The 2020 COVID-influenced lodging trade recession resulted in some noticeable modifications to the way in which motels present meals and beverage (F&B) service.

- Social distancing laws compelled operators to be inventive in the way in which they served meals and drinks to friends.

- Rising wage charges and sharp will increase in the price of meals and beverage merchandise compelled lodge managers to seek out methods to regulate prices.

- The shortcoming of motels to draw staff to fill the positions eradicated in the course of the recession required inventive options to enhance productiveness and supply extra with much less.

These elements resulted within the following lodge meals and beverage developments in the course of the subsequent restoration interval:

- The elevated providing of kiosks and grab-and-go venues

- The closing of conventional three-meal-a-day eating places

- A discount within the menus, variety of seats, and hours of remaining F&B venues

- Reductions in in-room eating and mini-bar service

- The conversion of meals and beverage area to different income producing functions

To learn the way these latest modifications in lodge meals and beverage operations have impacted revenues and bills, we’ve analyzed the working statements of two,500 U.S. full-service, resort, and conference motels that participated in CBRE’s annual Traits® within the Resort Business in 2021 and 2022. In 2022, these 2,500 properties averaged 285 rooms in dimension, and achieved an occupancy of 64.7%, together with a median every day price (ADR) of $225.60. To offer extra present info, we additionally relied on the month-to-month working statements of 1,200 properties in the course of the interval January via June of 2023.

