Fundamentals are strong regardless of the nonetheless unsure macroeconomic context. inexperienced transition and concrete regeneration are the drivers of the longer term. Amitrano, CEO of Dils

Logistics is the primary asset class for invested volumes, adopted by residing

Optimistic figures for take-up ranges and demand for brand spanking new places of work in Milan and Rome

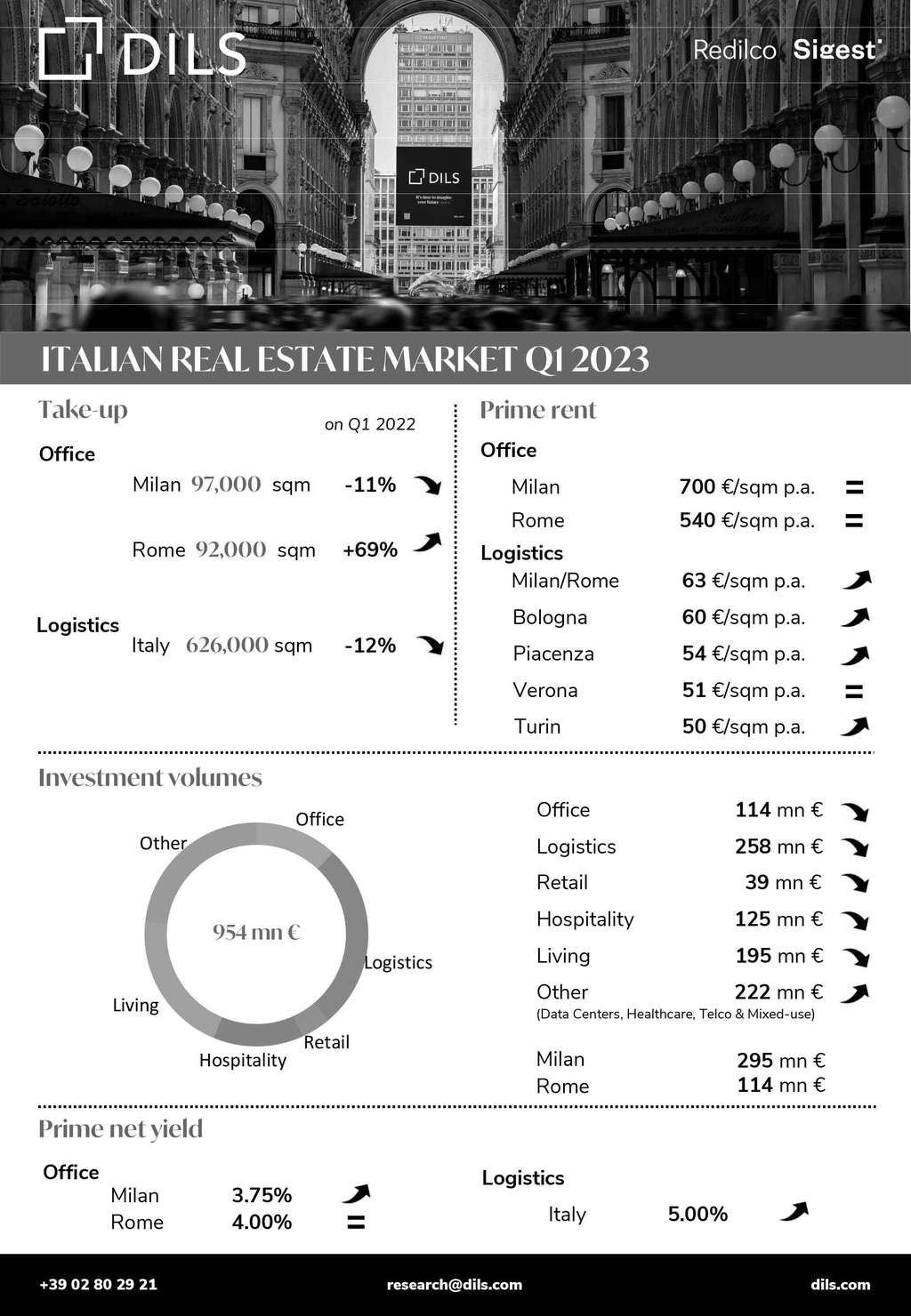

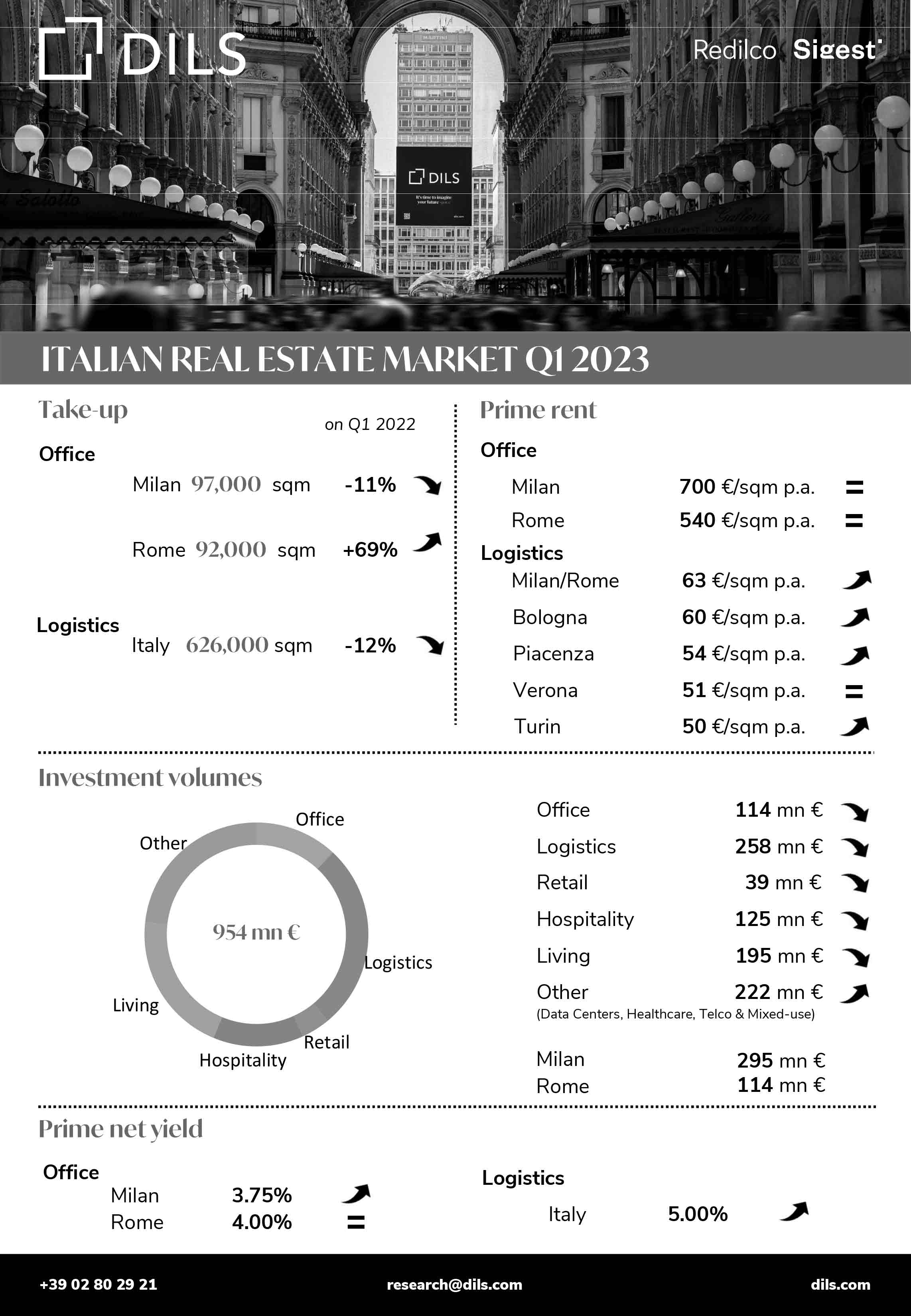

Milan – The amount of actual property investments in Italy within the first quarter of 2023 amounted to roughly 1 billion euros. In comparison with earlier quarters, the consequence highlights a decrease exercise throughout all asset courses as a consequence of the modifications within the worldwide capital market, primarily because of the rise in rates of interest which passed off within the final twelve months. Nonetheless, the efficiency beats the estimates made originally of the 12 months.

In Q1 2023, the Logistics sector is again to being the main asset class, attracting 258 million euros akin to 27% of quarterly complete funding quantity, nevertheless down by 17% in comparison with the earlier quarter.

Take-up quantity of logistics areas amounted to 626,000 sqm within the first quarter of 2023, exhibiting a slight contraction (-12%) on the identical quarter of 2022, nonetheless in a context of at all times restricted emptiness. The rising development of prime rents continued in the primary markets: the very best rental ranges are reached in Rome and Milan, the place they stand at €63/sqm/12 months, however will increase are registered in Bologna (€60/sqm/12 months), Piacenza (€54/sqm/12 months) and Torino (€50/sqm/12 months) as effectively.

