Posted: 2/8/2023 | February eighth, 2023

Since popping out in 2021, the Bilt Rewards Mastercard has been an absolute game-changer for renters that like to journey. It’s the one bank card that permits you to earn factors in your month-to-month hire cost — as much as 50,000 factors per 12 months, (which may pay for a round-trip flight to Hawaii, for instance).

You should use these factors like another journey rewards factors (akin to these from Chase, American Specific, or Capital One), transferring them to airline or lodge companions or paying for journey instantly via a particular portal.

However whereas the points-for-rent perk will get all the eye (and rightfully so), the Bilt Rewards Mastercard is greater than a one-trick pony.

To actually get essentially the most out of this worthwhile card (one which I feel each renter ought to have of their pockets), listed below are some key issues to know concerning the Bilt Mastercard:

1. There’s no annual charge

Some of the necessary issues to contemplate when opening a brand new bank card is whether or not there’s an annual charge, and if that’s the case, whether or not paying it is sensible in keeping with your spending habits and objectives.

Many of the greatest journey bank cards have annual charges, and for frequent vacationers, they’re normally price it. You will get way more worth out of a card than its annual charge for those who’re an avid flier who enjoys lounge entry, precedence boarding, checking further baggage, or different frequent perks.

However you don’t have to fret about that with Bilt, as the cardboard presently has no charge. You may earn factors in your hire utterly without spending a dime!

2. There’s additionally no welcome supply

Nonetheless, the flip aspect of there being no annual charge is that there’s additionally no welcome supply on the Bilt Rewards Mastercard.

Welcome presents (also called sign-up bonuses) are the factors you earn by spending a specific amount inside a specified time-frame after opening a bank card. For instance, you may be capable to earn 60,000 factors for those who spend $3,000 USD inside the first three months of opening a selected card.

These presents jump-start your factors “fund” and might typically quantity to a free round-trip flight proper off the bat. Welcome presents are so very important to any good journey hacking technique that I normally advise in opposition to signing up for a card except there’s a sizable one. The truth that I wholeheartedly suggest the Bilt card, even with out a welcome supply, ought to present you simply how nice I feel this card is.

3. There’s a minimal transaction requirement to earn factors

After opening the Bilt Mastercard, maybe an important factor to know is that you could make a minimal of 5 transactions every assertion interval to earn factors. That goes for all factors, together with the factors you’ll obtain for paying your hire.

Which means for those who don’t make 5 purchases in your card that interval, you received’t earn any factors in any respect — even for those who’ve paid hire via Bilt.

The excellent news is that there’s no minimal buy requirement, solely a minimal transaction requirement. So long as you make 5 purchases — of any measurement — in your Bilt card every month, you’ll get your factors.

4. You may earn factors on extra than simply hire

Whereas incomes factors on hire is the principle promoting level, the cardboard presents further methods to earn factors too:

- 2x factors on journey

- 3x factors on eating

- 1x factors on all different purchases

(These incomes classes are the identical as fan-favorite Chase Sapphire Most well-liked, for which there’s an annual charge of $95 USD).

So, for instance, for those who use your Bilt card in the course of the month on journey or eating purchases, you’ll not solely get 2-3 occasions the factors, however you’ll additionally hit your minimal five-purchase requirement.

5. You may max out on factors earned for hire

It’s additionally price utilizing your card for purchases aside from hire due to the truth that you may max out on the variety of factors earned for hire (factors for hire are capped at 50,000 per 12 months). After that, you received’t earn any extra factors on hire for that 12 months.

Nonetheless, contemplating you earn at a charge of 1 Bilt level per $1 spent on hire, you’ll solely attain the restrict for those who spend over $4,166/month in hire. In case your rental cost is underneath that, you don’t have to fret about hitting the restrict.

6. You may earn much more factors on hire day

On the primary day of the month, your factors incomes energy is doubled, that means that you simply’ll earn 6x factors on eating, 4x factors on journey, and 2x on different purchases (besides hire) made on the primary of the month.

Should you get into the behavior of utilizing your Bilt card for all the pieces you purchase on the primary day of the month, you’ll already be that a lot nearer to hitting your 5 minimal transactions, all whereas getting much more factors to your purchases.

