Incomes factors and miles is the easiest way to fly extra for much less. It’s the best way I’ve been capable of keep on the highway for therefore lengthy — and I’ve seen what a distinction it’s made for my readers too.

I write loads concerning the finest bank cards to get relying in your journey targets, however I’ve talked much less about how to make use of these factors.

Right this moment, I wish to change that as a result of I hold getting emails from folks speaking about the way it takes too many factors to guide a flight. After I observe up, it’s as a result of they’re reserving by means of the bank card’s journey portal and that’s one thing you need to not often, if ever, do!

Journey rewards playing cards supply two essential methods to make use of the factors that you simply earn to guide journeys:

- By transferring factors to their journey companions

- By utilizing a card issuer’s reserving portal

For individuals who are new to incomes and utilizing factors and miles, there’s quite a lot of confusion about which is the higher choice. Journey bank cards place their portals as the most suitable choice for utilizing your factors. However, in actuality, they not often ever are.

So let’s speak about why that is.

The Low-Down on Journey Portals

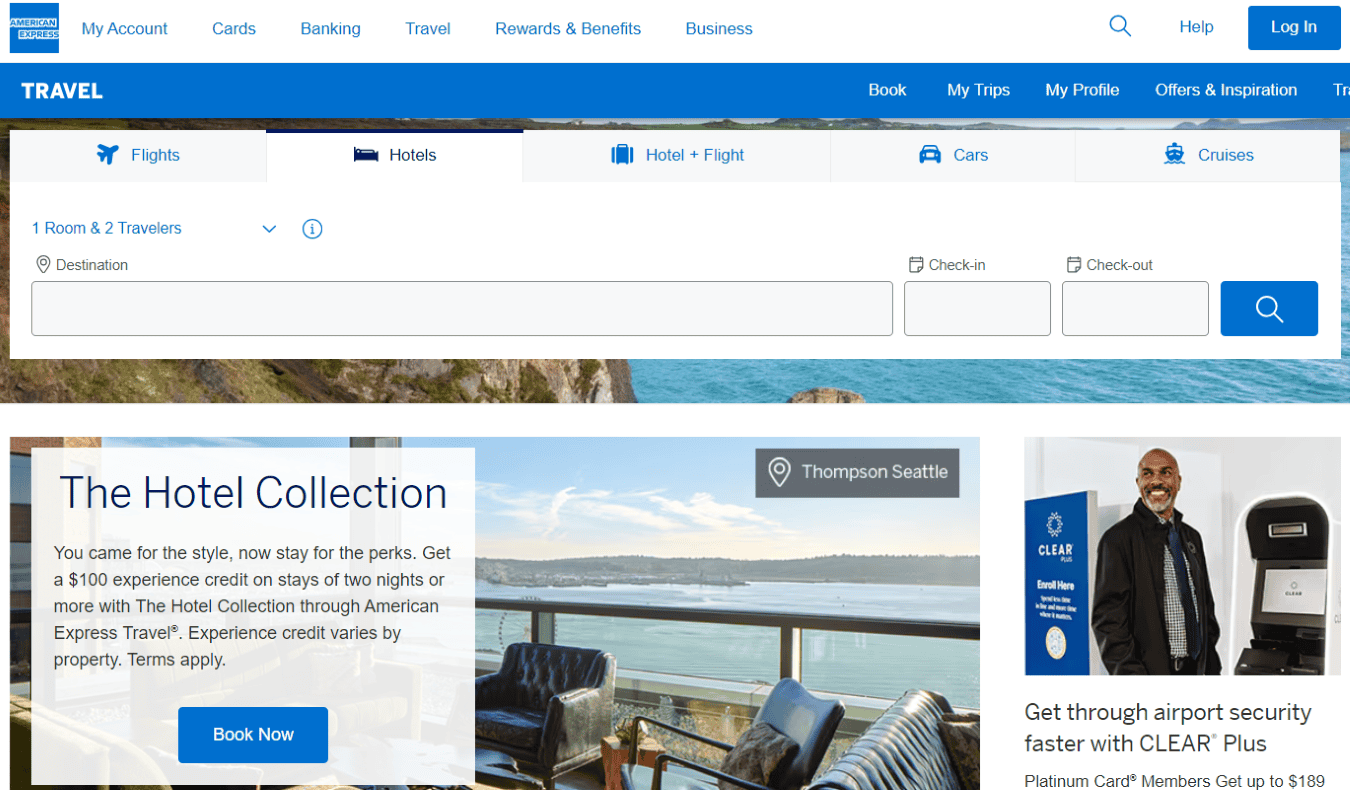

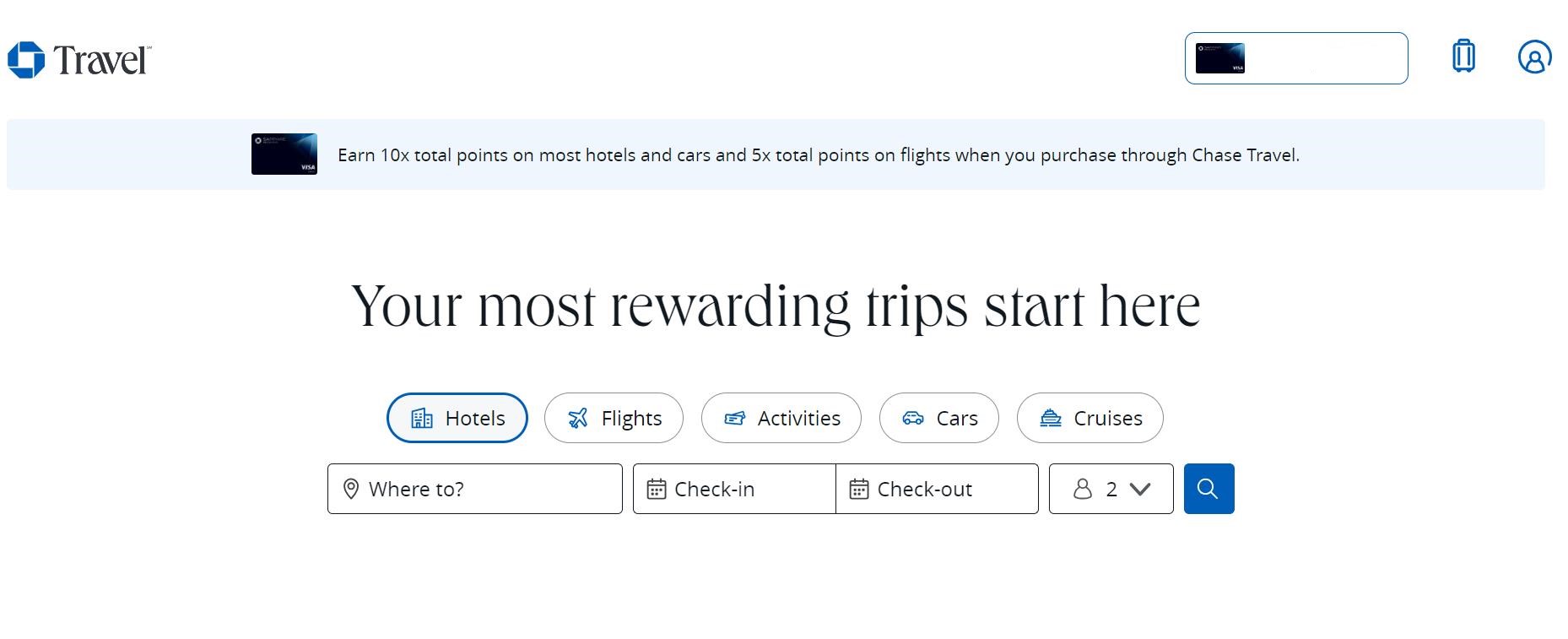

Journey portals are on-line journey businesses (OTAs) supplied by banks as a part of the advantages of holding considered one of their rewards playing cards. They work precisely like different OTAs, similar to Expedia or Kayak, the place you may guide flights, accommodations, and rental automobiles by looking for availability through their search engine.

The principle distinction is that these journey portals are linked to your bank card. This lets you use your factors and miles when reserving. You may also select to pay partially with factors and partially with money.

Utilizing journey portals is principally like utilizing your factors as money again. You get a hard and fast worth per level and additionally, you will earn factors/miles in your reserving.

