Bonus Depreciation is fading away over the following 5 years. With the assistance of the IRS Part 179 Deduction and nonetheless highly effective Bonus Depreciation, lodging Homeowners can save 1000’s of {dollars} in federal revenue tax financial savings in 2022 and past.

IRS Part 179 Depreciation

Part 179 of the United States Inner Income Code (26 U.S.C. § 179), permits a taxpayer to elect to deduct the price of sure forms of property on their revenue taxes as an expense, moderately than requiring the price of the property to be capitalized and depreciated. This property is usually restricted to tangible, depreciable, private property which is acquired for the use in commerce or enterprise.

For the lodge or lodging proprietor, tangible property bought, leased, or financed (new or used) for enterprise use, could also be deduct as much as $1,080,000 in 2022. There are a lot of tangible belongings that qualify for the Part 179 allowance, with the commonest lodging belongings being:

- Enterprise Automobiles with a gross car weight in extra of 6,000 lbs.

- Pc / Server Tools

- Visitor & Workplace Furnishings & Tools

- Equipment & Tools bought for enterprise use

- Off-the-Shelf Pc Software program

- Private Property utilized in enterprise

Bonus Depreciation: What Is It?

For tangible property purchases in extra of $1,080,000, not eligible for the Part 179 deduction, the lesser recognized ‘Bonus Depreciation’; also called the ‘accelerated first yr depreciation deduction’ exists. This device for accelerating depreciation, over time, has allowed the lodging owned to successfully expense a share (%) of their tangible private property within the yr the property was bought, leased, or financed. In recent times, that first-year bonus allowance has been 100% in recent times. That means, all private property bought, leased, or financed for enterprise use could be depreciated (expensed) within the yr acquired.

Sadly, Bonus Depreciation is slowly fading away, with 2022 being the final yr for 100% bonus depreciation, however as we are going to see under, bonus can nonetheless be a robust device for expensing tangible private property that exceeds the part 179 threshold.

Bonus Depreciation Historical past

With a passage of the Tax Cuts and Jobs Act (‘TCJA’) in 2017 by Congress, and signature of the President, 100% Bonus Depreciation (First Yr Depreciation) was born. Constructing off the 2002 Job Creation and Employee Assistant Act, of 30% Bonus Depreciation (First Yr Depreciation), the hope was to influence US companies to put money into new crops and gear; to spur the financial progress and job creation.

Bonus Depreciation has had a brief life, however has been used a number of occasions, previously 20-years to assist stimulate the economic system and enhance job creation. Although there are lesser recognized, and focused legal guidelines which have affected depreciation, by means of the usage of Bonus Depreciation:

- The Act to Present for Reconciliation Pursuant to Titles II and V of the Concurrent Decision

on the Finances for Fiscal Yr 2018 - The Gulf Alternative Zone Tax Reduction Act of 2005

- The Tax Extenders and Various Minimal Tax Reduction Act of 2008.

Extra Acts Having Impression

The extra generally recognized ‘Acts’ (under) have stored the Economic system, and the Workforce transferring ahead, and it’s assumed that 100% bonus depreciation through the top of the COVID Pandemic (2/2020 – 9/2021), did its half to maneuver the sluggish economic system ahead. Companies, and Economists, had hoped pre-pandemic, and through the top of the pandemic, that Congress would renew 100% Bonus Depreciation earlier than the deliberate phaseout beginning in 2023.

- Job Creation and Employee Help Act of 2002: 30% (First Yr Depreciation) of the certified property positioned in service after 9/10/01

- The Jobs and Progress Tax Reduction Reconciliation Act of 2003: 50% (First Yr Depreciation) of the certified property positioned in service between 5/6/03 and 12/31/04

- The Financial Stimulus Act of 2008: 50% (First Yr Depreciation) of the certified property positioned in service between 1/1/08 and 12/31/08

- The American Restoration and Reinvestment Act of 2009: 50% (First Yr Depreciation) of the certified property positioned in service between 1/1/09 and 12/31/09

- The Small Enterprise Jobs Act of 2010: 50% (First Yr Depreciation) of the certified property positioned in service between 1/1/10 and 1/1/10

- The Tax Reduction Act of 2010: 100% (First Yr Depreciation) of the certified property positioned in service between 9/9/10 and

12/31/11 and 50% First Yr Depreciation) of the certified property positioned in service between 1/1/12 and 12/31/12 - The Tax Reduction Act of 2012: 50% (First Yr Depreciation) of the certified property positioned in service between 1/1/13 and

12/31/13 - The Tax Reduction Act of 2014: 50% (First Yr Depreciation) of the certified property positioned in service between 1/1/14 and

12/31/14 - The Defending People from Tax Hikes Act of 2015:

- 50% (First Yr Depreciation) of the certified property positioned in service between 1/1/15 and 12/31/17

- 40% (First Yr Depreciation) of the certified property positioned in service between 1/1/18 and 12/31/18

- 30% (First Yr Depreciation) of the certified property positioned in service between 1/1/19 and

12/31/19

- The Tax Cuts and Jobs Act of 2017:

- 100% (First Yr Depreciation) of the certified property positioned in service between 9/28/2017 and 12/31/2022

- 80% (First Yr Depreciation) of the certified property positioned in service between 1/1/2023 and 12/31/2023