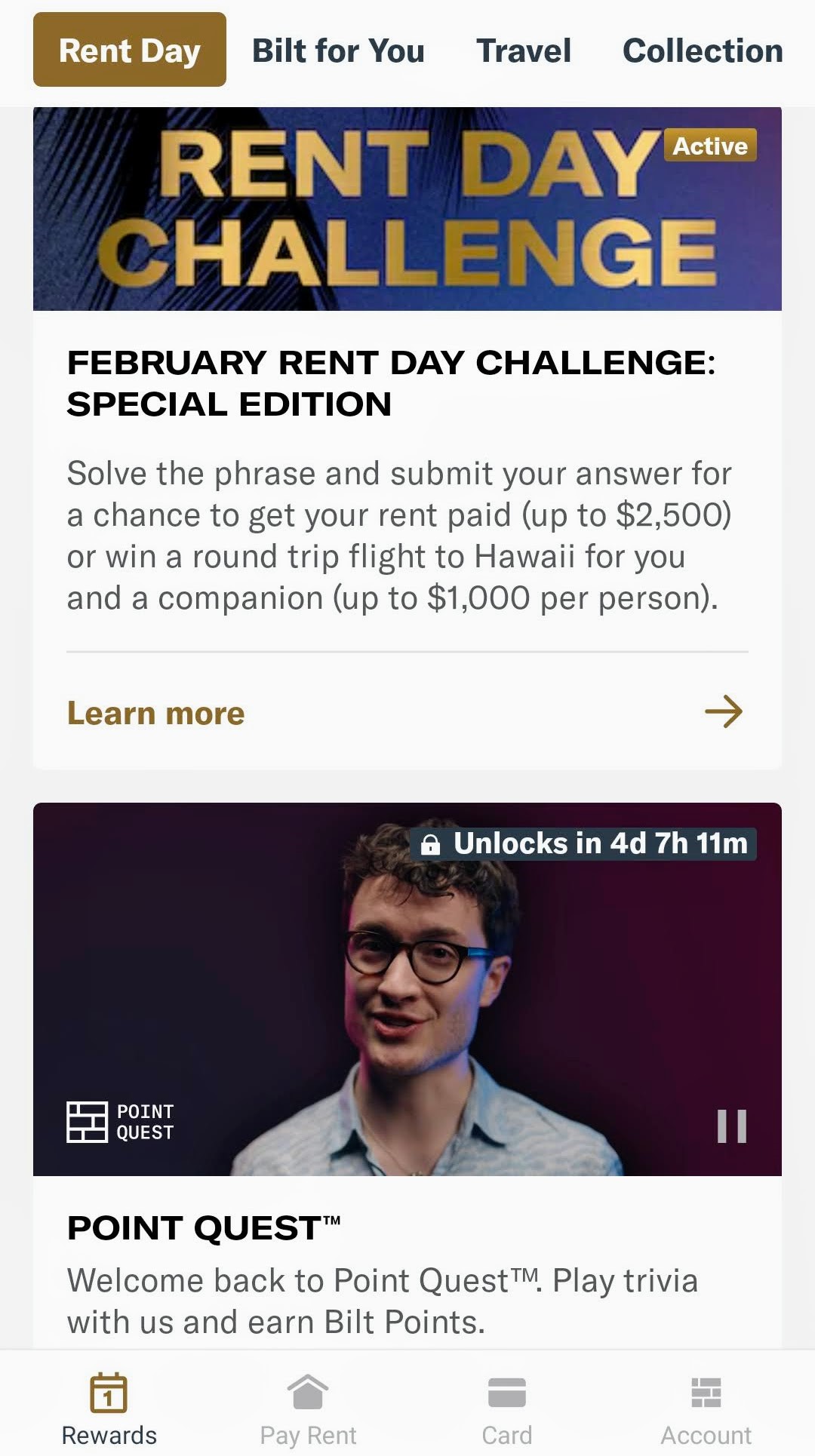

And whereas nobody desires extra apps on their telephones, you’ll want to obtain the Bilt app for possibilities to earn much more factors. Each hire day, there are new methods to simply earn factors within the app. These change each month, however up to now have included taking part in Level Quest, during which you earn factors for proper solutions to trivia questions.

There’s additionally the Lease Day Problem, in which you’ll be able to enter to win a free month’s hire by appropriately finishing a fill-in-the-blank phrase in the course of the day.

