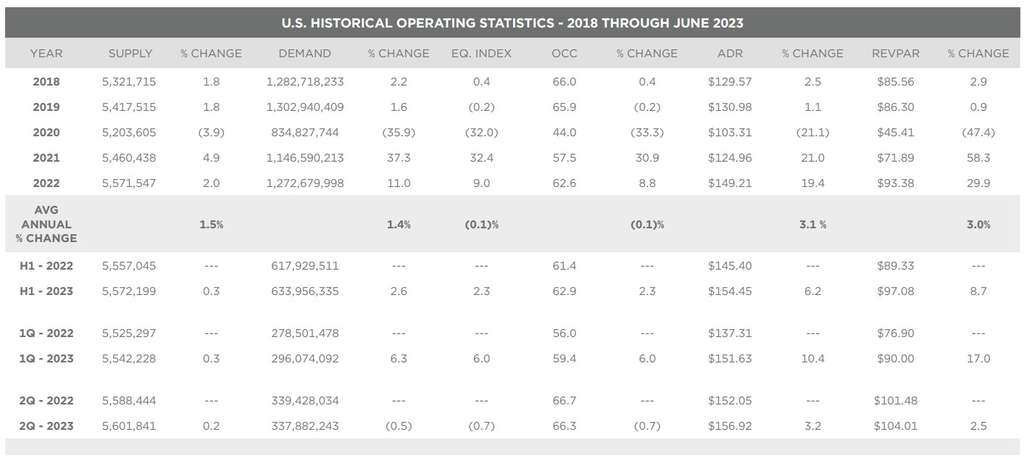

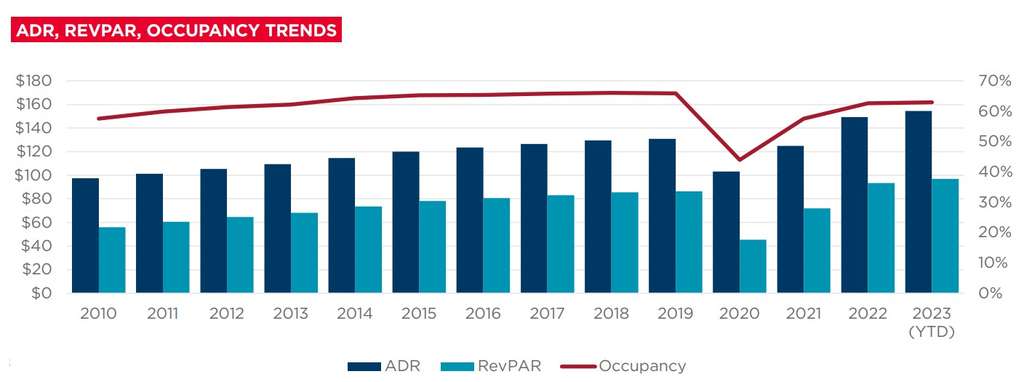

From 2019 to 2022, U.S. lodge income noticed the sharpest decline and subsequent restoration of any prior cycle. Prior declines attributable to financial and enterprise “black swan” occasions required 4 to eight years for RevPAR to recuperate. The present market has seen RevPAR and general income within the 12 months ending June 2023 attain a historic peak, simply three years from the preliminary decline. The restoration is pushed by exceptionally robust day by day fee development, as nationwide lodge occupancy continues to be striving to recuperate to 2019 ranges. The current efficiency information is summarized within the chart under.

The phrase of the second is “normalization.” Utilized to the nationwide lodge business efficiency, members acknowledge that the income restoration is nearing 2019 ranges, and future achievements are extra in keeping with pre-pandemic historic developments.

With masks use seemingly far behind us, shoppers are extra captivated with journey than ever. Questions nonetheless stay about enterprise journey developments and the complete resurgence of downtown city lodges, however nationwide business efficiency is sustaining an upward trajectory.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a number one international actual property providers agency that delivers distinctive worth for actual property occupiers and house owners. Cushman & Wakefield is among the many largest actual property providers corporations with roughly 50,000 staff in over 400 places of work and roughly 60 nations. In 2021, the agency had income of $9.4 billion throughout core providers of property, amenities and venture administration, leasing, capital markets, and valuation and different providers.

To be taught extra, go to www.cushmanwakefield.com or comply with @CushWake on Twitter.

Jeffrey Brown

Senior Managing Director – United States

Cushman & Wakefield