Income Traits

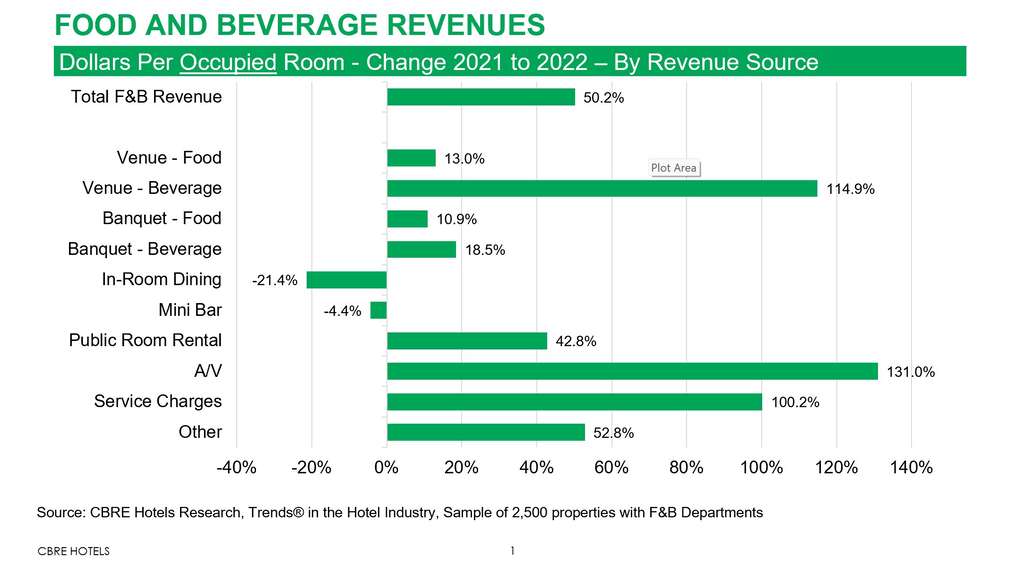

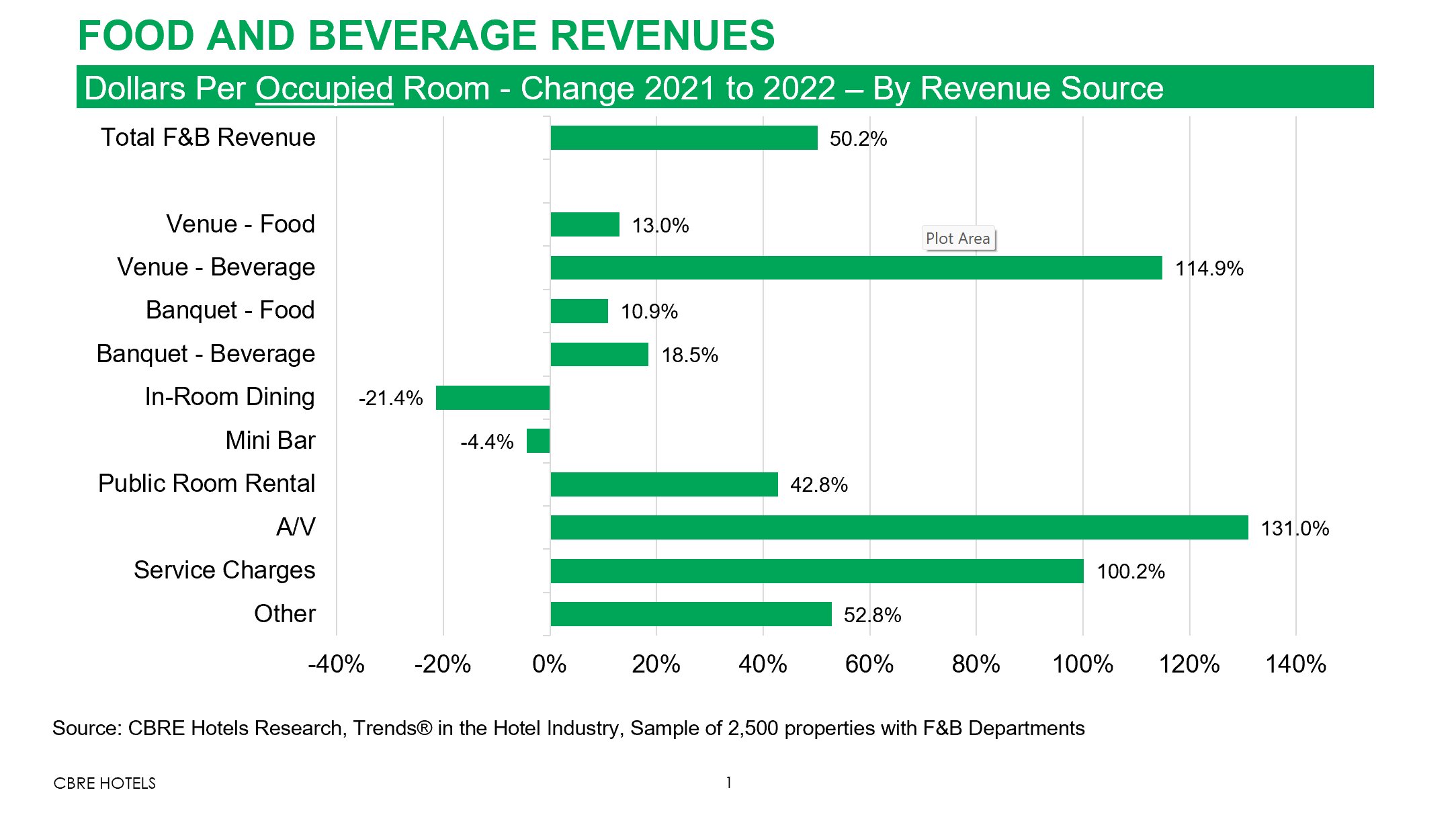

Because the majority of lodge meals and beverage patrons come from in-house friends, it’s applicable to research income developments on a dollar-per-occupied room (POR) foundation. From 2021 to 2022, complete lodge F&B revenues POR for the motels within the examine pattern elevated by 50.2%. For comparative functions, complete lodge income for a similar motels elevated 24.0% POR. That is in step with the delay within the restoration of revenues linked to group demand (ex. catering and banquet income) throughout 2021.

F&B income sources exhibiting the best POR share will increase throughout 2022 had been beverage venue revenues, public-room rental, audio-visual (A/V) income, and obligatory service expenses. The rise in beverage venue revenues (bars and lounges) is in step with the elevated recognition of specialty cocktails and craft beers, together with the conversion of rooftop areas to bars. Public room-rental and A/V income positive aspects are the results of the preliminary levels of the restoration of conventions and conferences. The rise in service-charge income is reflective of the elevated implementation of obligatory surcharges inside lodge F&B retailers to offset the rising prices of operations. That is much like the rise in lodge resort charges as a complement to rooms income.

