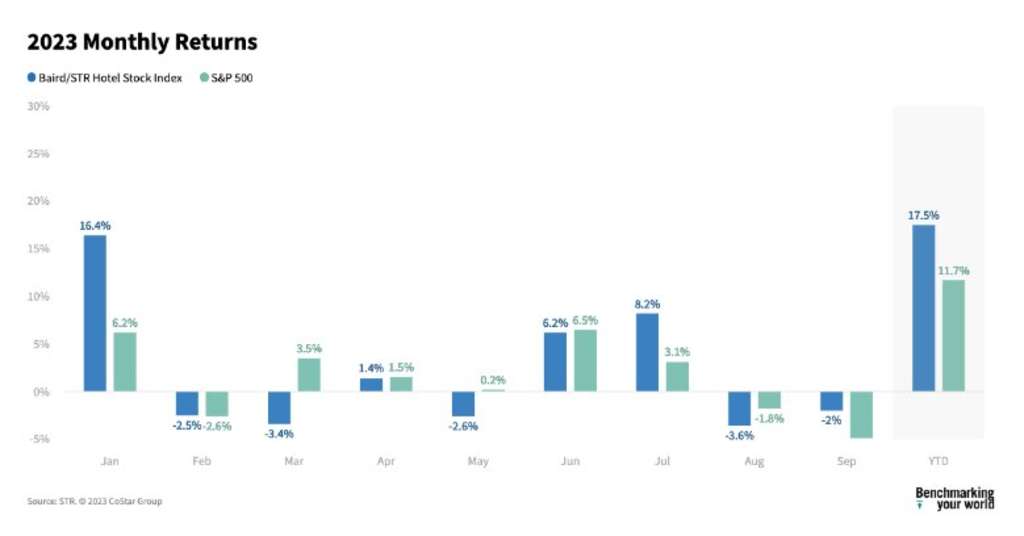

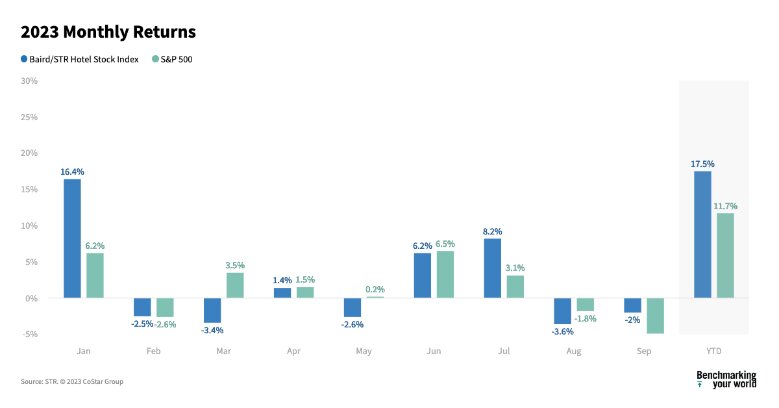

The Baird/STR Lodge Inventory Index dropped 2.0% in September to a degree of 5,739.

“Lodge shares have been down once more in September, however they outperformed their relative benchmarks,” mentioned Michael Bellisario, senior lodge analysis analyst and director at Baird. “Each the S&P 500 and the RMZ had their worst month-to-month efficiency of the 12 months as larger rates of interest weighed on inventory costs and investor sentiment; inns doubtless benefited from continued sluggish however secure RevPAR development in the course of the month. Yr-to-date, the lodge model sub-index is +23%, whereas the Lodge REIT sub-index is -1.5%.”

“U.S. room demand has decreased 12 months over 12 months in 5 of the final six months, however September’s degree was the second highest ever recorded for the month behind final 12 months,” mentioned Amanda Hite, STR president. “Demand for premium inns continued to develop however not sufficient to offset decreases by financial system and unbiased inns, which proceed to drive the general declines. Pricing traits proceed to differ by phase as properly, however total ADR development was at its highest degree since Might, which made the identical true for RevPAR. There isn’t any doubt that enterprise journey, significantly group, has returned in latest weeks, and we count on that to proceed into the vacation season.”

In September, the Baird/STR Lodge Inventory Index surpassed the S&P 500 (-4.9%) and the MSCI US REIT Index (-7.5%).

The Lodge Model sub-index dropped 2.4% from August to 10,974, whereas the Lodge REIT sub-index decreased 0.4% to 1,023.

Concerning the Baird/STR Lodge Inventory Index and Sub-Indices

The Baird/STR Lodge Inventory Index was set to equal 1,000 on 1 January 2000. Final cycle, the Index peaked at 3,178 on 5 July 2007. The Index’s low level occurred on 6 March 2009 when it dropped to 573.

The Lodge Model sub-index was set to equal 1,000 on 1 January 2000. Final cycle, the sub-index peaked at 3,407 on 5 July 2007. The sub-index’s low level occurred on 6 March 2009 when it dropped to 722.

The Lodge REIT sub-index was set to equal 1,000 on 1 January 2000. Final cycle, the sub-index peaked at 2,555 on 2 February 2007. The sub-index’s low level occurred on 5 March 2009 when it dropped to 298.

About STR

STR supplies premium knowledge benchmarking, analytics and market insights for the worldwide hospitality business. Based in 1985, STR maintains a presence in 15 international locations with a North American headquarters in Hendersonville, Tennessee, a world headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), a number one supplier of on-line actual property marketplaces, info and analytics within the industrial and residential property markets. For extra info, please go to str.com and costargroup.com.