Bank card corporations place their portals as the easiest way to make use of factors. They need you to make use of the portals and keep inside their ecosystem in order that they will earn a living off of you.

To maintain you on their website, they provide incentives that you could solely get when utilizing their portal. These incentives embody the next:

- Journey credit – In the event you use the portal, many playing cards supply assertion credit to offset your buy. For instance, the card_name presents $50 USD lodge credit score when reserving by means of Chase JourneySM, and the card_name presents a $300 USD annual credit score for bookings by means of Capital One Journey.

- Elevated rewards incomes energy – You’ll earn further factors when utilizing the portal. For instance, the Capital One Enterprise X and the card_name playing cards each supply 10x on accommodations and rental automobiles and 5x on flights when booked by means of their portals.

- Elevated level worth – You’ll get a small increase within the variety of factors/miles you may money in simply by utilizing the portal. For holders of Chase Sapphire playing cards, for instance, 1 level turns into 1.25 or 1.5 factors (with the Chase Sapphire Most well-liked or the Chase Sapphire Reserve, respectively) when reserving by means of the portal. (Whereas that looks like an incredible deal, you may often get a significantly better worth per level when transferring to journey companions, as I’ll get into under.)

Journey portals are straightforward and handy. Nonetheless, utilizing them is often not the perfect worth on your factors. What you get in simplicity and comfort you lose within the fastened redemption worth that often isn’t the perfect.

The Low-Down on Switch Companions

On the flip facet, you may switch factors out of your account on to the place the place you wish to guide (similar to an airline or lodge). Whereas transferring your factors to journey companions is a little more work, you may get way more worth out of your hard-earned factors this manner.

Solely sure playing cards earn you transferable factors although. For instance, airline- and hotel-specific playing cards (such because the card_name or the card_name) solely earn you factors that can be utilized at that airline or lodge. They’re much less helpful, as a result of they’re much less versatile. Transferable factors are helpful (and what you need to purpose to get), as a result of they’re so versatile.

Listed below are just a few kinds of transferable currencies and a few playing cards that earn them:

- American Categorical Membership Rewards: The Platinum Card by American Categorical, the American Categorical Gold Card, the American Categorical Inexperienced Card.

- Chase Final Rewards: the Chase Sapphire Most well-liked® Card, Chase Sapphire Reserve®, Chase Ink Enterprise Most well-liked® Credit score Card.

- Bilt Rewards: Bilt Mastercard®.

- Capital One miles: All Capital One Enterprise playing cards.

- Citi ThankYou Rewards: Citi Premier® Card.

