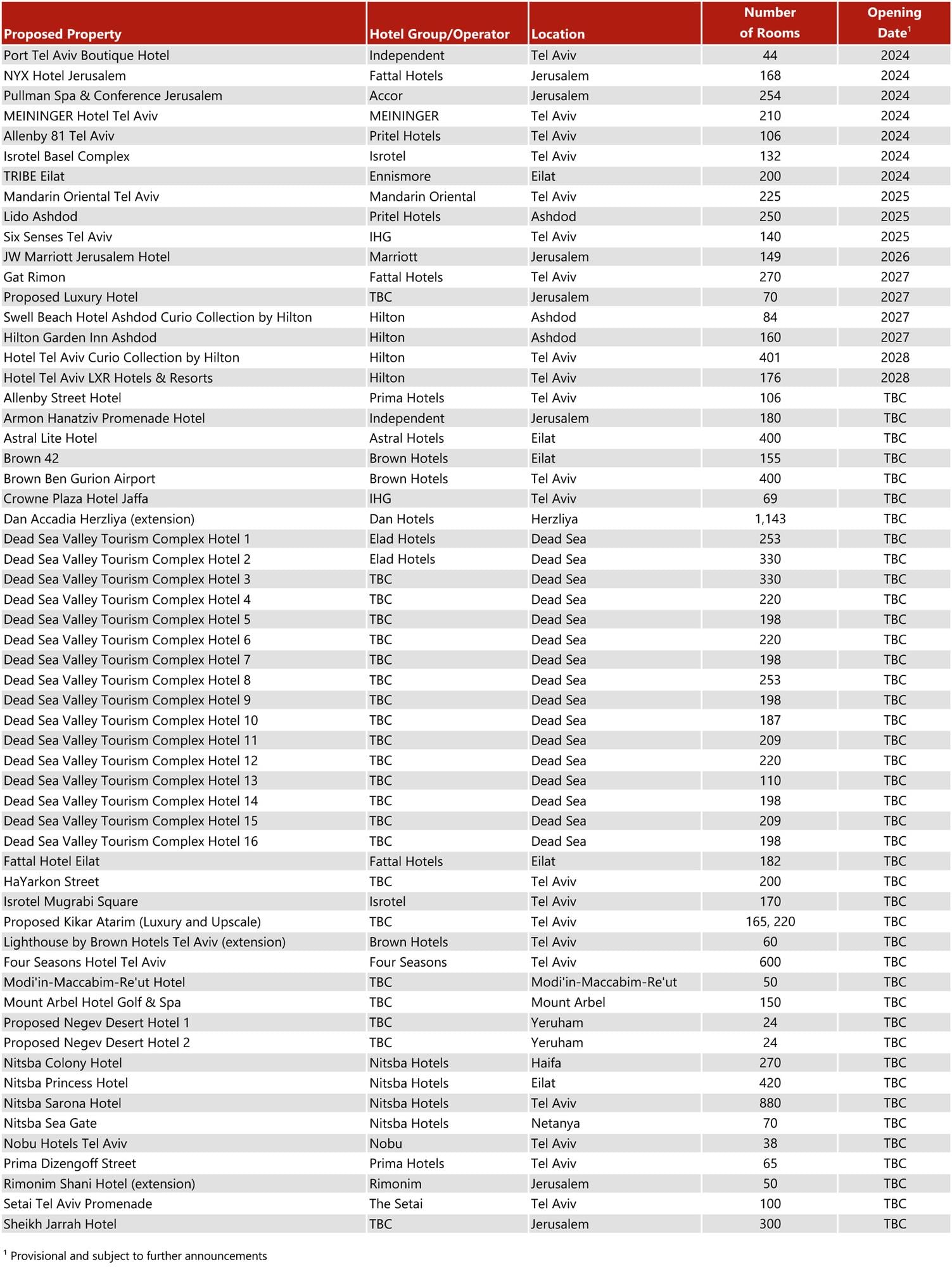

Determine 9 offers an summary of not too long ago opened properties and proposed new provide in Israel. The opening dates exclude potential additional delays attributable to the present scenario, and we count on extra certainty round these initiatives to evolve over the subsequent 12 months.

