Simply the opposite day I obtained a textual content from a pal, and fellow RV Full Timer asking what insurance coverage provider we used for our RV insurance coverage. Seems she has one other pal who’s starting her Full-Time RV journey and was simply asking round to see what choices others have been utilizing.

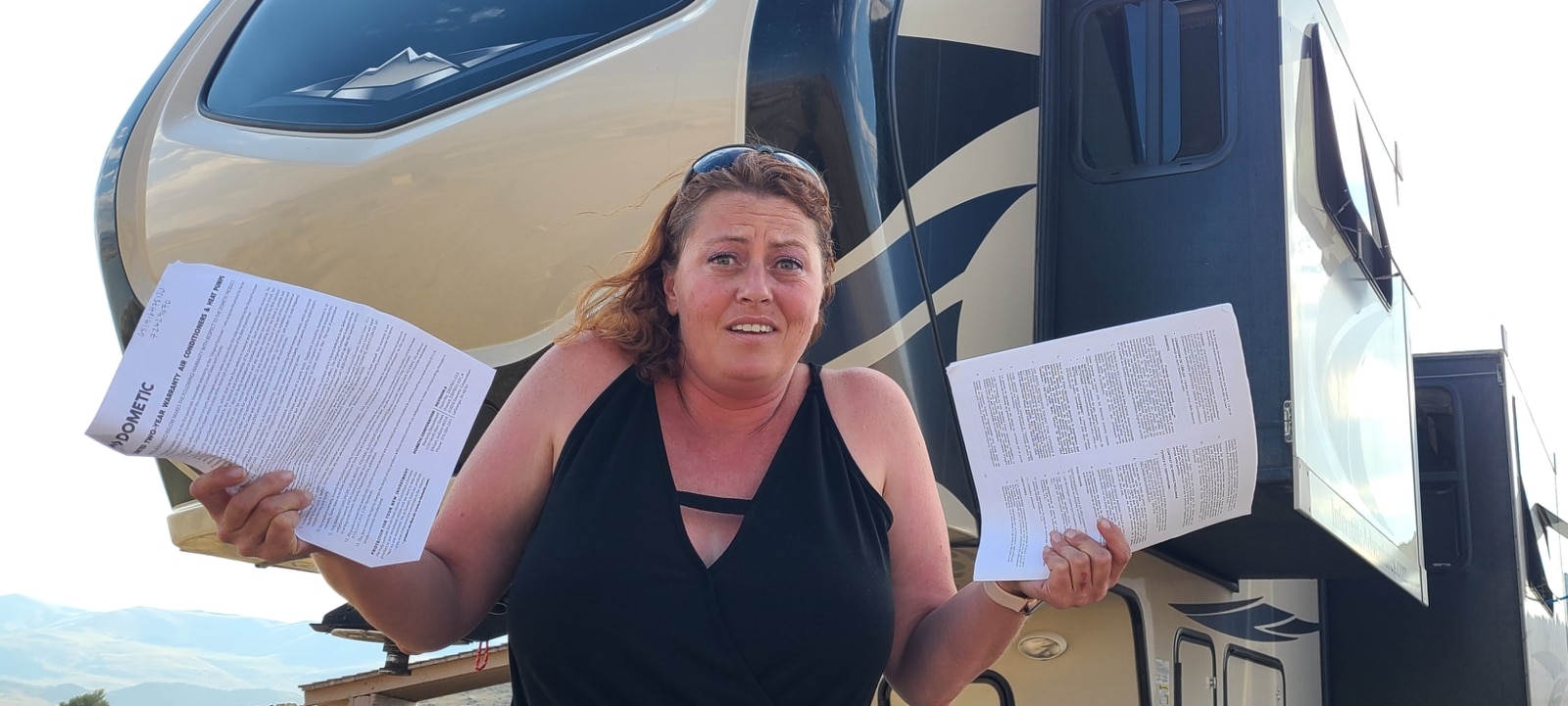

Throughout the dialog it got here out that when her pal was buying her RV the salesperson advised her that she didn’t want insurance coverage particular for dwelling full time in it as a result of she had bought the prolonged guarantee. Now, I’m no genius, however I know that isn’t proper. We did get the RV Beginner all straightened out, but it surely actually obtained me pondering that that is one thing that I’m positive a couple of individual has heard, and I actually wanted to convey consideration to it!

