Any optimism for a post-COVID resurgence of lodge lending exercise has evaporated because the market stalls within the face of the very best rate of interest setting in over a decade. The surging financial uncertainty is undoubtedly impacting the extent of angst many lodge homeowners are feeling in the intervening time. The magnitude and unpredictability of fixing mortgage underwriting assumptions prior to now sixty to ninety days alone have meaningfully elevated funding threat.

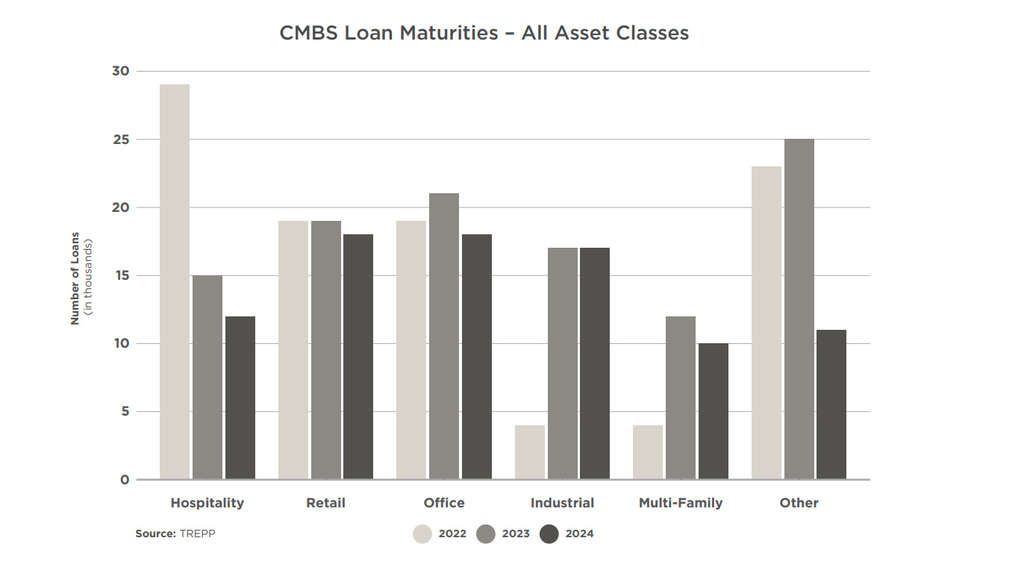

New debt for lodge acquisitions has all however vanished, however an even bigger downside would be the wave of present debt services of every kind which might be scheduled to mature this yr and subsequent. Starting firstly of 2022 and thru the tip of 2023, almost 45,000 CMBS lodge loans totaling about $30 billion in worth have been set to mature …

Click on right here to learn the complete article.

Greta Hart

Senior Vice President of Advertising & Partnerships

The Plasencia Group