Lodge Values and Funding

Lodge Values Again to Pre-Pandemic Ranges

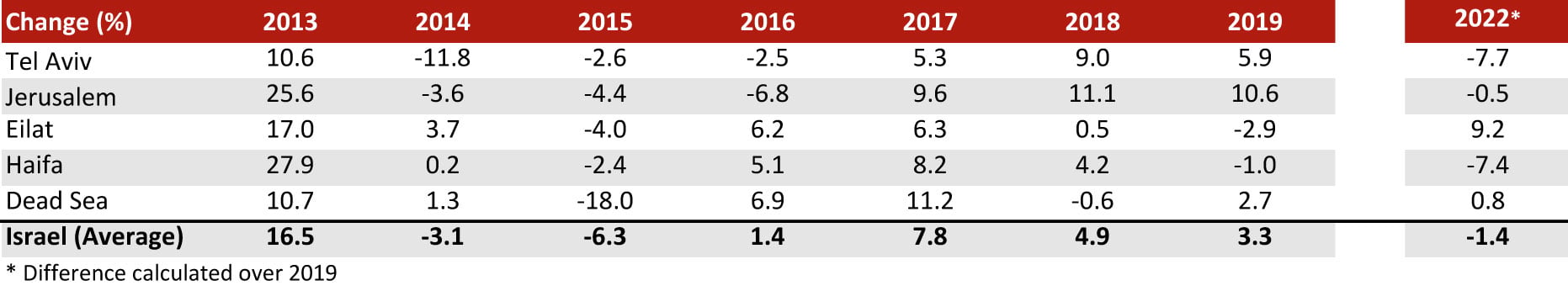

Whereas we had chosen to not publish any indications for modifications in resort values in Israel because the emergence of the pandemic, primarily because of the lack of resort transactions within the nation throughout this quite difficult interval, we are actually in a spot to judge the worth evolution between 2019 and 2022 for accommodations in Israel.

Unsurprisingly, over the course of 2020, 2021 and the primary trimester of 2022, journey restrictions, lockdown measures and decreased journey demand led to a lower in resort RevPAR ranges, which contributed to reducing EBITDA ranges and in the end resort values. Uncertainty in regards to the restoration timeline and decreased investor confidence have considerably dampened demand for resort properties throughout this era, whereas the general financial impression has made it difficult to promote or lease at beneficial costs.

For the reason that second trimester of 2022, resort efficiency has been on the rise and reverted to pre-pandemic ranges, even exceeding them in some instances, and translated right into a constructive impression on resort values within the nation.

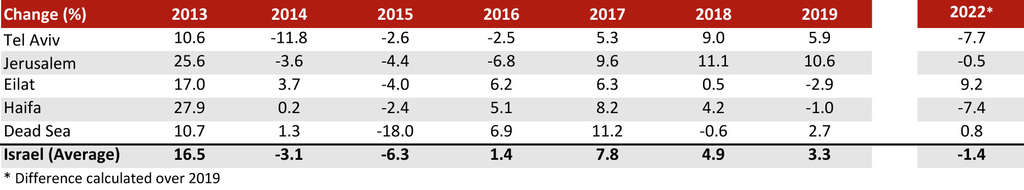

The indications for modifications in resort values in Israel (offered in Determine 10) are based mostly on buying and selling outcomes from 2012 to 2022 and our view of buying and selling prospects and funding urge for food for the foreseeable future. The constructive development in resort efficiency throughout the nation and extra broadly inside Europe basically, mixed with an rising stage of confidence amongst traders and builders, however diminished by the rising value of capital, led Israeli resort values in 2022 to stay just below 2019 values, by 1.4% in nominal phrases, whereas the general European market stays at round 8.0% beneath 2019 resort values, in nominal phrases (please consult with our 2023 European Lodge Valuation Index report). Eilat and the Lifeless Sea recorded the very best good points by way of values per resort room (+9% and +1% vs 2019, respectively), which is of no shock contemplating the improbable efficiency in occupancy and common price in these resorts in latest months. Then again, Tel Aviv resort values stay 8.0% beneath their 2019 ranges, because of the metropolis’s higher reliance on worldwide tourism, as mentioned earlier on this report. Haifa reported an identical development to Tel Aviv, and Jerusalem has virtually recovered at simply 0.5% beneath its 2019 ranges.