With investments for 195 million euros, Residing is proving to be one of the vital sought-after asset courses by traders in addition to the one asset class to point out a rising development in comparison with the earlier quarter (+45%), with Milan main the market when it comes to invested volumes (83%).

Outcomes from the residential gross sales market are as soon as once more constructive: in 2022 the nationwide quantity of NTN touches 784,500 – therefore the very best 12 months ever – with a rise of 4.8% on 2021 and +30% on 2019. Milan registers one other file, because of over 28,500 NTN (+6.2% on 2021 and +32% on 2019) representing the very best worth ever recorded. Additionally within the Rome market progress continues, as 2022 ends with over 40,000 transactions (+3.2% on 2021 and +22% on 2019), a price that had by no means been seen within the final decade and that approaches the pre-2008 ranges.

Within the first quarter of 2023, investments within the Workplace sector confirmed a contraction, with invested volumes equal to roughly 114 million euros, towards absorption information in keeping with the earlier quarters. A rising variety of traders, particularly international traders, adopted a wait-and-see angle. That is because of the mixed results of the rise within the prime internet yield (equal to three.75% in Q1 2023), and consequent mismatch between provide and demand, along with the exhaustion of an essential pipeline of core offers within the earlier months. The outlook for the following two quarters expects progress when it comes to funding volumes, with the rise in rates of interest mitigated by the inflationary impact on rents.

Take-up recorded on the Milan workplace market within the thought of interval virtually reached 100,000 sqm: a consequence that, though exhibiting a slight contraction – primarily because of the smaller common floor space of the operations – is constructive in comparison with the variety of registered leases, indicating the vitality of the market. A determine to underline through the quarter issues the Rome market, the place the absorption of workplace areas equaled that of Milan, marking a 69% progress in comparison with the earlier 12 months additionally because of a large-scale operation within the EUR district. For each markets, the sturdy choice of tenants for A/A+ grade areas was confirmed, which signify 75% and 80% of the absorbed quantity respectively in Milan and Rome. The prime rents of the 2 markets remained fixed through the first quarter of 2023, standing at €700/sqm/12 months in Milan and €540/sqm/12 months in Rome.

In Q1 2023 funding volumes regarding the Hospitality sector present a decline on each the earlier quarter and the identical interval of 2022, totalling roughly 125 million euros, primarily distributed in small-medium sized offers. The Retail sector, particularly in its out-of-town section, information an extra decline in funding volumes, equalling 39 million euros.

The Alternate options sector totals investments for 222 million euros, principally represented by offers involving new mixed-use developments and healthcare services.

Although the market is present process instances of uncertainty, within the first quarter of 2023 its fundamentals stay strong – mentioned Giuseppe Amitrano, CEO and Founding father of Dils – and the demand for high quality premises stays vibrant in all asset courses. We consider that the present part must be overcome by adopting a long-term view, considering the primary innovation drivers of the approaching 10 years. Within the first place is the inexperienced transition, unavoidable since our nation has considered one of Europe’s most out of date actual property shares, whose refurbishment, pushed by current European directives, will rework all the modernization course of in a novel alternative of repositioning for the entire sector and for Italy itself. Secondly, the evolution of the inflexible distinction between asset courses by the introduction of latest codecs: hybridization of areas will open the way in which to picturing and realizing new working, learning, and residing areas that provide tangible advantages to all stakeholders similar to tenants, neighborhood and surroundings. We think about that the innovation of the actual property sector can generate a multiplier impact for the territory, not solely in financial phrases, but in addition from the geographical – creating new centralities and rediscovering high-potential areas – and notably social standpoint, because of constructive spillovers on the standard of life for residents and neighborhoods.

About Dils

Dils is the brand new title of GVA Redilco & Sigest, Italy’s main actual property participant, lively in the marketplace for over 50 years with a key function in remodeling and altering all the sector by innovation and digitalization. ‘Think about your future area’ is the message guiding the communication marketing campaign which marks the Group’s new begin and goals to boost consciousness of the significance of imagining and reflecting on the concept of the cities and areas of the longer term. With a workforce of greater than 170 professionals, and places of work in Milan and Rome, Dils is a key associate serving to nationwide and multinational firms, traders, monetary operators, and personal people to seek out and develop the very best funding alternatives inside and out of doors Italy. Providing purchasers an entire vary of consultancy, advisory and built-in actual property providers within the Workplace, Retail, Logistics, Hospitality, Residing and Residential sectors. Dils has launched its worldwide enlargement, aiming to export the imaginative and prescient and enterprise mannequin efficiently developed in Italy to different markets.