The highest lodge markets on this STR U.S. bubble chart replace present a seasonal momentum shift from conventional winter/spring break hotspots to a broader vary of locations with more and more travel-friendly climates.

For the 4 weeks ending 15 April 2023, restoration development throughout a spread of trade indicators took a small backstep, with occupancy (64.1%) falling 0.7 proportion factors (ppts) from the prior month. Latest occupancy indicators had been additionally down yr over yr (-0.2 ppts) in addition to from 2019 (-5.1 ppts). Nevertheless, these drops are usually not a critical concern given calendar impacts.

The four-week interval included the prolonged Easter/Passover vacation, which characteristically constrains company journey. With that in thoughts, it isn’t too shocking that general U.S. demand and occupancy decreased from our earlier month-to-month replace.

As to annual comparisons, you will need to keep in mind that roughly half of the nation had already gotten again on observe this time final yr, notably these markets which can be seasonally robust throughout spring. The opposite half of the nation, principally centered in bigger cities, was on the verge of a strong Q3 restoration spurt. Matched comparisons in opposition to final yr are in opposition to a peak pandemic leisure journey interval. In making long-term efficiency comparisons to 2019, it’s value including that this matched interval comparability in opposition to 2019 doesn’t embody the Easter vacation in 2019—that occurred in later in April.

Time comparisons apart, the trade continues to evolve, and this provides nuance in benchmarking markets’ lodge efficiency. Leisure journey, which had been king throughout the COVID period, stays robust throughout the present section of the restoration. In comparison with final yr, nevertheless, pent-up demand and extra financial savings have fallen. Likewise, inflation, comparatively flat wage development together with labor prices have additionally led to some belt-tightening throughout private and enterprise vacationers alike. Consequently, weekend together with leisure journey have decreased from pandemic peaks towards extra standard ranges.

Contrasting to the enterprise facet, staff are more and more again within the workplace with cities benefiting from an bettering mixture of company journey together with positive factors in conference and group bookings. Journey is returning to cities and shifting to regular ranges from “diversion locations.”

On this section of the restoration, the highest performing markets (at the very least to date into 2023) proceed to supply hotter climates and both instantly cater to leisure vacationers or present a complimentary mixture of leisure-friendly facilities.