On the draw back, we noticed reductions within the quantity of income earned on a POR foundation from in-room eating and minibars throughout 2022. Social distancing necessities compelled motels to restrict visitor interplay throughout the visitor room. Accordingly, the extent of in-room eating service has been lowered and changed with the elevated use of grab-and-go operations. As well as, motels have continuously eliminated mini-bars from visitor rooms in favor of offering mini-refrigerators for visitor use.

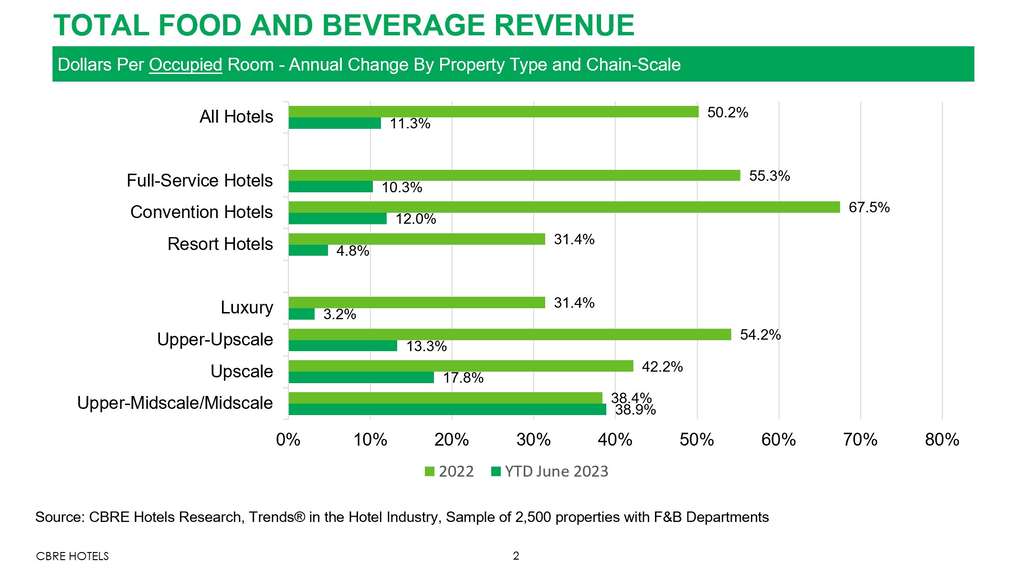

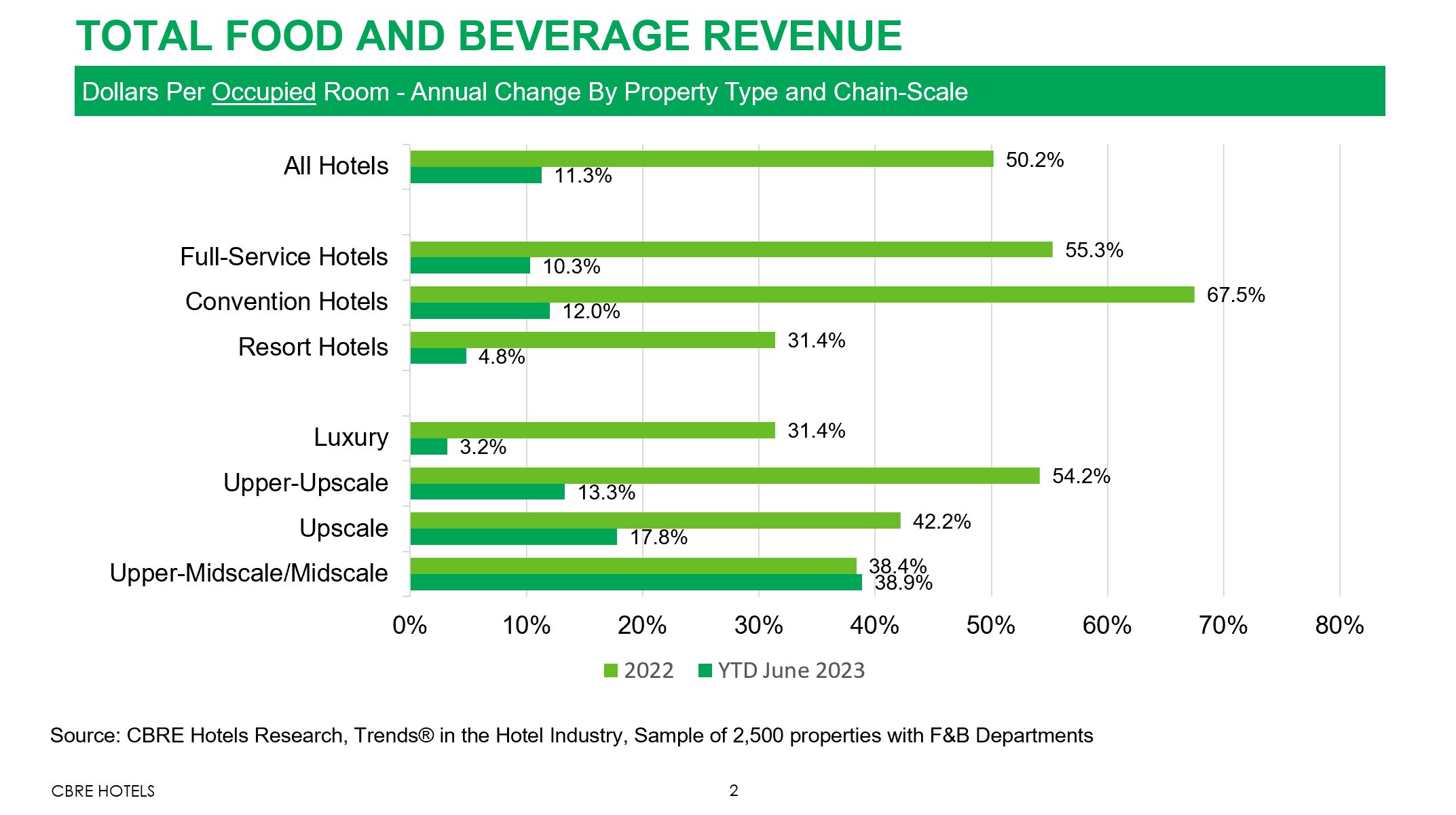

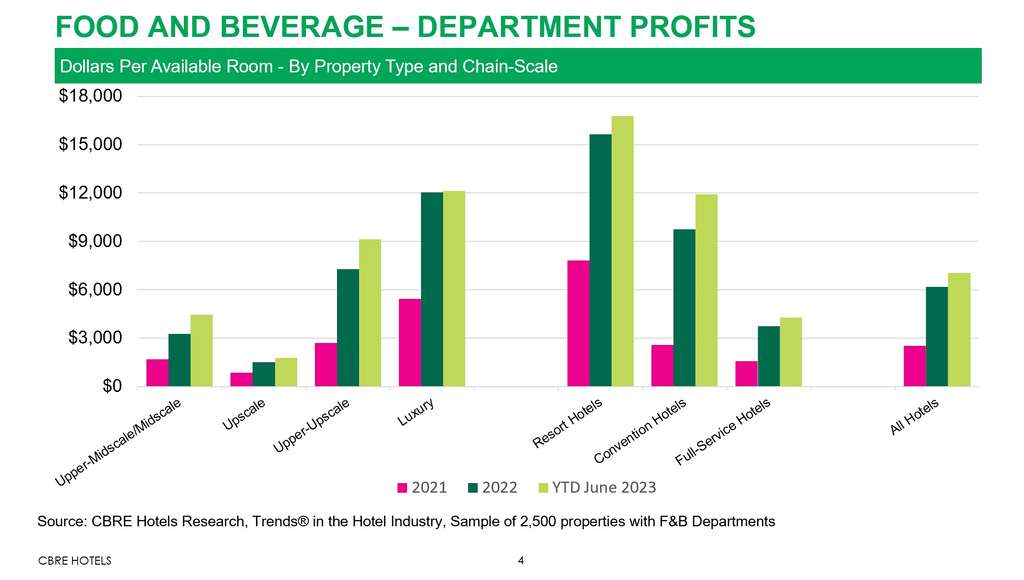

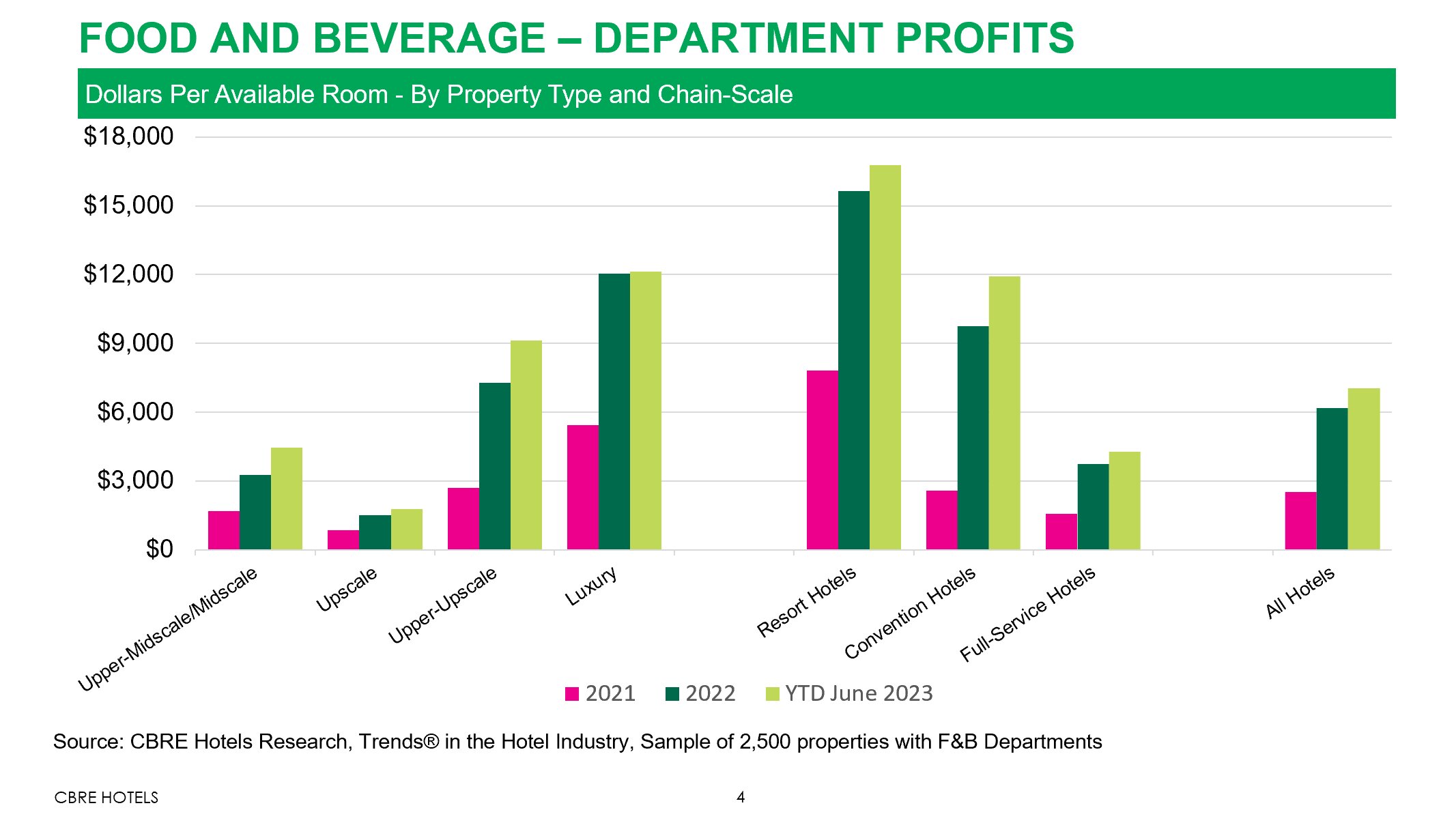

When analyzing modifications in meals and beverage income by property kind and chain-scale, we see consistency with latest modifications in lodge demand. From 2021 to 2022, the best F&B income POR positive aspects had been achieved by full-service, conference, and upper-upscale motels. Normally, full-service, conference, and upper-upscale motels benefited essentially the most in 2022 from the preliminary levels of the restoration of group and company demand.

In 2023 we’ve seen a slowdown in complete F&B income progress. From January via June of 2023, complete F&B income has elevated by simply 11.3% from the primary six months of 2022. It needs to be famous that almost all of this achieve occurred in January of 2023 when comparisons had been extraordinarily favorable to the Omicron-depressed efficiency in January of 2022.