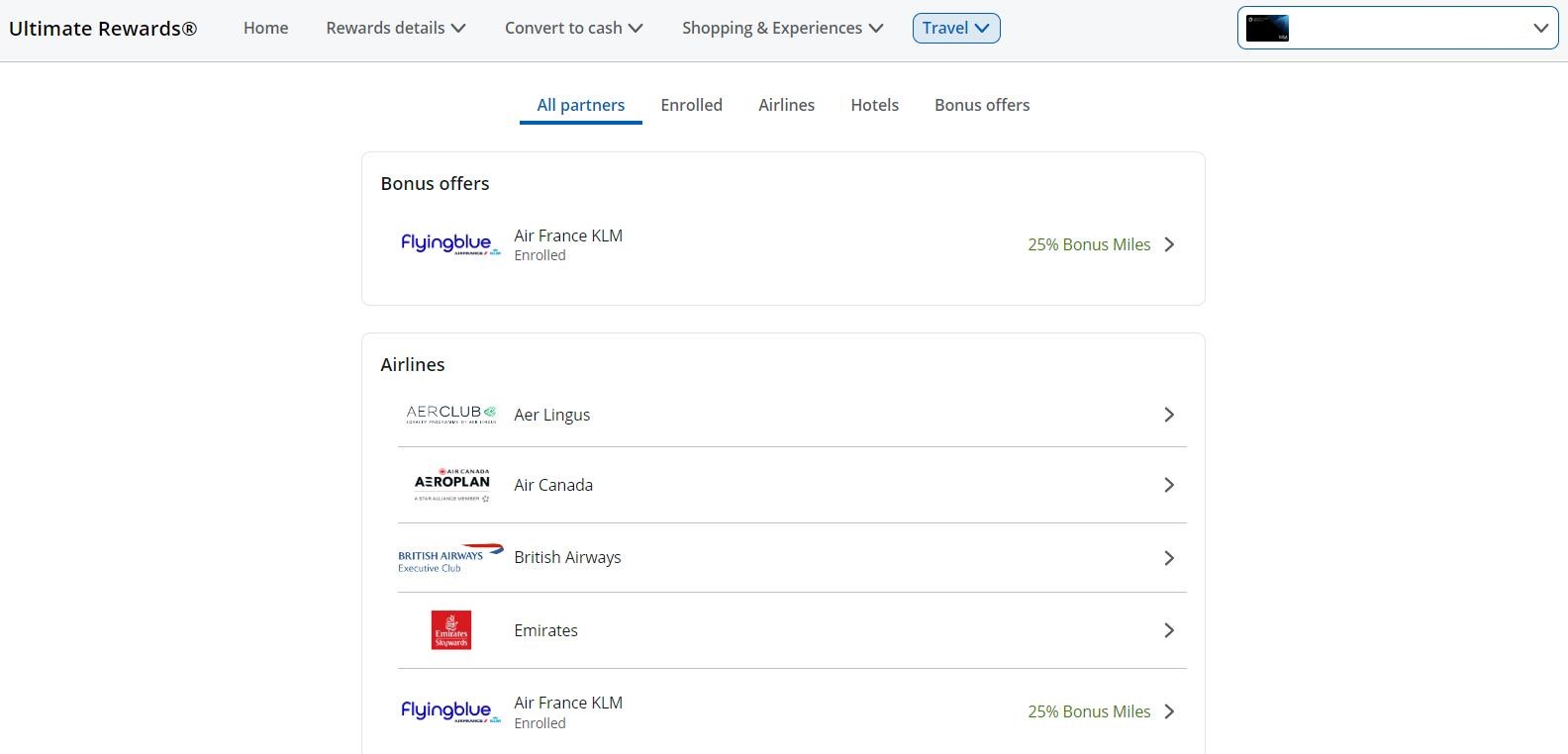

Every transferable foreign money has totally different journey companions (many overlap). Listed below are a few of Chase’s journey companions, listed on the Chase JourneySM website:

Whereas the precise worth you may get varies enormously primarily based on the flight or lodge, an excellent benchmark is The Factors Man’s month-to-month valuation chart, which values most transferable currencies at over 2 cents per level when used as transferable factors. That’s double what you’ll get on journey portals, and sometimes you may get way more.

That’s as a result of when transferring your factors, you may also make the most of switch bonuses supplied by bank cards and flash offers (similar to Air France-KLM Flying Blue promo awards, that are month-to-month offers on award flights). These may be unimaginable offers, as much as a 50% low cost!

Whereas discovering award availability instantly with airways can appear overwhelming, the excellent news is that instruments like Level.me (an award flight search instrument) make it simpler than ever.

Usually talking, I all the time switch my factors. Doing so gives the perfect worth and reserving direct ensures that there is no such thing as a third-party concerned ought to there be a problem with my flight. Furthermore, it takes loads fewer factors for a redemption this manner. Let me inform you why within the subsequent part.

Evaluating Companions vs Portals: Which One Is Greatest for You?

Until there’s a tremendous low cost flight or room (lower than $150 USD), I all the time switch factors to journey companions, particularly when reserving business-class flights or nicer lodge rooms. You simply get extra bang on your buck.

For instance, a enterprise class flight from New York to Paris in peak season is 88,000 factors on United every means (each Chase Final Rewards and Bilt Rewards switch to United). These flights often price about $2,400 (although they will get as excessive as $5,000). In the event you had the Chase Sapphire Most well-liked or Bilt Rewards Card and booked by means of their respective portals, you would wish 192,000 factors (every level is price 1.25 cents in both of those portals). That’s over double what you’d want when transferring your factors to United reserving instantly.