- 60% (First Yr Depreciation) of the certified property positioned in service between 1/1/2024 and 12/31/2024

- 40% (First Yr Depreciation) of the certified property positioned in service between 1/1/2025 and 12/31/2025

- 20% (First Yr Depreciation) of the certified property positioned in service between 1/1/2026 and 12/31/2026

State of the US Economic system

The State of the US Economic system has put a halt of any hopes of renewal of 100% Bonus Depreciation. The explanation for this shift in sentiment is the “BIG-I” – Inflation! The present inflationary increase (9.1%), coupled with a low US unemployment fee (3.6%) and powerful US Gross Home Product (5.7%) has Congress, Enterprise, Economists, and the Basic Public acknowledging {that a} highly effective financial progress and job creation device, like Bonus Deprecation, will not be the right device for our inflationary economic system.

Methods for a Fading Bonus Depreciation

Profit nonetheless exists for eligible industrial private and actual property. Within the subsequent 5 years, as bonus is diminished, time could be your enemy.

Bonus Depreciation

2022: 100%

2023: 80%

2024: 60%

2025: 40%

2026: 20%

2027: 0%

- 100% Bonus (First Yr Depreciation) is healthier than 80% Bonus (First Yr Depreciation), so attempt to push your scheduled 2023 Purchases of eligible property into 2022.

- 80% Bonus (First Yr Depreciation) is healthier than 60% Bonus (First Yr Depreciation), so attempt to push your scheduled 2024 Purchases of eligible property into 2023.

- 60% Bonus (First Yr Depreciation) is healthier than 40% Bonus (First Yr Depreciation), so attempt to push your scheduled 2025 Purchases of eligible property into 2024.

- 40% Bonus (First Yr Depreciation) is healthier than 20% Bonus (First Yr Depreciation), so attempt to push your scheduled 2026 Purchases of eligible property into 2025.

- 20% Bonus (First Yr Depreciation) is healthier than 0% Bonus (First Yr Depreciation), so attempt to push your scheduled 2027 Purchases of eligible property into 2026.

Profit – Web Current Worth Tax Financial savings

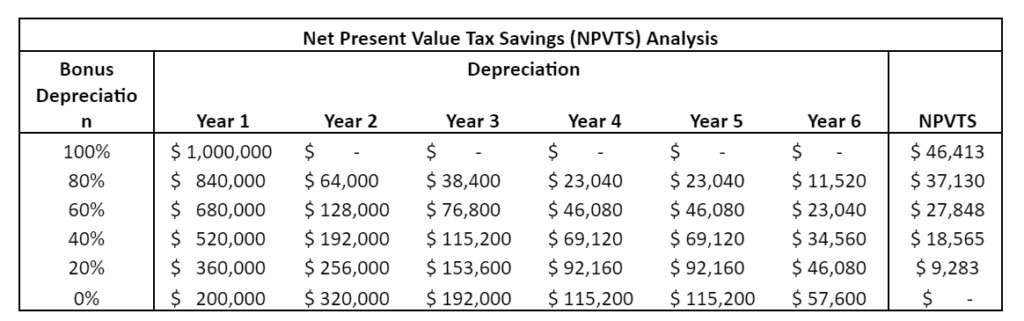

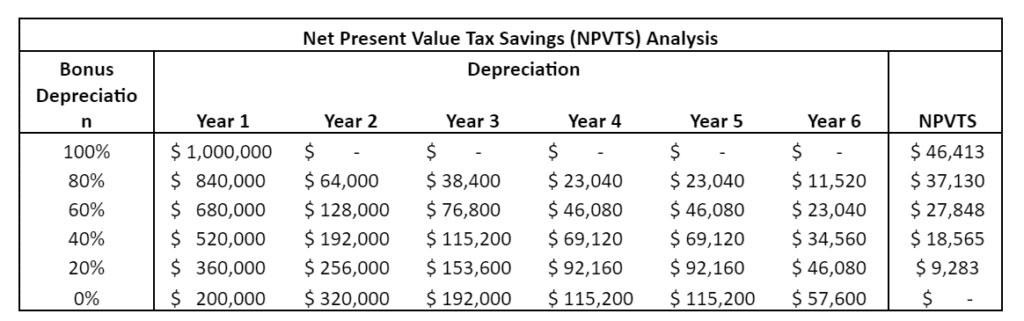

We are able to exhibit the impact of declining good thing about diminished Bonus Depreciation (First Yr Depreciation) trying on the Web Current Worth Tax Saving at every of the Bonus Depreciation Charges (100%, 80%, 60%, 40%, 20% and 0%).

Property Analyzed:

- Product: Lodging Furnishings, Fixtures & Tools

- Buy Worth: $1,000,000

- Federal Revenue Tax Price: 33%

- State Revenue Tax Price: 6%

- MACRS Depreciation: Mid-Yr Conference

- Return on Funding / Low cost Price: 8%

- Tax Depreciation Interval: 5-Years

Calculate the Financial savings

As our graph reveals (above), the Web Current Worth Tax Financial savings (NPVTS), if delayed, reduces our NPVTS by $9,283 for every year the acquisition is delayed! Revenue tax planning, and a focused buy date of private and actual property acquisitions, ought to be coordinated to maximise tax financial savings.