The evaluation in native forex, thus eradicating the impression of forex fluctuations, signifies that resort values in Israel stay wanting 2019 resort values by round 7.1%.

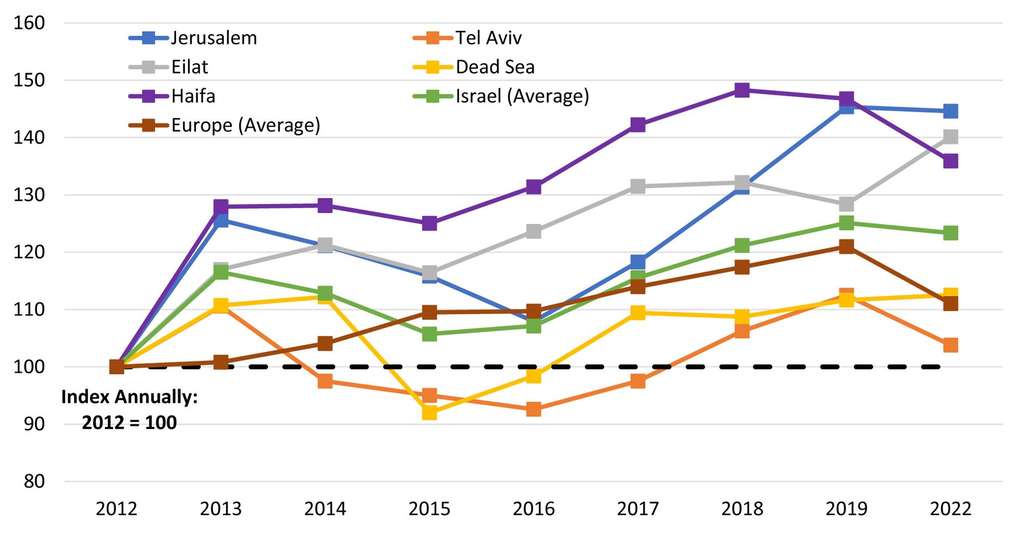

Whereas listed to 2012 (base 100), Jerusalem, Eilat and Haifa are the Israeli cities through which resort values improved probably the most with 145, 140 and 136, respectively (Determine 11). Then again, Tel Aviv resort values improved the least, with an index of 104. General, Israel resort values have outpaced the European common over the studied interval, with an index of 123 in comparison with 111, respectively.

Regardless of a major enchancment in efficiency, a rising resort pipeline and a considerable amount of Israeli capital deployed in continental Europe, the resort transaction market in Israel nonetheless lacks transparency, with restricted data within the public area in regards to the only a few transactions which have taken place. We’d welcome receiving particulars of any transactions that our pricey readers are acquainted with.

Conclusions

The Israel resort market has demonstrated exceptional resilience within the face of challenges and has efficiently rebounded to the pre-pandemic ranges seen in 2019. Regardless of the heavy disruptions attributable to the COVID-19 pandemic, the trade has proven adaptability and innovation in implementing well being and security protocols, making certain visitor confidence and a protected surroundings.

With the gradual return of home and worldwide journey, initially leisure-driven however later complemented by enterprise travellers, coupled with the nation’s distinctive points of interest and cultural significance, the Israel resort market is effectively positioned for additional development and success. Seeking to the long run, the Israel resort market holds nice promise as the federal government’s dedication to attracting worldwide and regional tourism in addition to retaining home guests stays steadfast with beneficiant participation in new resort developments by way of grants of as much as 20% of growth prices. Travellers can anticipate an thrilling and vibrant hospitality panorama, making Israel an attractive vacation spot for years to come back.

With the uplift in efficiency already achieved and extra but to come back, together with the return of investor confidence, resort values in Israel have the worst behind them. Hoteliers must give attention to placing the correct methods in place to maintain prices in examine for a full restoration in all markets.

The alternatives generated following the signing of the Abraham Accords current additional potential development in guests to Israel, thereby creating will increase in resort demand, profitability and in the end resort values.