Since most flight redemptions for financial system begin at 20,000 factors (when transferring on to airways), it is advisable discover a flight that’s lower than $250 for it to be price it to make use of the portal. That is when utilizing the Chase Sapphire playing cards or the Bilt card, which give you greater than 1 cent per level when reserving through their portals. For Amex or Capital One playing cards, you solely get 1 cent per level/mile. Which means you’d have to discover a flight for $200 or much less for it to make sense to make use of their portals.

For accommodations and rental automobiles, it’s rather less black and white since you don’t all the time have switch companions.

For instance, I’m reserving accommodations through the Chase Journey portal on an upcoming journey to Barcelona as a result of there are not any rooms bookable with factors out there. (You’ll be able to solely switch factors from bank cards to chains like Hyatt or Marriott.) Since accommodations are $300 and up per night time, I’m simply utilizing my factors to save lots of me cash by reserving with a non-chain lodge. I wouldn’t be capable of guide with factors in any other case. That is the exception to the rule.

Listed below are another instances during which utilizing the portal is your only option:

- There are not any award seats out there in your desired flight (similar to in case you’re flying in peak season or through the holidays) or lodge (similar to if you wish to guide a boutique lodge that’s not bookable with factors).

- You’re reserving a rental automobile and wish to use factors (you may’t guide rental automobiles instantly through factors).

- You’re chasing airline standing and wish to earn factors in your reserving.

- You merely received’t use your factors in any other case.

About that final merchandise: all the time contemplate your journey targets and decide whether or not the benefit and comfort of utilizing the portal is price it to you. Utilizing your factors, no matter how, is best than letting them sit round! By no means stockpile your factors. They get devalued on a regular basis. So use them fairly than lose them!

Journey portals may be an attractive means to make use of your factors. They’re handy, and banks offer you incentives to make use of them. In the event you’re new to factors and miles and simply need a easy method to money in your earnings, they’re undoubtedly an choice.

Nonetheless, you may often get significantly better worth out of your factors by transferring them on to airways or accommodations. The less factors you employ per journey, the extra factors you’ve got for extra journey (or extra factors to fly/keep in luxurious).

However the great point is that you simply don’t have to decide on both the portal or transferring to companions. You’ll be able to combine and match relying on the most suitable choice on the time. So do a fast comparability and use factors to guide your subsequent journey!

E book Your Journey: Logistical Ideas and Tips

E book Your Flight

Discover a low cost flight by utilizing Skyscanner. It’s my favourite search engine as a result of it searches web sites and airways across the globe so that you all the time know no stone is being left unturned.

E book Your Lodging

You’ll be able to guide your hostel with Hostelworld. If you wish to keep someplace aside from a hostel, use Reserving.com because it persistently returns the most affordable charges for guesthouses and accommodations.

Don’t Neglect Journey Insurance coverage

Journey insurance coverage will defend you towards sickness, damage, theft, and cancellations. It’s complete safety in case something goes fallacious. I by no means go on a visit with out it as I’ve had to make use of it many occasions prior to now. My favourite corporations that supply the perfect service and worth are:

Need to Journey for Free?

Journey bank cards help you earn factors that may be redeemed at no cost flights and lodging — all with none further spending. Try my information to choosing the right card and my present favorites to get began and see the most recent finest offers.

Want Assist Discovering Actions for Your Journey?

Get Your Information is a big on-line market the place you could find cool strolling excursions, enjoyable excursions, skip-the-line tickets, non-public guides, and extra.

Able to E book Your Journey?

Try my useful resource web page for the perfect corporations to make use of whenever you journey. I checklist all those I exploit once I journey. They’re the perfect at school and you’ll’t go fallacious utilizing them in your journey.

Advertiser Disclosure: “Nomadic Matt has partnered with CardRatings for our protection of bank card merchandise. Some or the entire card presents on this web page are from advertisers and compensation might influence how and the place card merchandise seem on the location. Nomadic Matt and CardRatings might obtain a fee from card issuers.”

Editorial Disclosure: “Opinions, opinions, analyses & suggestions are the creator’s alone, and haven’t been reviewed, endorsed, or authorized by any of those entities. This web page doesn’t embody all card corporations or all out there card presents.”

For charges and costs of the Marriott Bonvoy Bevy™ American Categorical® Card, See Charges and Charges.

For charges and costs of the Delta SkyMiles(R) Gold American Categorical Card, See Charges and Charges.