Luxurious motels have struggled essentially the most to develop F&B income in 2023. That is in step with the lack of luxurious motels to extend room charges in the course of the 12 months. It has develop into obvious that the double-digit progress in luxurious lodge room charges and F&B costs loved throughout 2021 and 2022 has confirmed to be unsustainable in 2023.

Expense Traits

From 2021 to 2022, complete F&B division bills on the motels in our pattern elevated by 82.3%. For comparative functions, that is considerably larger than the 63.5% rise in bills for all operated departments. Amongst all of the bills throughout the lodge F&B division, the best improve was noticed within the mixed prices for salaries, wages, and worker advantages. From 2021 to 2022, complete F&B division labor prices elevated by 85.9%. This progress in labor prices is primarily attributable to the rise in worker wage charges, versus hours labored. Supplemental analyses carried out by CBRE and different companies have discovered that motels are working with fewer staff and hours labored in comparison with pre-COVID ranges. The mix of rising labor prices and a discount in obtainable staff and hours labored has been a big affect on the choice to scale back the degrees of meals and beverage service at motels.

Among the many different bills throughout the F&B division, the cost-of-goods bought rose by 73.5% in 2022, whereas all different division bills (provides, tabletop utensils, uniforms, and many others.) grew by 84.2%.

Revenue Traits

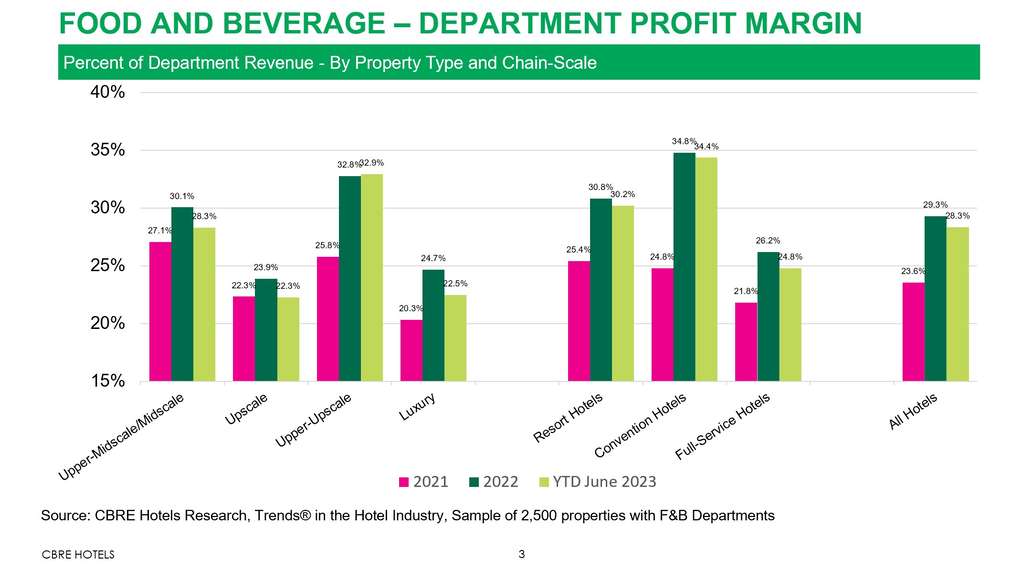

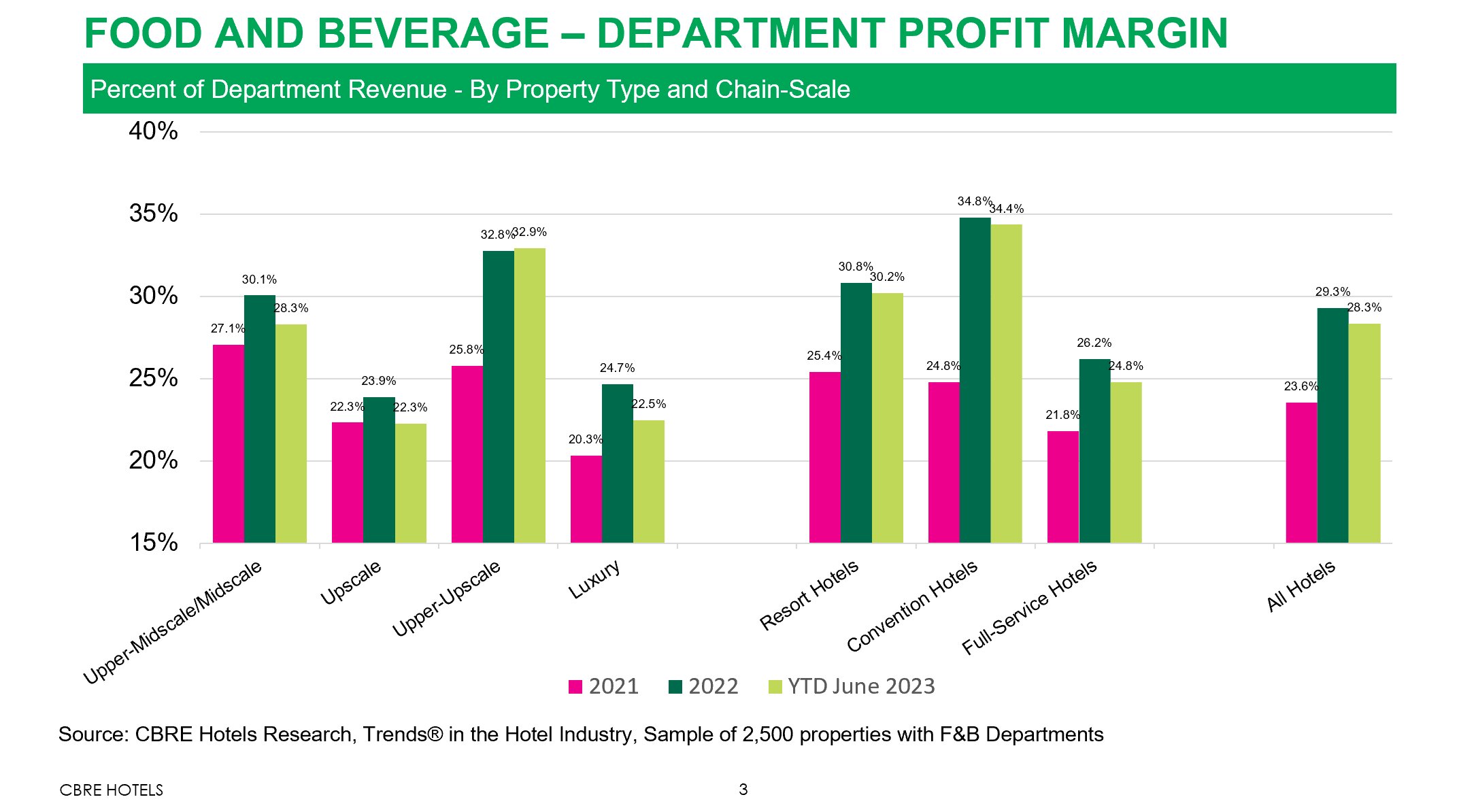

The beforehand referenced developments in lodge F&B revenues and bills resulted in a wholesome 145.2% improve in F&B division earnings from 2021 to 2022. This progress in earnings was not solely attributable to the will increase in income however enhanced working efficiencies within the division as nicely. F&B division revenue margins elevated from 21.3% in 2021 to 25.8% in 2022. Following income developments, the best positive aspects in F&B division earnings throughout 2022 had been achieved by conference and upper-upscale motels.

Sadly for hoteliers, the income slowdown in 2023 has additionally resulted in a deceleration of earnings positive aspects. Via June of 2023, F&B division revenue progress has slowed all the way down to 14.2%. Struggling essentially the most are luxurious and resort motels which have seen revenue progress of 0.7% and seven.1% respectively in the course of the first six months of 2023.

F&B division working efficiencies have additionally suffered in 2023. June year-to-date F&B division revenue margins have dropped from 29.3% in 2022 to twenty-eight.3% in 2023, whereas division revenue margins have declined in 2023 for all chain-scale and property kind classes. The lone exception has been upper-upscale motels whose F&B division revenue margins have improve barely from 32.8% to 32.9% in the course of the first six months of 2023.