Many individuals don’t know this, however lots of producers will void any guarantee in your RV in the event you reside in it full time. In some instances, even when it’s a semi-permanent residence, such as you winter in Florida in your RV and nonetheless have a stick and bricks residence in Montana.

In the event you reside in your RV for greater than just a bit get-away, there’s a excessive chance that you’ve voided any and all producers warranties, even an prolonged guarantee! Sadly, salesman don’t let you know this.

Let’s be sincere right here, the salesperson goes to get a fee on each product he upsells you, to incorporate the prolonged guarantee that possible turned void the minute you parked the camper and moved in. I don’t imply to say that every one salesman are unhealthy individuals, or that they’re deliberately placing blinders over your eyes to get you to purchase one thing else. In some instances, I actually imagine that the salesmen don’t even know this.

Honestly, only a few individuals sit there and skim a whole contract phrase for phrase earlier than signing it. Sadly, we have a tendency take the phrase of the individual sitting throughout the desk who has been, “so sincere and pleasant.” They stated it covers every little thing. Why would they lie? Possibly they aren’t mendacity, possibly they don’t know both. Isn’t it believable that they’re simply repeating what their boss advised them?

Earlier than promoting every little thing and transferring into your RV Full Time, there’s lots of analysis to do. However you additionally must know what must be researched. Typically ignorance is bliss, however different occasions, it simply bites us within the you realize what. However your guarantee and insurance coverage protection ought to be a type of gadgets in your record to look into intimately.

Let’s say you do discover a producer that has a great guarantee for a Full Timer. Nice! However again to my acquaintance from above, does buying the prolonged guarantee negate or change the insurance coverage coverage you have got in your new residence? I feel this can be a good alternative to level out – We actually must cease referring to the RV, as simply an RV.

If you’re transferring into it, it must be known as your HOME. Identical to whenever you bought your stick and brick residence, you had insurance coverage on it, and possibly you bought a house guarantee. The identical holds true to your new touring residence. Each of these insurance policies will cowl various things. Is it potential there’s some overlap in protection, yeah, possibly. However typically talking right here, they do various things.

A guaranty could cowl the components and labor if a slide cable breaks on you. However is it going to cowl a spot so that you can keep whereas the RV is in being repaired, most likely not. The best insurance coverage coverage will although. A guaranty may even cowl in case your cupboard latches aren’t holding, or your fridge randomly breaks. Your insurance coverage provider doesn’t care about these issues. They’d possible chuckle at you in the event you known as to open a declare for them.

If you’re dwelling in your RV Full Time, you want a House Homeowners Insurance coverage Coverage in your new HOME. Identical to you wanted on your own home. If somebody breaks into my residence and steals my stuff, the guarantee I bought on the dealership doesn’t imply something. My House Homeowners coverage alternatively, will present me with financial compensation for the worth of the belongings that have been stolen.

In an excellent worse case situation, if my residence caught fireplace, or we have been in an accident driving down the street whereas towing, the insurance coverage firm would once more present me monetary compensation for my loss. I don’t know any producer guarantee that’s going to do this.

I actually hope this brings a bit readability to the topic, as a result of I used to be fairly distraught eager about my pal being steered the mistaken manner and never even figuring out it was taking place. The underside line right here, except you intend to do your entire repairs by yourself… You want each a Full Time RV Residing Guarantee AND a House Homeowners Insurance coverage Coverage.

And don’t simply belief the very nice salesman, do your personal analysis and be sure you know what sort of guarantee and insurance coverage coverage you’re buying earlier than you procure them.