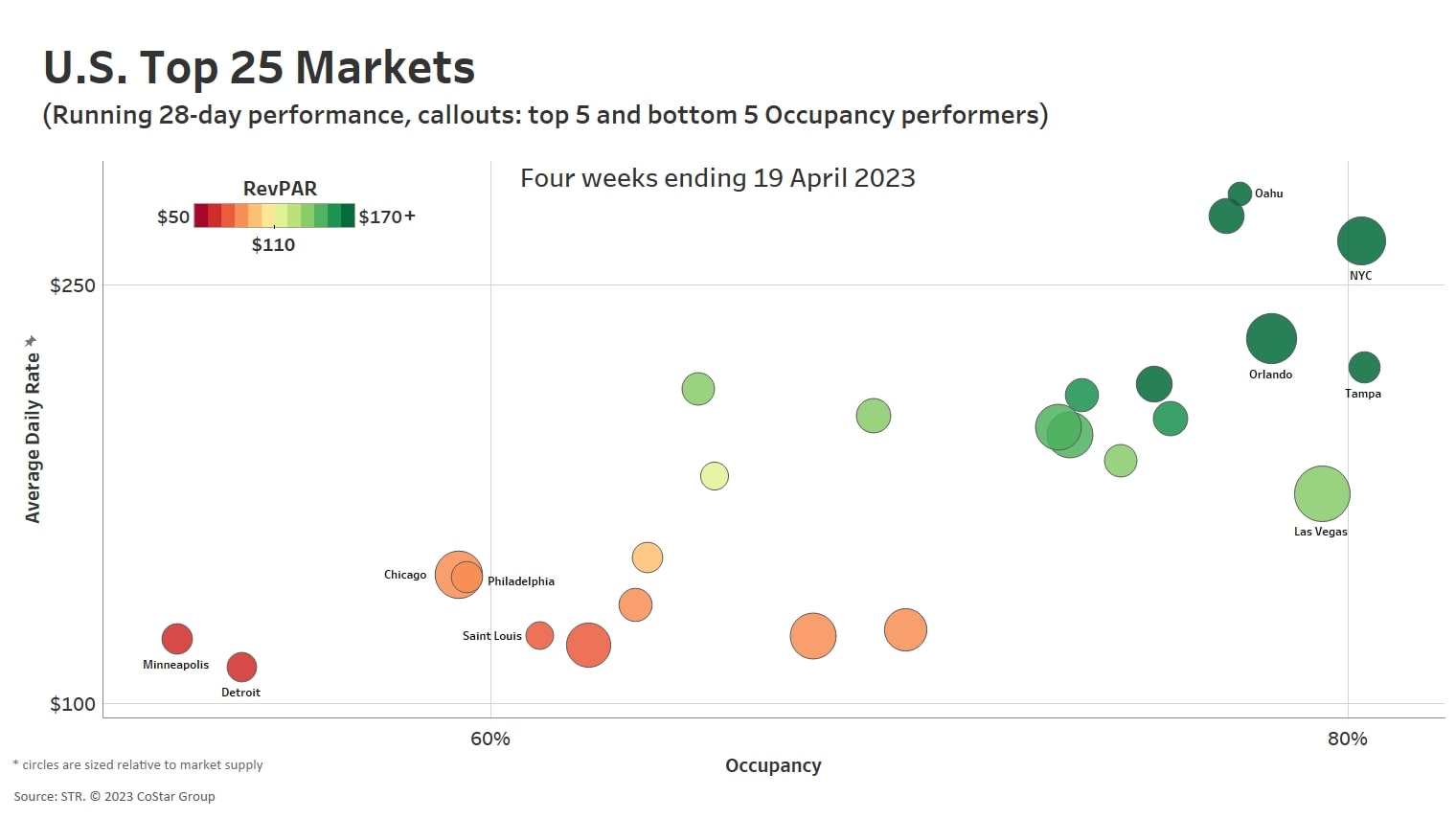

The Prime 25 Markets had been led in occupancy by Tampa (80.4%) which, coming off of Spring Break season, had a 5.5 proportion level decline from the prior 4 weeks. Notably, the market’s interval occupancy usually matches its similar time efficiency final yr. Subsequent was New York Metropolis (80.3%, +4.2 ppts YoY), Las Vegas (79.4%, -2.6 ppts), Orlando (78.2%, -0.9 ppts) and Oahu (77.5%, +2.1 ppts).

Not one of the Prime 25 Markets matched their 2019 occupancy ranges for the latest 4 weeks. Nevertheless, many giant markets have narrowed their occupancy margins above this time final yr. Oahu ran the narrowest occupancy deficit from 2019 (-1.8 ppts) whereas six of the Prime 25 Markets confirmed four- week/2019 occupancy shortfalls of 10 ppts or higher, together with Chicago, Philadelphia, and Minneapolis.

Compared to the Prime 25 Markets, 65 of the 142 remaining STR-defined markets skilled occupancy positive factors above final yr’s weekly match. In complete, 25 of 167 markets had higher occupancy than in 2019. As famous beforehand, this long-term comp shouldn’t be clear neither is it as regarding as latest knowledge contains the week of the Easter/Passover vacation, whereas the vacation fell later throughout the pre-COVID comparability.

Features in common each day charge (ADR) amongst Prime 25 Markets current a extra favorable sample with all however two giant markets seeing year-over-year (YoY) will increase. 4 of the higher performing markets (Oahu, Tampa, New York Metropolis and Orlando) noticed 8% or greater will increase in ADR. Maybe as a mirrored image of evolving trade income methods or inflation, a handful of decrease performing occupancy markets likewise noticed hyperactive YoY ADR positive factors, together with St. Louis (+10.5%) and Chicago (+9.4%). Total, the final tempo of annual ADR positive factors amongst Prime 25 Markets has moderated from prior months.

By way of income per out there room (RevPAR), 18 of the Prime 25 Markets skilled YoY positive factors in RevPAR for the match interval. New York Metropolis had the biggest YoY RevPAR greenback acquire, rising $40 (+23.1%) to $213. Whereas Tampa led giant markets in occupancy, its YoY RevPAR declined to $118 from $154.

Exterior of the Prime 25 Markets, the Florida Keys’ four-week 84.8% common occupancy continues to steer different markets for this time of yr, with seasonal dominance nonetheless in play regardless of a 0.7 ppt occupancy decline from 2019. For the complete span of the pandemic restoration interval, the high-end Keys’ lodge market has been a constant leisure-driven highflyer, each by way of occupancy and ADR. For this most up-to-date interval, the Keys market was adopted in occupancy by Charleston (80.2%, -3.3 ppts YoY); Sarasota (79.1%, +0.2 ppts), Savannah (78.7%, -2.0 ppts) and Fort Lauderdale (77.9%, -2.9%).

Most small-to-medium sized markets noticed substantial YoY positive factors of their nominal (non-inflation adjusted) ADR. When mixed with occupancy efficiency, 33 markets skilled RevPAR development within the double-digits, which is effectively upfront of the latest annual tempo of inflation. Regardless of tough interval comps, RevPAR general grew in 110 markets past the Prime 25. The steepest annual RevPAR declines occurred in choose markets that had the massive COVID-spurred positive factors in 2022.

For extra data, be sure you examine our weekly Market Restoration Monitor.

In case you are all for accessing the information behind this visible by way of our hospitality platform in CoStar, please contact please contact [email protected]

About STR

STR offers premium knowledge benchmarking, analytics and market insights for world hospitality sectors. Based in 1985, STR maintains a presence in 15 international locations with a North American headquarters in Hendersonville, Tennessee, a global headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), a number one supplier of on-line actual property marketplaces, data and analytics within the business and residential property markets. For extra data, please go to str.com and costargroup.com.