Whereas a few of these alternatives don’t supply many factors, they take little or no time to finish, and so they all add up!

7. Bilt factors = American Airways factors

Another excuse to amass factors is as a result of Bilt has American Airways as a switch associate — and it’s the one card that does. Since no different card presents factors that switch to American, Bilt is the one technique to get AA factors with out having an AA card.

That is nice information for American Airways loyalists or vacationers with particular journeys in thoughts for which they wish to use AA factors. For instance, I’m presently prioritizing my Bilt card as an alternative of my Chase Sapphire, as a result of I need these AA factors for a visit I’m planning to Japan this 12 months (AA is a associate with Japan Airways).

Along with American Airways, you may switch your Bilt factors on a 1:1 foundation to many different journey companions, together with:

- Air Canada

- Air France

- Cathay Pacific

- Emirates

- Hawaiian Airways

- Hyatt

- IHG

- Turkish Airways

- United

- Virgin Atlantic

You can even redeem factors for health courses, like SoulCycle, Solidcore, Rumble, and Y7, and for objects within the Bilt Assortment, a curated number of artisan residence décor objects. Nonetheless, I’d advise in opposition to this, as redeeming factors for health courses comes out to round one level per cent — and you may get a a lot better redemption on journey purchases.

8. Bilt presents nice journey safety

Past its points-earning capabilities, Bilt presents strong journey safety, particularly for a no-fee card. Simply remember that you could ebook journey utilizing the Bilt card with the intention to obtain these advantages. The protections are much like that of different “starter” journey bank cards, just like the Chase Sapphire Most well-liked.

Listed below are the journey protections that Bilt presently presents:

- Journey cancellation safety and interruption protection

- Journey delay reimbursement (for delays of six hours or extra)

- Automobile rental collision protection

- Mobile phone safety (as much as $800 USD)

- No overseas transaction charges

Click on right here for a full breakdown of rewards and advantages and charges and charges.

Whereas these protections — like that of any card — aren’t an alternative to journey insurance coverage (which it’s best to at all times get!), they’re nice perks, and also you get them at no further price.

All in all, getting the Bilt card is a no brainer for anybody who pays hire within the US, because it’s presently the one technique to earn factors without spending a dime on this obligatory month-to-month expense.

However, whereas it’s price getting for simply that profit alone, the Bilt card presents lots of different superior options that make it much more worthwhile. The flexibility to switch to American Airways, double factors on Lease Day, new methods to earn further factors, and a well-rounded roster of journey advantages and protections make the Bilt card greater than worthy of area in your pockets. It’s grow to be certainly one of my favourite playing cards and I discover myself reaching for it quite a bit!

Need to study all about factors and miles?

Cease paying full worth for airfare! Obtain our free information to journey hacking and study:

Cease paying full worth for airfare! Obtain our free information to journey hacking and study:

- The best way to choose a bank card

- The best way to earn miles without spending a dime flights & resorts

- Is journey hacking actually a rip-off?

Guide Your Journey: Logistical Suggestions and Tips

Guide Your Flight

Discover a low cost flight through the use of Skyscanner. It’s my favourite search engine as a result of it searches web sites and airways across the globe so that you at all times know no stone is being left unturned.

Guide Your Lodging

You may ebook your hostel with Hostelworld. If you wish to keep someplace aside from a hostel, use Reserving.com because it constantly returns the most affordable charges for guesthouses and resorts.

Don’t Overlook Journey Insurance coverage

Journey insurance coverage will defend you in opposition to sickness, harm, theft, and cancellations. It’s complete safety in case something goes flawed. I by no means go on a visit with out it as I’ve had to make use of it many occasions up to now. My favourite firms that supply one of the best service and worth are:

Need to journey without spending a dime?

Journey bank cards let you earn factors that may be redeemed without spending a dime flights and lodging. They’re what hold me touring a lot for therefore little. Take a look at my information to choosing the right card and my present favorites to get began and see the most recent greatest offers.

Able to Guide Your Journey?

Take a look at my useful resource web page for one of the best firms to make use of whenever you journey. I checklist all those I take advantage of once I journey. They’re one of the best at school and you’ll’t go flawed utilizing them in your journey.